- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:OUST

Ouster (OUST): Assessing Valuation After Strong Q3 Results and Updated Growth Outlook

Reviewed by Simply Wall St

Ouster (OUST) shares drew investor attention after the company released third quarter earnings. The report revealed higher sales and a reduced net loss compared to a year ago, along with new revenue guidance for the current quarter.

See our latest analysis for Ouster.

Ouster’s impressive 221.8% total shareholder return over the past year stands out, especially after this week’s notable swing. Shares jumped 6.6% in a day following upbeat quarterly results, but are still down 7.7% for the month. Despite the recent turbulence, momentum from earlier in the year suggests investor interest in Ouster’s growth potential remains strong.

If Ouster’s story has sparked your interest, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a discount to analyst targets and fresh growth numbers on the table, investors face a familiar dilemma: is Ouster undervalued, or is the market already factoring in all the future upside?

Most Popular Narrative: 34% Undervalued

With Ouster’s fair value now raised to $39, well above the last close of $25.71, the most popular narrative paints a much more bullish picture than recent market prices. This gap spotlights a confident outlook on Ouster’s business transformation and forward momentum.

Bullish analysts see Ouster's Department of Defense certification as a significant competitive advantage. They describe it as a material moat that could support future contracts and long-term revenue stability.

Curious how this bold valuation is built? The secret lies in eye-popping growth forecasts, ambitious targets for future margins, and a revenue surge that could surprise even optimists. Want the exact assumptions analysts are betting on, and what needs to happen for this projection to come true? Dive into the full narrative and find out.

Result: Fair Value of $39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected shifts in market demand or delays in securing large defense contracts could quickly challenge these optimistic projections.

Find out about the key risks to this Ouster narrative.

Another View: Is the Market Too Enthusiastic?

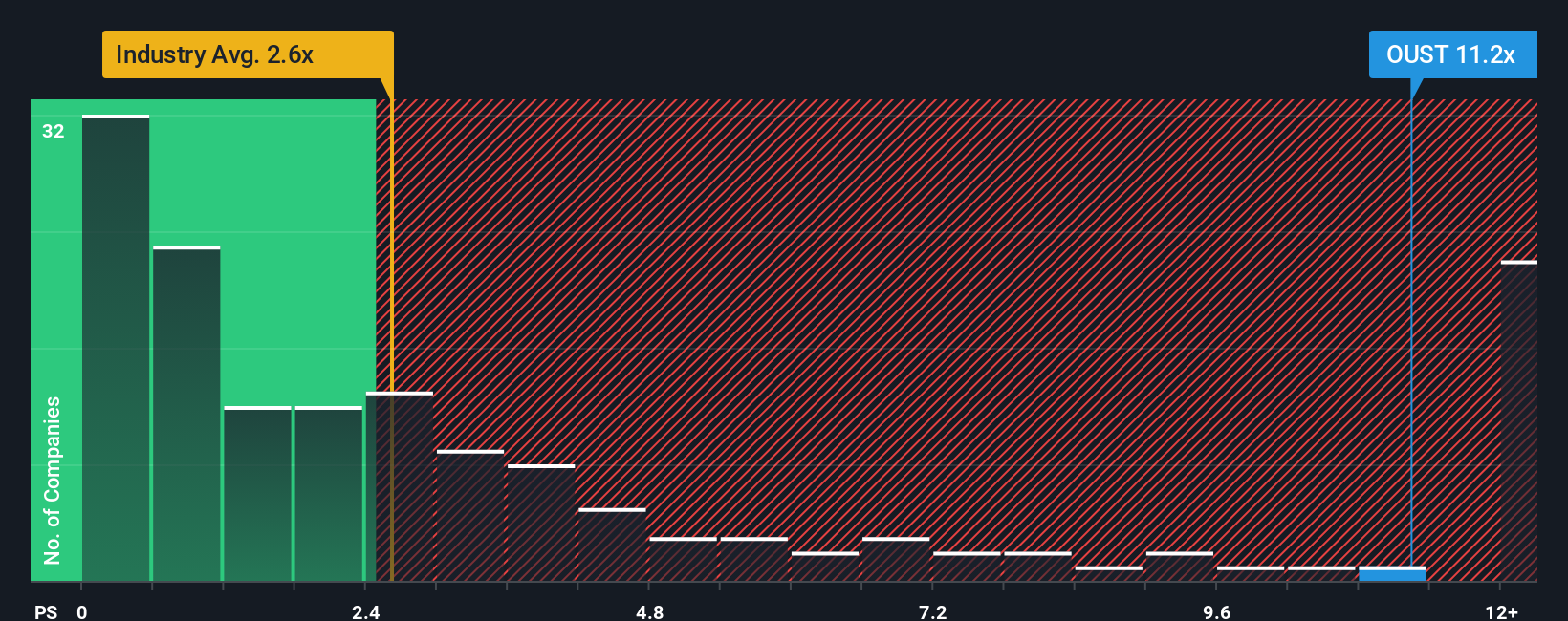

When we look at Ouster’s price-to-sales ratio of 11.2x, it is much higher than both the US Electronic industry average of 2.6x and the peer average of 5.8x. It also sits well above the fair ratio of 4.9x. This suggests investors could be paying a premium for future growth that might not materialize as quickly as hoped. Does this signal overconfidence, or is there still hidden value waiting to be uncovered?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ouster Narrative

If you are the kind of investor who likes to dig into the numbers personally and reach your own conclusions, the tools to build your perspective are right at your fingertips. Do it your way

A great starting point for your Ouster research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't stop your research with just one stock. The smartest investors always have a few bold ideas on their radar, and you should too. Use these powerful screeners to spot fresh opportunities that others might miss:

- Tap into the growth of machine learning and automation by checking out these 24 AI penny stocks, which are leading innovation in artificial intelligence and smart technologies.

- Boost your portfolio's potential with steady returns when you survey these 16 dividend stocks with yields > 3%, which pay attractive yields above 3%.

- Uncover rare value by tracking down these 875 undervalued stocks based on cash flows, which signal strong upside based on discounted cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OUST

Ouster

Provides lidar sensors for the automotive, industrial, robotics, and smart infrastructure industries in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives