- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLXS

The Bull Case For Plexus (PLXS) Could Change Following Evolv Contract Manufacturing Partnership—Learn Why

Reviewed by Sasha Jovanovic

- In a recent announcement, Evolv Technologies Holdings Inc. revealed it has entered into a contract manufacturing partnership with Plexus Corp., combining Evolv's product expertise with Plexus's design, supply chain, and global manufacturing capabilities to support expanding demand and operational efficiency.

- This collaboration is designed to boost Evolv's production capacity, provide cost-saving opportunities through Plexus's procurement scale, and enhance global supply chain resiliency.

- We'll explore how this partnership's global scalability and cost efficiencies could influence Plexus's investment narrative going forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Plexus Investment Narrative Recap

To be a Plexus shareholder, you need to believe in the company's ability to expand its role as a high-value electronics manufacturer through global partnerships and diversified clients. The new agreement with Evolv Technologies aims to grow Plexus's manufacturing footprint and enhance supply chain resilience, supporting near-term capacity and efficiency needs. However, this news doesn't meaningfully shift the biggest short-term catalyst, strong new program wins in high-growth sectors, nor does it eliminate the company's primary risk of sharp swings in demand from major customers or industry cycles.

Of all recent announcements, Plexus's strong Q4 and full-year earnings report stands out. Continued top-line and earnings growth in 2025 reflects both resilient demand and operational improvements, which align with the expansion goals behind the Evolv partnership, but also highlight just how exposed Plexus remains to customer concentration and program-driven variability.

By contrast, investors should also be aware that even as partnerships boost scalability, reliance on a few large clients means Plexus’s quarterly results can still be affected if...

Read the full narrative on Plexus (it's free!)

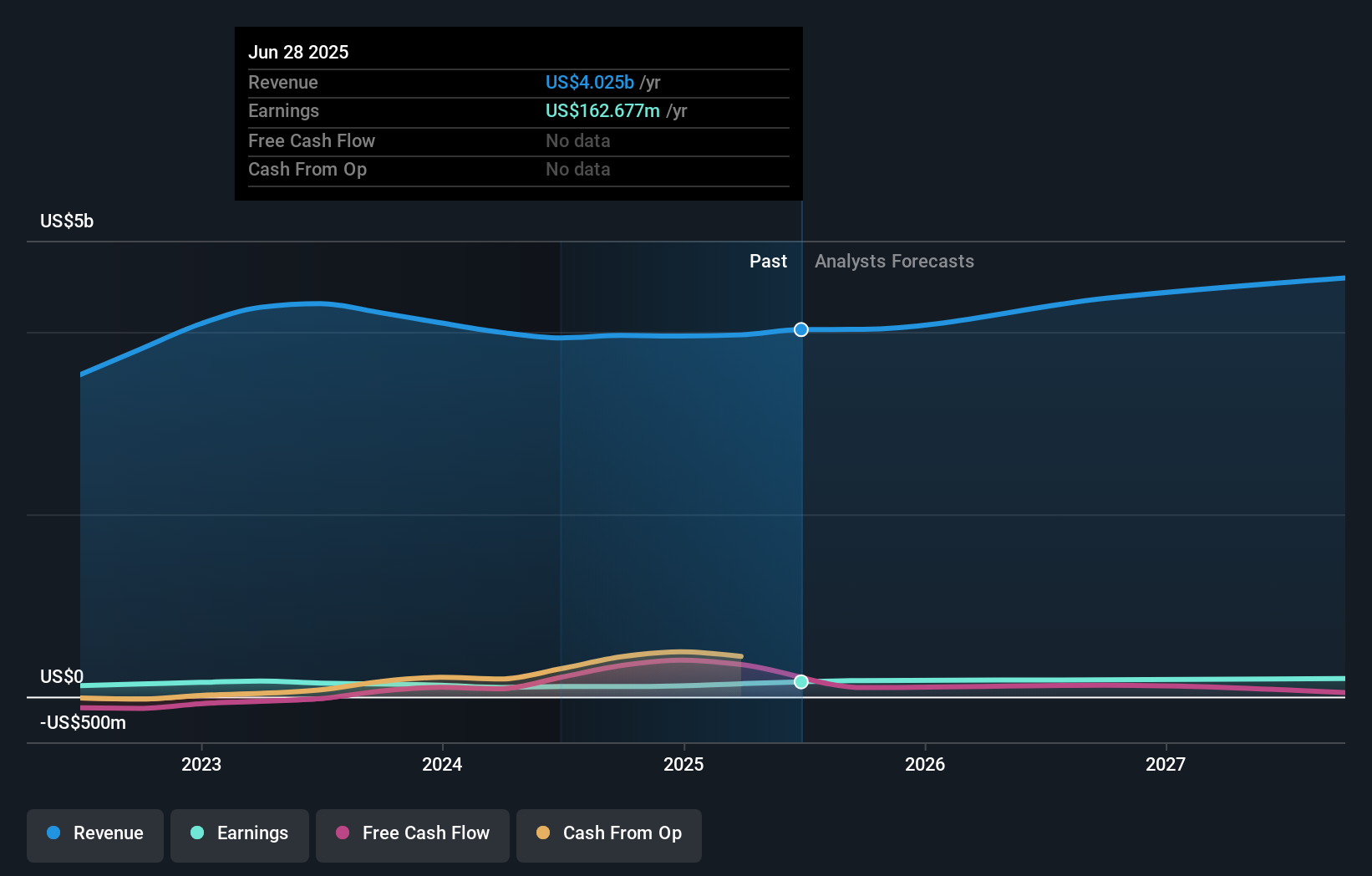

Plexus' narrative projects $4.8 billion revenue and $202.1 million earnings by 2028. This requires 6.1% yearly revenue growth and a $39.4 million earnings increase from $162.7 million today.

Uncover how Plexus' forecasts yield a $159.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community contributed one fair value estimate for Plexus at US$114.18, signaling a focused but singular outlook. Despite this, ongoing program-driven demand swings remain an important point for anyone weighing the company's performance against broader peer results.

Explore another fair value estimate on Plexus - why the stock might be worth 20% less than the current price!

Build Your Own Plexus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plexus research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Plexus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plexus' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLXS

Plexus

Provides electronic manufacturing services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives