- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

Evaluating ePlus (PLUS) After First Quarterly Dividend And Shift In Capital Returns

Dividend launch and capital return shift

ePlus (PLUS) has introduced its first quarterly dividend while keeping its share repurchase program in place, marking a new phase in capital return that investors may monitor closely.

See our latest analysis for ePlus.

Against this backdrop, ePlus shares closed at US$85.81, with a 17.06% 90 day share price return and a 5 year total shareholder return of 85.97%, while the new dividend and a recent omnibus shelf registration filing add fresh context to how the market weighs its growth prospects and risk profile.

If this shift in capital returns has you rethinking your watchlist, it could be a useful moment to widen your scope and check out high growth tech and AI stocks as potential next ideas.

With shares up 17.06% over 90 days and trading close to an analyst price target of US$92, the key question now is whether ePlus is still mispriced or if the market is already factoring in future growth.

Most Popular Narrative: 20.5% Undervalued

Compared with the narrative fair value of $108, ePlus at $85.81 sits at a clear discount, and the core of that gap centers on how future earnings quality and capital allocation are expected to play out.

The widespread adoption of remote/hybrid work models and escalating cybersecurity threats is ensuring continued robust demand for advanced networking and security solutions, which are core areas where ePlus is seeing double-digit growth. Security now represents 22.8% of gross billings, supporting both top-line revenue expansion and an improved margin mix from value-added services.

Curious what kind of revenue path and margin profile have to line up to support that higher value, even as consensus models in lower earnings ahead and a richer future earnings multiple than the sector? The full narrative spells out the cash flow path, discount rate and profit mix that need to fall into place to justify a fair value well above today’s price.

Result: Fair Value of $108 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be tested if large, one off enterprise deals fail to repeat or if customer concentration in telecom and government slows future orders.

Find out about the key risks to this ePlus narrative.

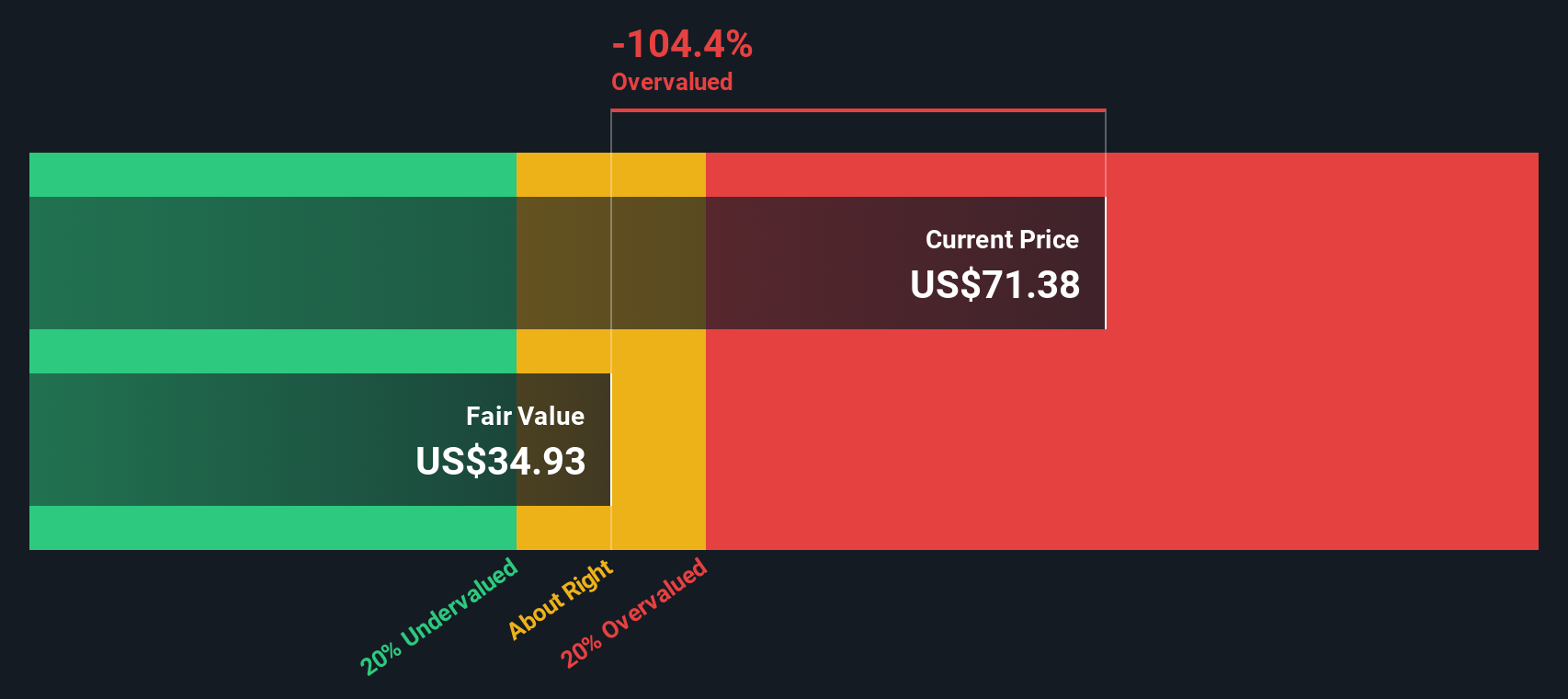

Another Angle: Our DCF Sends A Different Signal

While the narrative fair value of $108 points to upside, our DCF model is much more cautious, with an estimate of $43.88. At the current $85.81 price, that implies ePlus is trading well above its future cash flow value. Which story do you think better fits your own expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ePlus for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 887 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ePlus Narrative

If you see the story differently or just prefer to test the assumptions yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your ePlus research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next idea?

If ePlus is already on your radar, do not stop there. A few minutes with the right screeners can surface opportunities you would otherwise miss entirely.

- Spot companies priced below their estimated cash flow value by scanning these 887 undervalued stocks based on cash flows that might fit the profile you want in your portfolio.

- Zero in on cash generating names with income potential by filtering for these 12 dividend stocks with yields > 3%, especially if reliable yields matter to your plan.

- Tap into fast changing trends in digital assets by reviewing these 18 cryptocurrency and blockchain stocks and see which listed businesses align with that theme.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Otokar is the first choice for tactical armored land vehicles to meet Europe's defense industry needs.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion