- United States

- /

- Tech Hardware

- /

- NasdaqCM:QUBT

Does QUBT’s $500 Million Raise Reveal a New Phase in Quantum’s Commercialization Strategy?

Reviewed by Simply Wall St

- Quantum Computing Inc. recently announced agreements with institutional investors for the oversubscribed private placement of 26,867,276 shares of common stock at US$18.60 per share, aiming to raise approximately US$500 million in gross proceeds to support commercialization, acquisitions, and corporate initiatives.

- An interesting aspect of this fundraising is the participation of both prominent existing shareholders and a leading global alternative asset manager making its initial investment in the company.

- We’ll explore how broader government support for quantum computing technology is shaping Quantum Computing Inc.’s investment narrative moving forward.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Quantum Computing's Investment Narrative?

For investors thinking about Quantum Computing Inc., the core belief to have is in the transformative potential of quantum technology and the company's ability to turn technical breakthroughs into commercial opportunity. The recent US$500 million oversubscribed private placement, with support from both incumbent shareholders and a major global asset manager, injects significant capital and raises the bar for short-term expectations. With cash in hand, QCi may accelerate commercialization, attract new talent, and advance acquisitions, potentially shifting near-term catalysts from speculative partnership wins to meaningful revenue milestones. However, the capital raise also amplifies long-standing risks: ongoing heavy losses, shareholder dilution, frequent executive changes, and a very limited revenue base remain at the forefront. While the funding addresses short-term liquidity and may strengthen market confidence, it does not resolve fundamental operational or profitability challenges, particularly against a backdrop of heightened volatility and ongoing legal uncertainties. On the other hand, recent insider selling is a concern investors should not overlook.

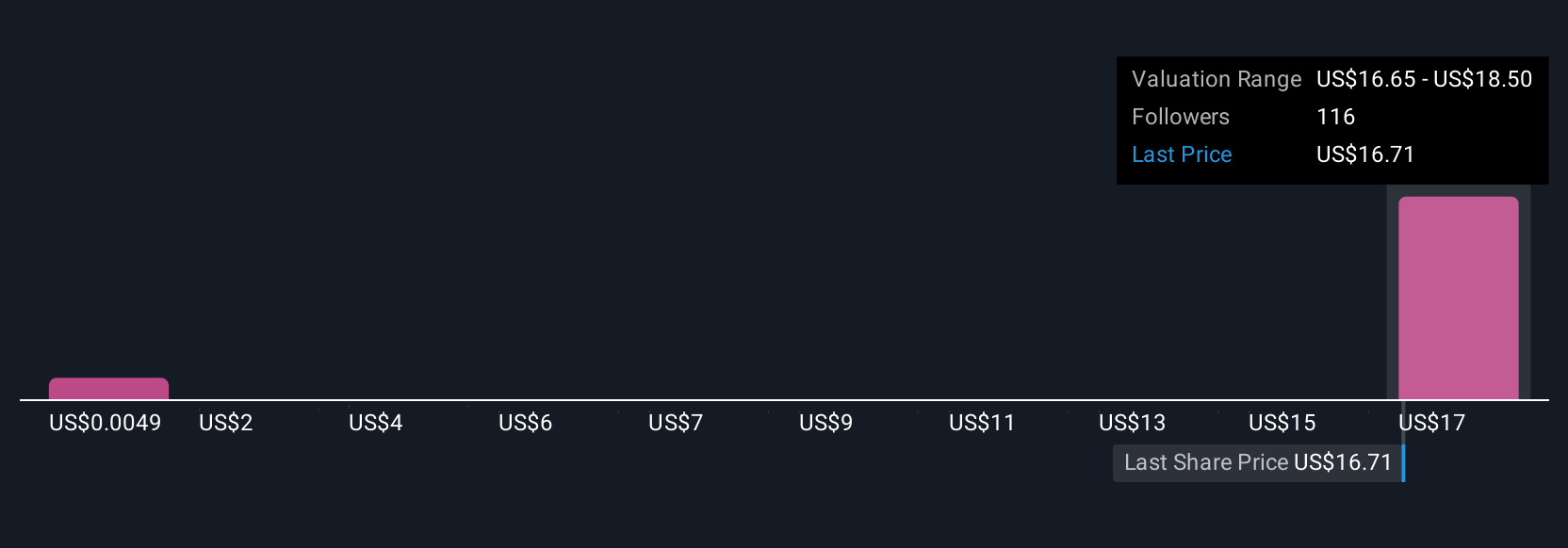

According our valuation report, there's an indication that Quantum Computing's share price might be on the expensive side.Exploring Other Perspectives

Explore 30 other fair value estimates on Quantum Computing - why the stock might be worth as much as $20.33!

Build Your Own Quantum Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quantum Computing research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Quantum Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quantum Computing's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QUBT

Quantum Computing

An integrated photonics company, provides quantum machines to commercial and government markets in the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion