It is not uncommon to see companies perform well in the years after insiders buy shares. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So we'll take a look at whether insiders have been buying or selling shares in NETGEAR, Inc. (NASDAQ:NTGR).

What Is Insider Buying?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, most countries require that the company discloses such transactions to the market.

We don't think shareholders should simply follow insider transactions. But equally, we would consider it foolish to ignore insider transactions altogether. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

View our latest analysis for NETGEAR

NETGEAR Insider Transactions Over The Last Year

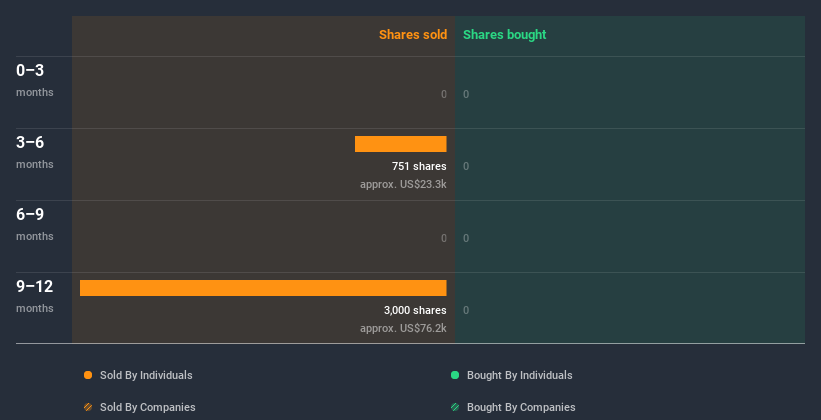

Over the last year, we can see that the biggest insider sale was by the Senior Vice President of Human Resources, Tamesa Rogers, for US$76k worth of shares, at about US$25.41 per share. That means that an insider was selling shares at slightly below the current price (US$38.17). We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal. We note that the biggest single sale was only 20% of Tamesa Rogers's holding.

NETGEAR insiders didn't buy any shares over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Insiders own 2.5% of NETGEAR shares, worth about US$28m. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

What Might The Insider Transactions At NETGEAR Tell Us?

The fact that there have been no NETGEAR insider transactions recently certainly doesn't bother us. We don't take much encouragement from the transactions by NETGEAR insiders. The modest level of insider ownership is, at least, some comfort. Of course, the future is what matters most. So if you are interested in NETGEAR, you should check out this free report on analyst forecasts for the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade NETGEAR, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NETGEAR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:NTGR

NETGEAR

Provides connectivity solutions the Americas; Europe, the Middle East, Africa; and the Asia Pacific.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives