- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

Is the Recent ePlus Surge Justified After Tech Partnership Expansion?

- Wondering if ePlus is trading at a bargain or carrying a premium? You are not alone. Digging into valuation could reveal some surprising insights.

- After a strong 21.5% jump over the past month and an impressive 21.6% gain year-to-date, ePlus has caught investors' attention. Its one-year return stands at 12.1%.

- In recent weeks, ePlus announced a key technology partnership and made headlines for expanding its cloud services business. These developments help explain the brisk uptick in its share price and growing optimism among investors.

- On our valuation scorecard, ePlus earns a 2 out of 6. This means the stock appears undervalued in 2 of the six assessment areas. Next, we will explore what each of these valuation checks means for shareholders and, later, reveal a smarter way to interpret the company's true value.

ePlus scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ePlus Discounted Cash Flow (DCF) Analysis

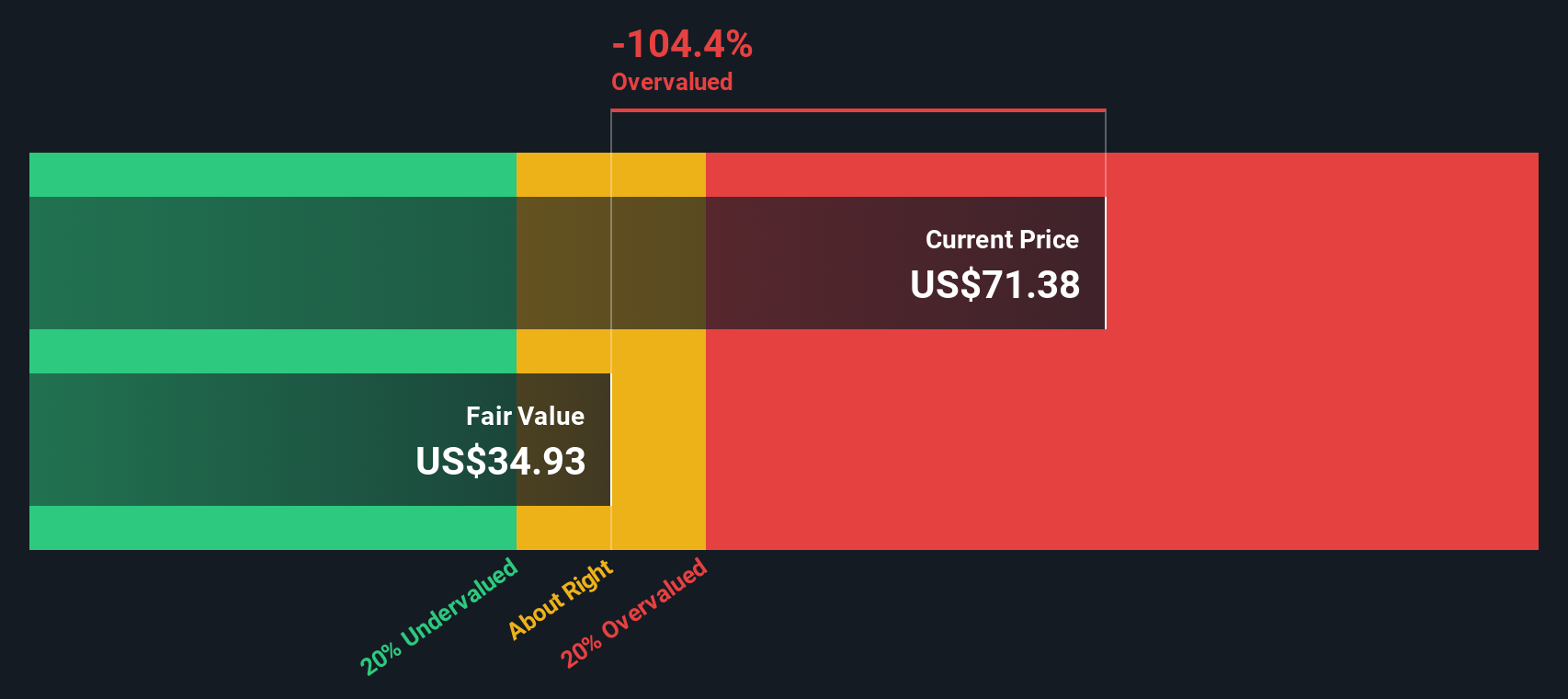

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to today's value. For ePlus, this involves analyzing how much cash the business is expected to generate and then evaluating what those future cash flows are worth in present terms.

Currently, ePlus reports Free Cash Flow (FCF) of $84.7 million. Analyst estimates see FCF rising to $138 million by 2027. Beyond that, projections are extrapolated with a steady, albeit slower, climb over the next ten years to around $58 million by 2035. All these figures are calculated in US dollars.

Based on the DCF analysis, the estimated intrinsic value for ePlus shares is $39.01. However, the current share price is approximately 130.7% higher than this value, implying that the stock is considered significantly overvalued according to this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ePlus may be overvalued by 130.7%. Discover 924 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ePlus Price vs Earnings

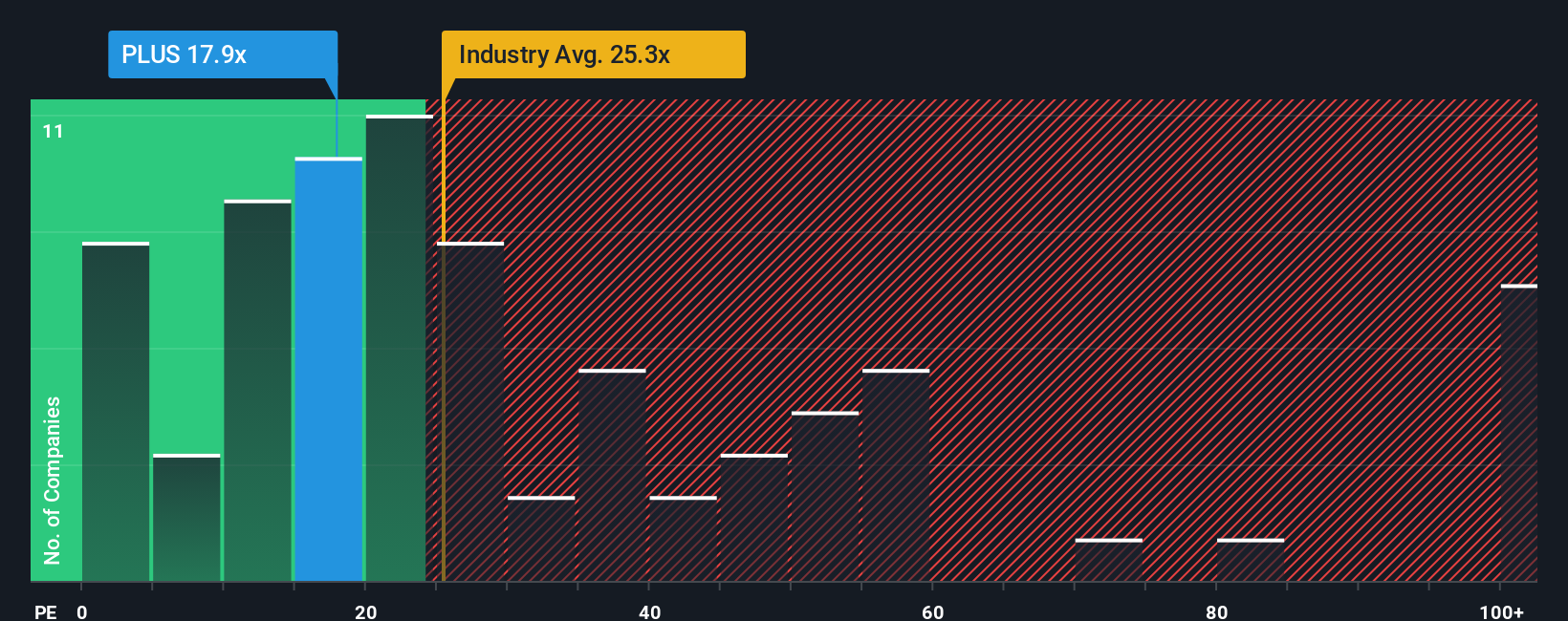

The Price-to-Earnings (PE) ratio is often the go-to valuation tool for profitable companies like ePlus because it connects a company’s share price to its bottom-line earnings. This offers a clear snapshot of how much investors are willing to pay for each dollar of profit. It is especially helpful when assessing established businesses with consistent profitability.

Growth prospects, business risks, and industry trends all influence what constitutes a "normal" or "fair" PE ratio. Higher expected growth or lower risk justifies paying a steeper PE, while slower growth or higher risks may push down what investors are willing to pay.

ePlus currently trades at 18.2x earnings. This is just slightly above its peer group average of 17.6x and noticeably below the electronic industry average of 24.7x. While these comparisons offer context, they do not account for ePlus’s specific financial health, growth trajectory, or risk profile.

The proprietary "Fair Ratio" from Simply Wall St calculates a company’s appropriate PE multiple by factoring in growth expectations, profitability, risk, industry benchmarks, and even company size. This method aims to offer a fairer estimate of what the market should pay, moving beyond simplistic peer or sector averages.

For ePlus, the current PE of 18.2x is just shy of its Fair Ratio of 20.2x. This suggests the stock is trading at a level reasonably aligned with its underlying fundamentals, growth, and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1432 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ePlus Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, structured way for investors to connect their view on a company's future. This includes expectations for revenue, profits, and margins, paired with a fair value estimate that supports actionable decisions.

With Narratives, you do not just look at the numbers; you give meaning to them by telling the story behind your forecast. Narratives link your perspective on ePlus, such as its potential in cloud and AI or the risks from margin pressure, to a dynamic fair value that updates as new news, earnings, or data are released. This ensures your analysis always reflects the latest available information.

Simply Wall St makes Narratives accessible to everyone through the Community page, which is used by millions of investors to share their scenarios and fair values. Narratives empower you to spot when ePlus appears undervalued or overvalued compared to your own or the community's fair value, helping inform timely buy or sell decisions in a fast-changing market.

For example, some investors currently value ePlus as high as $108 per share, seeing margin improvement ahead, while others, factoring in lower growth and compressed margins, set fair value closer to $39.01. Your Narrative and resulting price target will reflect what you believe is most likely for the company's future.

Do you think there's more to the story for ePlus? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Safaricom: Why I'm Holding Long

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.