- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

Will AI Infrastructure Hurdles Uncovered by ePlus' Survey Shift Its Long-Term (PLUS) Narrative?

Reviewed by Sasha Jovanovic

- ePlus recently released findings from its AI Industry Pulse Poll, revealing that nearly three-quarters of organizational leaders now prioritize revenue growth as the primary driver for AI initiatives, surpassing traditional aims like cost reduction and customer satisfaction.

- An important insight is that 81% of respondents expressed concern that their IT infrastructure cannot support advanced AI applications, highlighting persistent barriers such as talent shortages and data privacy concerns.

- We'll explore how ePlus's AI survey, spotlighting IT infrastructure challenges, could influence its long-term investment outlook and business narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ePlus Investment Narrative Recap

To be a shareholder in ePlus, you have to believe in the company's ability to capture accelerating enterprise demand for AI-powered infrastructure and services, even as near-term revenue growth faces potential lumpiness due to project-based sales. The latest AI Industry Pulse Poll spotlights infrastructure and workforce headwinds, but these are not likely to materially change the current main catalyst, which remains the momentum in managed services and recurring revenue streams, nor do they fully offset the biggest risk, project-based revenue volatility. Among recent company announcements, the expansion of ePlus’s Managed Services and Enhanced Maintenance Support with Juniper Networks integration stands out. This move aligns with growing market demands for scalable, reliable AI-ready infrastructure support, directly addressing the enterprise concerns revealed in the AI survey and reinforcing managed services as a key catalyst for predictable revenue. In contrast, what investors should be aware of is the ongoing risk that large, non-recurring deals could still cause future revenue to...

Read the full narrative on ePlus (it's free!)

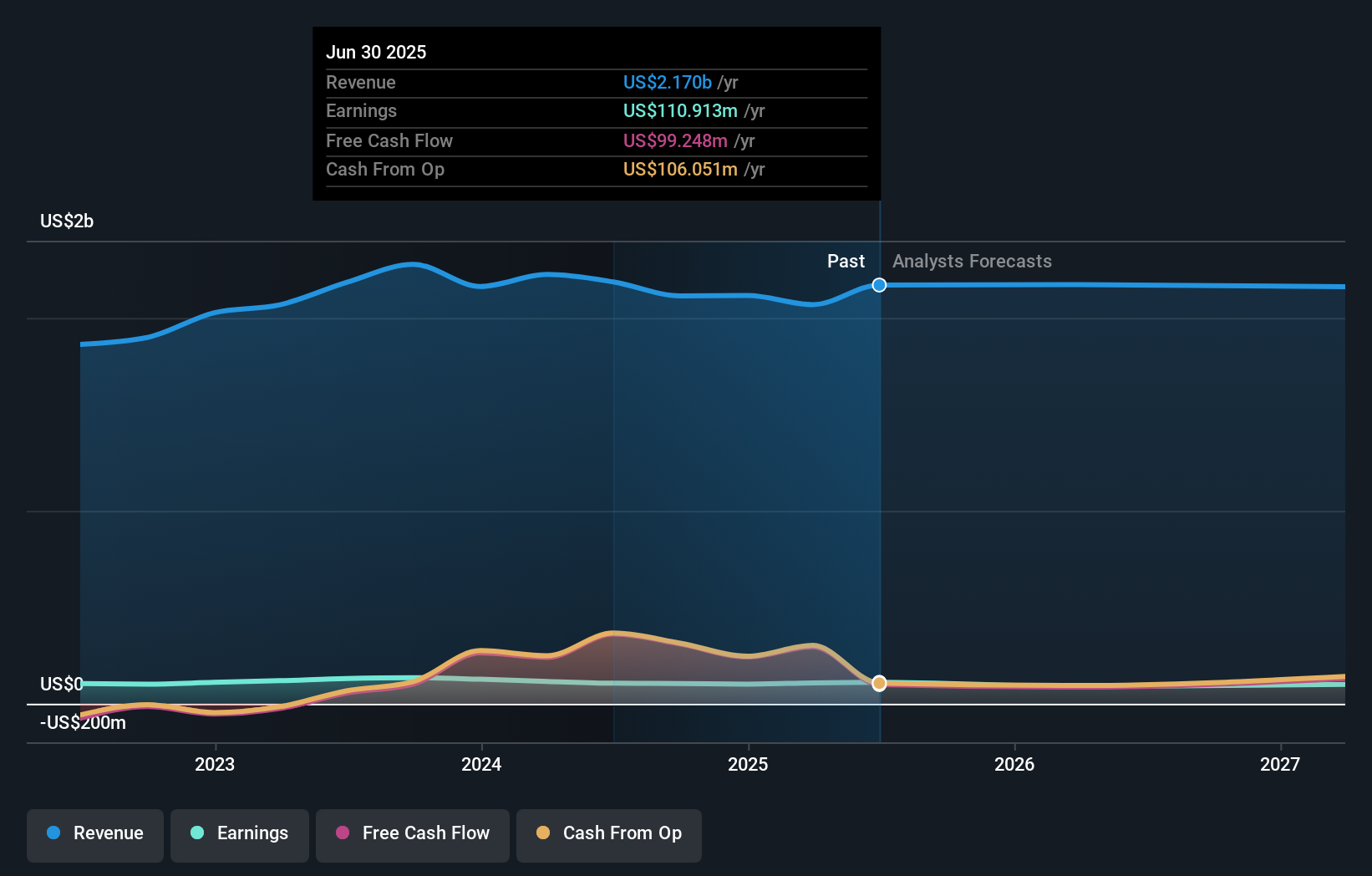

ePlus' outlook anticipates $2.2 billion in revenue and $78.4 million in earnings by 2028. This is based on a forecasted annual revenue decline of 0.2% and a decrease in earnings of $32.5 million from the current earnings of $110.9 million.

Uncover how ePlus' forecasts yield a $92.00 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates for ePlus ranging widely from US$34.94 to US$92.00 based on two analyses. While many see varying opportunities here, lingering revenue volatility from project-based sales remains a critical factor shaping future performance, so review several outlooks to see how these might inform your view.

Explore 2 other fair value estimates on ePlus - why the stock might be worth less than half the current price!

Build Your Own ePlus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ePlus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ePlus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ePlus' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives