- United States

- /

- Communications

- /

- NasdaqCM:ONDS

A Look at Ondas Holdings (ONDS) Valuation as Earnings Anticipation Drives Investor Interest

Reviewed by Simply Wall St

Ondas Holdings (ONDS) recently filed a $5.6 million shelf registration for new common stock, providing the company with flexibility to raise capital in the future. This move comes as anticipation builds ahead of the company’s earnings report.

See our latest analysis for Ondas Holdings.

Investor buzz is building around Ondas Holdings as anticipation runs high ahead of next week’s earnings and the company’s leadership in autonomous drone tech stays in focus. Despite a sharp 37% drop in the past month, the stock’s momentum is hard to miss with a 120.9% year-to-date share price return and a staggering 670.6% total shareholder return over the past year. Clearly, growth expectations and risk appetite have both picked up.

If this kind of dramatic price action has you looking for your next big opportunity, why not broaden your search and discover fast growing stocks with high insider ownership

With shares climbing far ahead of the broader market and trading at a premium to both peers and fundamentals, the key question is whether Ondas Holdings remains undervalued or if the market is already factoring in its next wave of growth.

Most Popular Narrative: 38.8% Undervalued

With Ondas Holdings closing at $5.81 and the most popular narrative pegging fair value at $9.50, market watchers may be questioning just how much upside is already priced in. The latest narrative brings together analyst expectations with a focus on tech expansion and sector momentum, setting the stage for a bold outlook.

The strategic partnership with Palantir Technologies aims to leverage advanced AI capabilities to enhance operational efficiencies and scale OAS’s operations, which is expected to support the revenue ramp and broaden their customer base, influencing earnings and margins through improved operational scale.

Curious what powers this bullish price target? Discover why analysts are relying on triple-digit growth assumptions, upward profit margin swings, and one surprising multiple to back this valuation. The path to $9.50 involves aggressive projections. See what could drive the next move before everyone else does.

Result: Fair Value of $9.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including potential delays in expanding defense contracts and ongoing volatility in profit margins. These factors could challenge the bullish outlook.

Find out about the key risks to this Ondas Holdings narrative.

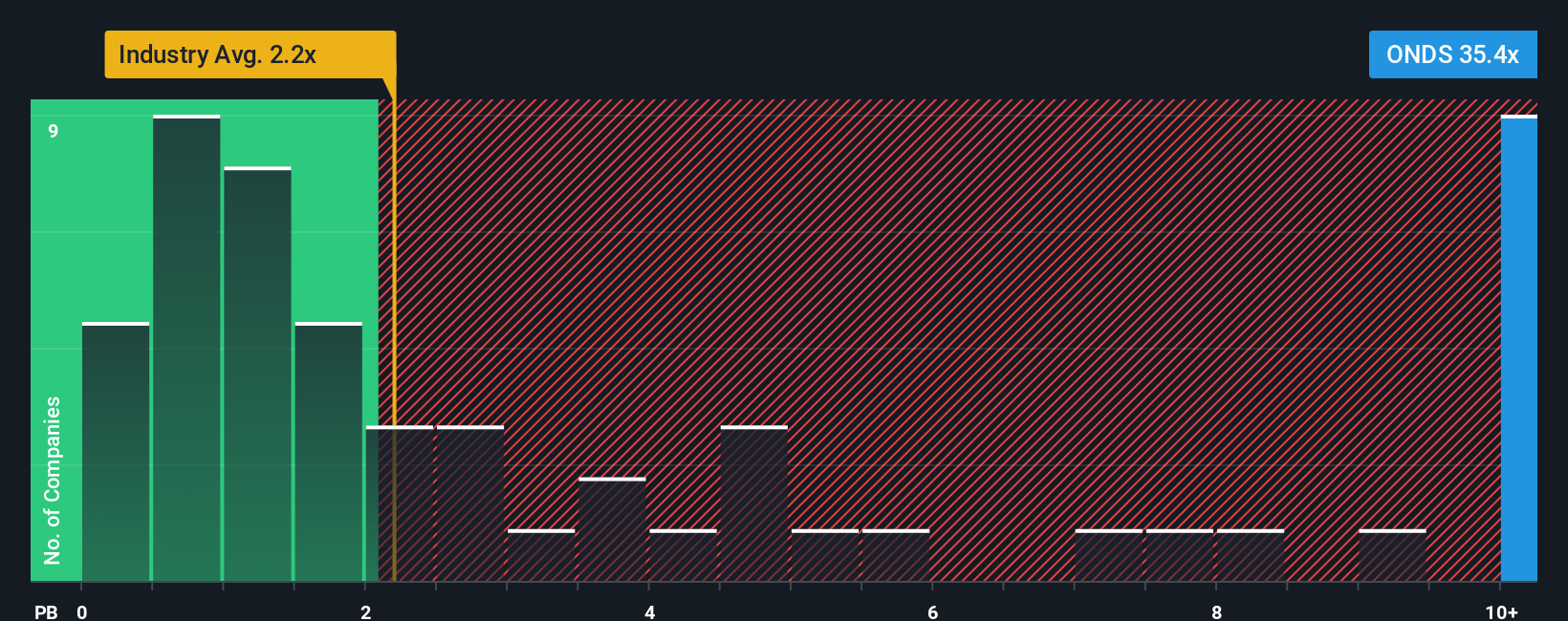

Another View: High Price-to-Book Ratio Raises Questions

While the fair value estimate suggests upside, Ondas Holdings stands out as expensive when compared to its peers using the price-to-book ratio. Trading at 22.3 times book value compared to the US Communications sector average of 2.1 times, the valuation risk is significant if the company fails to deliver. Is this a sign of long-term opportunity, or could market enthusiasm be running too hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ondas Holdings Narrative

If you see things differently or want to dive into the numbers yourself, you can craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Ondas Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Level up your portfolio with handpicked themes built for tomorrow. These investment opportunities are too promising to let slip by unnoticed. Your next winning stock could be among them.

- Target steady income and long-term wealth by tapping into these 16 dividend stocks with yields > 3% offering yields above 3%, designed for investors who value both growth and stability.

- Tap fresh opportunities from advances in medical technology and artificial intelligence with these 32 healthcare AI stocks, where innovation is driving transformative breakthroughs in healthcare.

- Fuel your portfolio's growth by uncovering these 876 undervalued stocks based on cash flows that are overlooked by the market and could deliver outsized returns as their true worth emerges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives