- United States

- /

- Tech Hardware

- /

- NasdaqGS:NTAP

What NetApp (NTAP)'s AI-Ready Storage and Hyperscale Integrations Mean for Shareholders

Reviewed by Sasha Jovanovic

- At its INSIGHT Customer Conference, NetApp unveiled new AI-ready storage systems, advanced cyber resilience services, and expanded collaborations with leading technology partners including Google Cloud, Cisco, Red Hat, and Equinix to power hybrid cloud, enterprise AI, and SAP workloads. These developments mark a significant step in NetApp’s push to provide unified, secure, and scalable infrastructure solutions tailored to emerging AI and cloud-driven business needs.

- A key material insight is NetApp’s integration of its enterprise-grade storage platform with hyperscalers and AI technologies, aiming to eliminate data silos, enhance cyber resilience, and simplify access for organizations operating in hybrid and multicloud environments.

- We’ll explore how NetApp’s AI-powered advancements and new hyperscaler integrations could reshape its investment narrative and future growth outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

NetApp Investment Narrative Recap

To own NetApp as a shareholder, you have to believe in its strategy to lead the evolving data infrastructure market as demand shifts from on-premises to cloud and AI-powered solutions. The recent burst of AI-ready product launches and high-profile cloud partnerships may help ease near-term concerns around competitive differentiation, but the most important catalyst remains continued adoption in production-scale AI and cloud workloads, while the risk of margin pressure from reliance on hyperscaler partners is ever-present. The impact of these product announcements on either catalyst or risk is potentially positive, but not immediately material to the near-term outlook.

Among the many announcements, NetApp’s expanded integration with Google Cloud is especially relevant. By adding unified block and file capabilities to NetApp Volumes and strengthening direct paths for AI data workloads across cloud and on-premises environments, this move directly addresses enterprise needs for hybrid data management and AI readiness, tying to the catalyst of growing hybrid and AI workload demand. This development, while promising, does not fully resolve longer-term margin or competitive challenges facing NetApp as the market continues to evolve...

Read the full narrative on NetApp (it's free!)

NetApp's outlook projects $7.5 billion in revenue and $1.4 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 4.3% and an earnings increase of $0.2 billion from the current $1.2 billion.

Uncover how NetApp's forecasts yield a $119.71 fair value, in line with its current price.

Exploring Other Perspectives

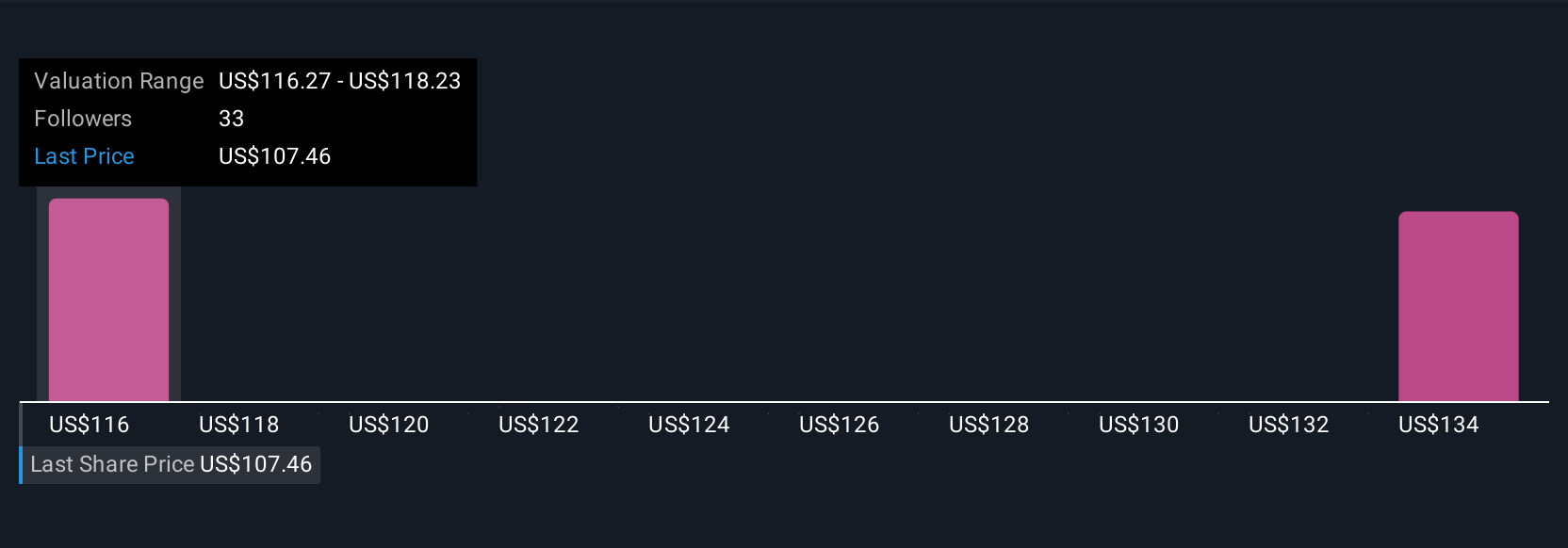

Five unique fair value estimates from the Simply Wall St Community place NetApp shares between US$119.71 and US$178.77. With margin pressure from cloud partners on investors' minds, it is essential to understand how differing outlooks can impact expectations, see how community views line up against these risks.

Explore 5 other fair value estimates on NetApp - why the stock might be worth just $119.71!

Build Your Own NetApp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NetApp research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NetApp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NetApp's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetApp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTAP

NetApp

Provides a range of enterprise software, systems, and services that customers use to transform their data infrastructures in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives