- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:MTEK

Here's Why Shareholders Will Not Be Complaining About Maris-Tech Ltd.'s (NASDAQ:MTEK) CEO Pay Packet

Key Insights

- Maris-Tech to hold its Annual General Meeting on 14th of August

- CEO Israel Bar's total compensation includes salary of US$268.8k

- Total compensation is similar to the industry average

- Maris-Tech's total shareholder return over the past three years was 69% while its EPS grew by 37% over the past three years

We have been pretty impressed with the performance at Maris-Tech Ltd. (NASDAQ:MTEK) recently and CEO Israel Bar deserves a mention for their role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 14th of August. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

Check out our latest analysis for Maris-Tech

How Does Total Compensation For Israel Bar Compare With Other Companies In The Industry?

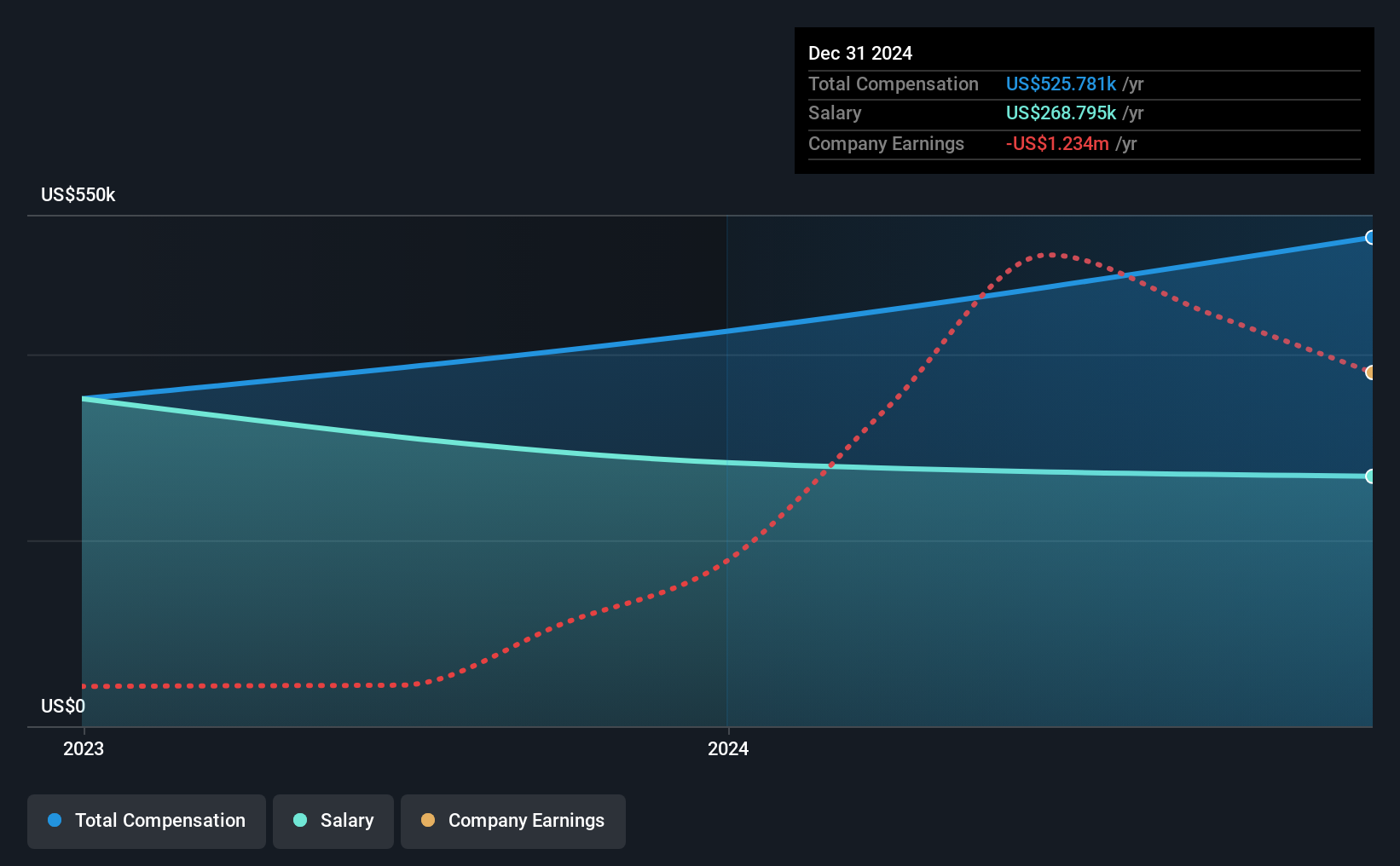

According to our data, Maris-Tech Ltd. has a market capitalization of US$21m, and paid its CEO total annual compensation worth US$526k over the year to December 2024. That's a notable increase of 24% on last year. We note that the salary of US$268.8k makes up a sizeable portion of the total compensation received by the CEO.

On comparing similar-sized companies in the American Electronic industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$462k. From this we gather that Israel Bar is paid around the median for CEOs in the industry. What's more, Israel Bar holds US$6.6m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Speaking on an industry level, nearly 23% of total compensation represents salary, while the remainder of 77% is other remuneration. According to our research, Maris-Tech has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Maris-Tech Ltd.'s Growth Numbers

Over the past three years, Maris-Tech Ltd. has seen its earnings per share (EPS) grow by 37% per year. Its revenue is up 51% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Maris-Tech Ltd. Been A Good Investment?

Most shareholders would probably be pleased with Maris-Tech Ltd. for providing a total return of 69% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Some shareholders will probably be more lenient on CEO compensation in the upcoming AGM given the pleasing performance of the company recently. In saying that, some shareholders may feel that the more important issues to be addressed may be how the management plans to steer the company towards sustainable profitability in the future.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for Maris-Tech (2 are a bit unpleasant!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:MTEK

Maris-Tech

Designs, develops, manufactures, and sells digital video and audio products and services.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

This strategic transformation of TTE? Significant re-rating potential

Q3 Outlook modestly optimistic

Okamoto Machine Tool Works focus on profitability

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.