- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

At US$66.90, Is It Time To Put ePlus inc. (NASDAQ:PLUS) On Your Watch List?

ePlus inc. (NASDAQ:PLUS), might not be a large cap stock, but it saw a significant share price rise of 22% in the past couple of months on the NASDAQGS. Shareholders may appreciate the recent price jump, but the company still has a way to go before reaching its yearly highs again. As a small cap stock, hardly covered by any analysts, there is generally more of an opportunity for mispricing as there is less activity to push the stock closer to fair value. Is there still an opportunity here to buy? Today we will analyse the most recent data on ePlus’s outlook and valuation to see if the opportunity still exists.

We check all companies for important risks. See what we found for ePlus in our free report.Is ePlus Still Cheap?

Great news for investors – ePlus is still trading at a fairly cheap price according to our price multiple model, where we compare the company's price-to-earnings ratio to the industry average. In this instance, we’ve used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock’s cash flows. we find that ePlus’s ratio of 16.82x is below its peer average of 21.7x, which indicates the stock is trading at a lower price compared to the Electronic industry. Although, there may be another chance to buy again in the future. This is because ePlus’s beta (a measure of share price volatility) is high, meaning its price movements will be exaggerated relative to the rest of the market. If the market is bearish, the company’s shares will likely fall by more than the rest of the market, providing a prime buying opportunity.

View our latest analysis for ePlus

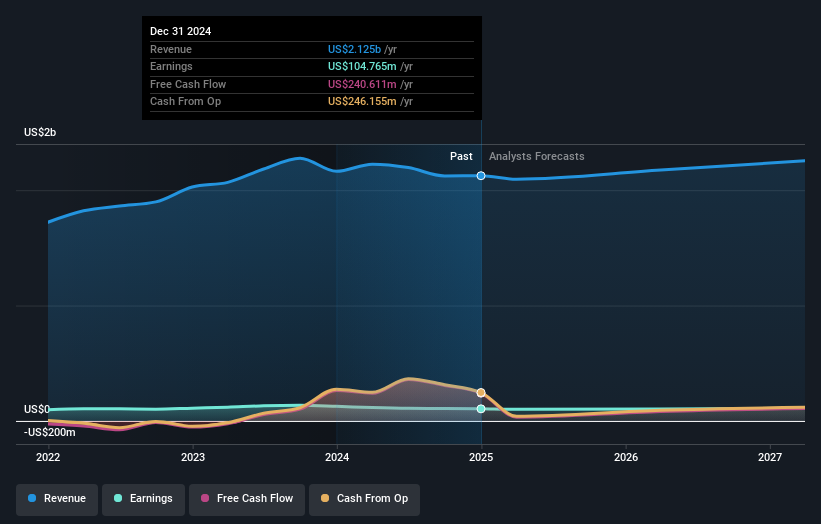

Can we expect growth from ePlus?

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. However, with a relatively muted profit growth of 3.3% expected over the next couple of years, growth doesn’t seem like a key driver for a buy decision for ePlus, at least in the short term.

What This Means For You

Are you a shareholder? Even though growth is relatively muted, since PLUS is currently trading below the industry PE ratio, it may be a great time to accumulate more of your holdings in the stock. However, there are also other factors such as capital structure to consider, which could explain the current price multiple.

Are you a potential investor? If you’ve been keeping an eye on PLUS for a while, now might be the time to enter the stock. Its future profit outlook isn’t fully reflected in the current share price yet, which means it’s not too late to buy PLUS. But before you make any investment decisions, consider other factors such as the strength of its balance sheet, in order to make a well-informed assessment.

Diving deeper into the forecasts for ePlus mentioned earlier will help you understand how analysts view the stock going forward. At Simply Wall St, we have the analysts estimates which you can view by clicking here.

If you are no longer interested in ePlus, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

The Architect of Sovereignty: Palantir’s Premium Paradox at $149

BYLOT: Re-Rating Potential Tempered by UK Tax Drag and Speculative-Grade Debt Dynamics – Neutral (Hold)

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion