- United States

- /

- Tech Hardware

- /

- NasdaqGS:NTAP

Is NetApp's (NTAP) Board Response to Shareholder Rights Proposal Shaping Its Governance Outlook?

Reviewed by Simply Wall St

- On July 25, 2025, NetApp filed a definitive proxy statement urging shareholders to vote against a proposal to eliminate a shareholder rights provision restricting newer shareholders from calling special meetings, a proposal originally submitted by John Chevedden for consideration at the upcoming annual meeting.

- This governance debate highlights ongoing shareholder activism focused on the company’s approach to shareholder rights and board accountability practices.

- We’ll now explore how this governance proposal and board response may influence NetApp’s investment outlook, particularly regarding shareholder engagement and corporate governance.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

NetApp Investment Narrative Recap

To invest in NetApp, you need confidence in its ability to capitalize on cloud growth, AI-driven storage solutions, and disciplined execution, while effectively managing risks tied to sales consistency and market demand. The recent proxy statement urging shareholders to maintain special meeting restrictions is unlikely to materially affect short term business catalysts or the largest risk: ongoing execution challenges and deal slippage, especially at quarter-end.

Of NetApp’s recent actions, the ongoing share buyback program stands out, with more than US$1.2 billion authorized in 2025. While not directly tied to the governance proposal, buybacks continue as another method of shareholder returns, aligning with management’s focus on operational discipline and capital allocation amid revenue and margin catalysts from flash storage and cloud solutions.

In contrast, weaker demand in European markets and the US public sector remains a risk that investors should be aware of, especially as...

Read the full narrative on NetApp (it's free!)

NetApp's outlook projects $7.5 billion in revenue and $1.4 billion in earnings by 2028. This assumes a 4.3% annual revenue growth rate and a $0.2 billion increase in earnings from the current $1.2 billion level.

Uncover how NetApp's forecasts yield a $115.32 fair value, a 8% upside to its current price.

Exploring Other Perspectives

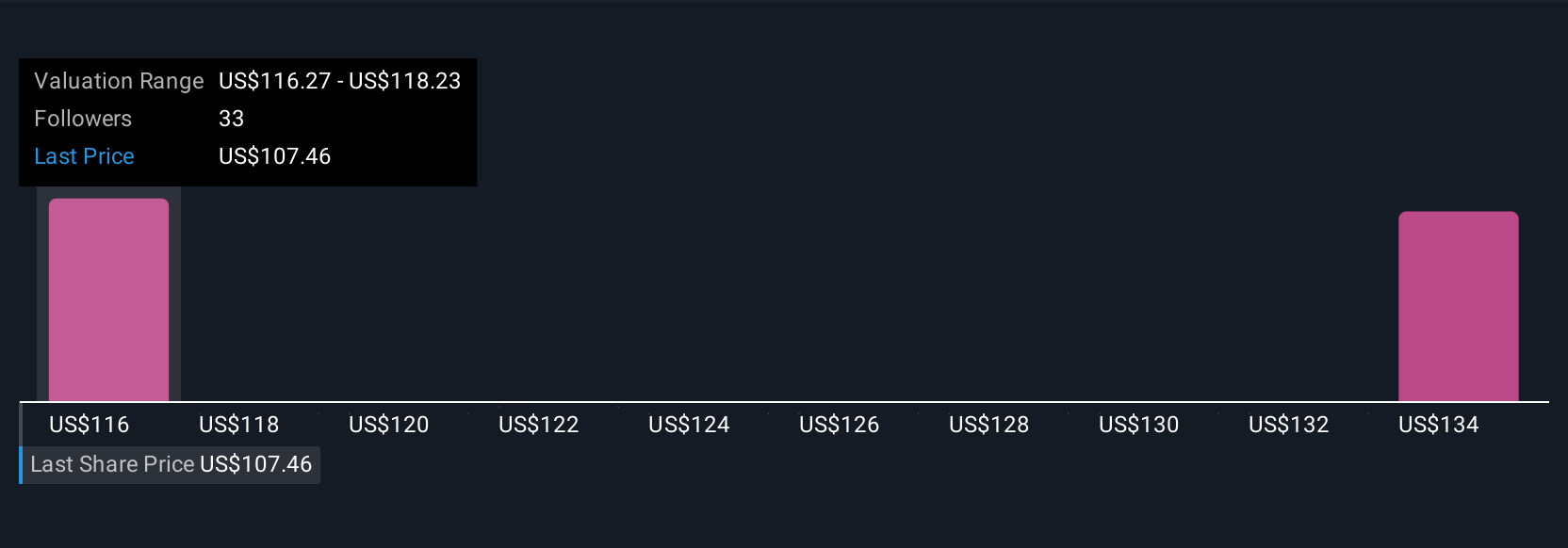

Fair value estimates from four Simply Wall St Community members range from US$115.32 to US$180.13. You can see this diversity of opinion while weighing ongoing risks around sales execution and market softness for a more complete view of the company’s future.

Explore 4 other fair value estimates on NetApp - why the stock might be worth as much as 68% more than the current price!

Build Your Own NetApp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NetApp research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free NetApp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NetApp's overall financial health at a glance.

No Opportunity In NetApp?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetApp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTAP

NetApp

Provides a range of enterprise software, systems, and services that customers use to transform their data infrastructures in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives