- United States

- /

- Tech Hardware

- /

- NasdaqGM:QMCO

Lacklustre Performance Is Driving Quantum Corporation's (NASDAQ:QMCO) Low P/S

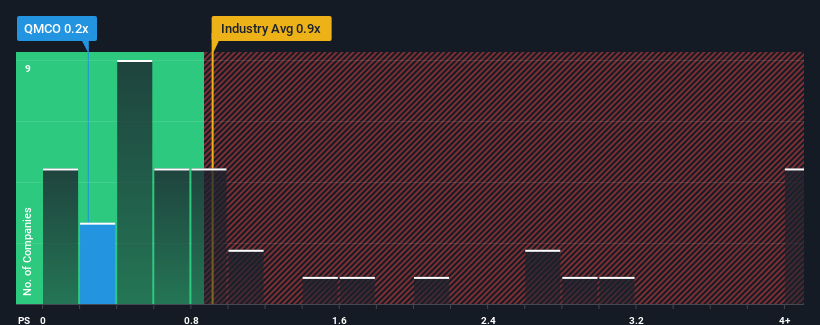

With a price-to-sales (or "P/S") ratio of 0.2x Quantum Corporation (NASDAQ:QMCO) may be sending bullish signals at the moment, given that almost half of all the Tech companies in the United States have P/S ratios greater than 0.9x and even P/S higher than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Quantum

What Does Quantum's Recent Performance Look Like?

Quantum hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Quantum will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Quantum's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. As a result, revenue from three years ago have also fallen 23% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 0.2% as estimated by the two analysts watching the company. With the industry predicted to deliver 5.0% growth, that's a disappointing outcome.

With this information, we are not surprised that Quantum is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Quantum's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Quantum's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Quantum (of which 2 are a bit concerning!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Quantum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:QMCO

Quantum

Provides products for storing and managing digital video and unstructured data in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Medium-low risk and undervalued.

Similar Companies

Market Insights

Community Narratives