Stock Analysis

- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NSSC

High Growth Tech Stocks In The United States You Should Know

Reviewed by Simply Wall St

The market is up 1.6% over the last week and has risen 22% over the last 12 months, with earnings forecast to grow by 15% annually. In this thriving environment, identifying high growth tech stocks that align with these positive trends can be crucial for investors looking to capitalize on robust market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.49% | 27.13% | ★★★★★★ |

| Sarepta Therapeutics | 24.13% | 44.72% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.44% | 65.92% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Ascendis Pharma | 39.71% | 68.43% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.81% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 251 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Catalyst Pharmaceuticals (NasdaqCM:CPRX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Catalyst Pharmaceuticals, Inc., a commercial-stage biopharmaceutical company, develops and commercializes therapies for rare debilitating neuromuscular and neurological diseases in the United States, with a market cap of $2.31 billion.

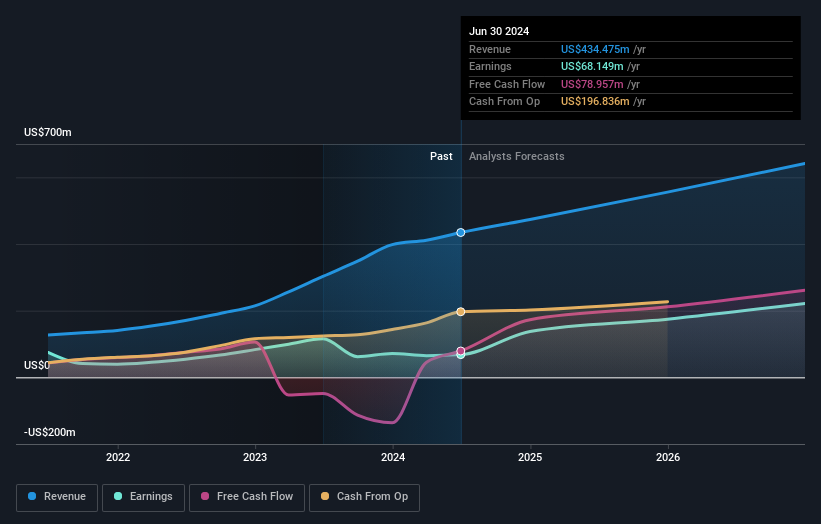

Operations: Catalyst Pharmaceuticals, Inc. generates revenue primarily through the development and commercialization of drug products, totaling $434.48 million. The company focuses on therapies for rare chronic neuromuscular and neurological diseases in the U.S.

Catalyst Pharmaceuticals has shown robust revenue growth, with a 13.3% annual increase expected to outpace the US market's 8.8%. Despite a significant earnings drop of -41% last year, the company's projected earnings growth rate of 20.9% annually over the next three years indicates strong future potential. Notably, Catalyst's R&D expenses have been strategically managed to support innovation without excessive spending, ensuring sustainable development in its product pipeline. Recent partnerships and licensing agreements further bolster its market position and potential for expansion in new therapeutic areas.

- Click here and access our complete health analysis report to understand the dynamics of Catalyst Pharmaceuticals.

Understand Catalyst Pharmaceuticals' track record by examining our Past report.

Napco Security Technologies (NasdaqGS:NSSC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Napco Security Technologies, Inc. develops, manufactures, and sells electronic security systems for various applications in the United States and internationally, with a market cap of approximately $1.35 billion.

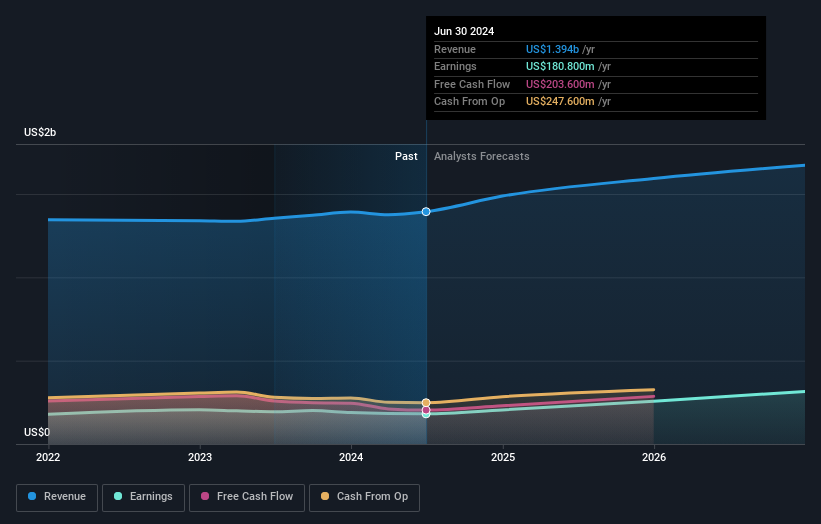

Operations: Napco Security Technologies generates revenue primarily from its electronic security devices, amounting to $188.82 million. The company serves commercial, residential, institutional, industrial, and governmental sectors both domestically and internationally.

Napco Security Technologies has demonstrated impressive earnings growth of 83.6% over the past year, significantly outpacing the Electronic industry's -9.3%. The company's revenue is forecasted to grow at 12.5% annually, surpassing the US market's 8.8%, while its earnings are expected to increase by 20.7% per year, indicating robust future potential. Notably, Napco's R&D expenses have been strategically allocated to support innovation without overspending, contributing $188.82 million in revenue for FY2024 compared to $170 million last year and net income of $49.82 million up from $27.13 million previously.

- Click to explore a detailed breakdown of our findings in Napco Security Technologies' health report.

Crane NXT (NYSE:CXT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Crane NXT, Co. operates as an industrial technology company that provides technology solutions to secure, detect, and authenticate customers’ important assets with a market cap of $3.20 billion.

Operations: Crane NXT generates revenue primarily through two segments: Crane Payment Innovations ($870.10 million) and Security and Authentication Technologies ($523.90 million). The company's market capitalization stands at $3.20 billion.

Crane NXT's recent performance highlights its strategic positioning in the tech sector, with earnings forecasted to grow at 21.9% annually, outpacing the US market's 15.2%. Notably, their R&D expenses have been effectively utilized, contributing significantly to innovation and growth; for instance, their revenue increased from $681.5 million to $684.2 million over six months. The company also repurchased shares recently and announced a quarterly dividend of $0.16 per share payable on September 11, 2024.

Taking Advantage

- Navigate through the entire inventory of 251 US High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Napco Security Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NSSC

Napco Security Technologies

Develops, manufactures, and sells electronic security systems for commercial, residential, institutional, industrial, and governmental applications in the United States and internationally.