- United States

- /

- Tech Hardware

- /

- NasdaqCM:QUBT

How Investors Are Reacting To Quantum Computing (QUBT) Raising $750 Million for Growth and Acquisitions

Reviewed by Sasha Jovanovic

- Quantum Computing Inc. recently completed an oversubscribed private placement, raising approximately US$750 million to strengthen its cash reserves for growth initiatives such as acquisitions, sales expansion, and increased production capabilities.

- Amid heightened government interest and industry discussions over potential federal equity stakes, the company’s fundraising underscores a broader momentum and optimism for quantum technology’s potential applications in areas like cybersecurity and communications.

- We'll examine how this substantial influx of capital reshapes Quantum Computing Inc.'s investment narrative and growth prospects in the quantum technology sector.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Quantum Computing's Investment Narrative?

For anyone following Quantum Computing Inc., the finished $750 million private placement marks a clear shift in the company’s short-term outlook. This fresh capital puts acquisition activity, accelerated sales, and scaled production much closer to starting, squarely addressing the cash concerns that had clouded QUBT’s previous strategy. Investor optimism is showing in recent share price moves, but risk remains sharply tilted: the company is still booking very low revenue, facing higher operating losses, and meaningful questions linger around dilution from all the new shares. Near term, catalysts like further government investment, big customer contracts, and possible tech breakthroughs will likely stay in focus, especially as QUBT’s government and industry links deepen. Yet, alongside this optimism, operational risks around cash burn, legal actions, and recent insider selling are not erased by the new funding. As Q3 results approach, the balance between ambitious growth plans and persistent business risks is more pronounced than ever.

On the other hand, the pace of shareholder dilution is a crucial detail not to overlook.

Exploring Other Perspectives

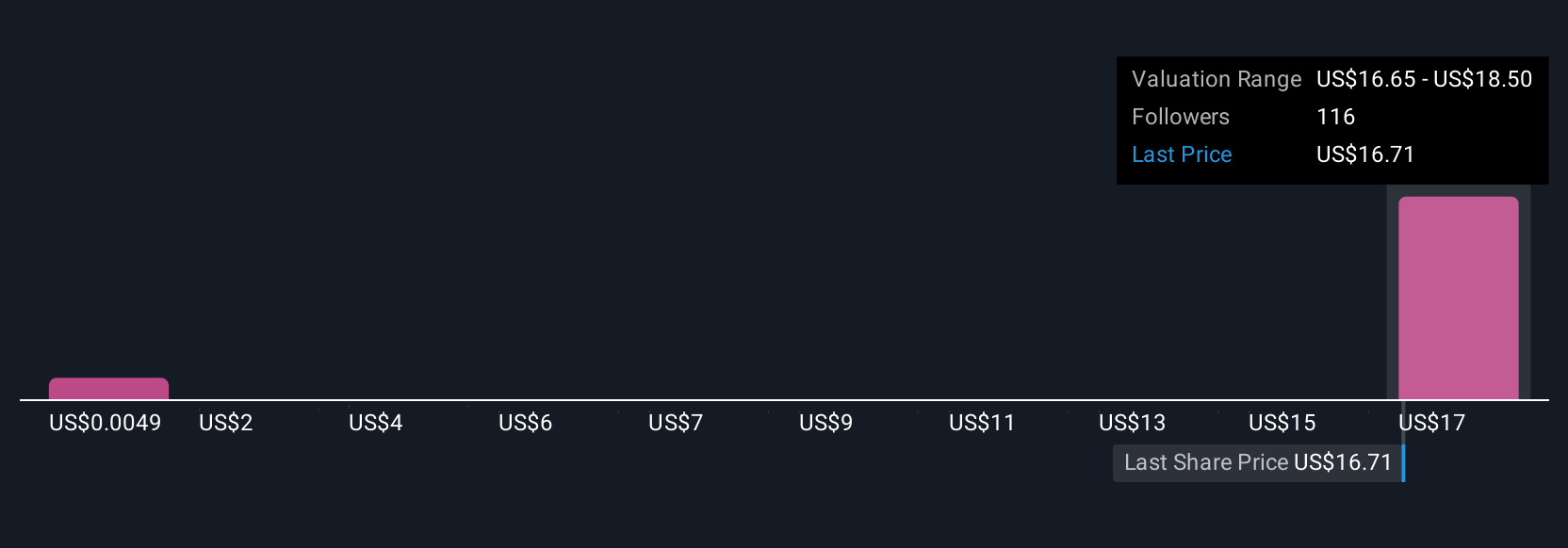

Explore 31 other fair value estimates on Quantum Computing - why the stock might be worth as much as 71% more than the current price!

Build Your Own Quantum Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quantum Computing research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Quantum Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quantum Computing's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QUBT

Quantum Computing

An integrated photonics company, provides quantum machines to commercial and government markets in the United States.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives