Stock Analysis

- United States

- /

- Communications

- /

- NasdaqGS:LITE

Market Participants Recognise Lumentum Holdings Inc.'s (NASDAQ:LITE) Revenues Pushing Shares 26% Higher

Despite an already strong run, Lumentum Holdings Inc. (NASDAQ:LITE) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 89%.

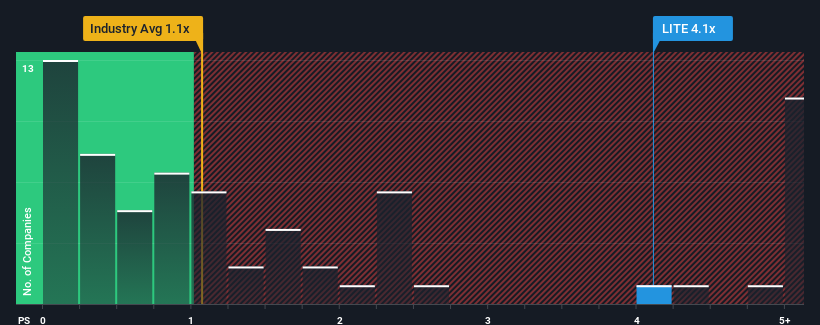

After such a large jump in price, you could be forgiven for thinking Lumentum Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.1x, considering almost half the companies in the United States' Communications industry have P/S ratios below 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Lumentum Holdings

What Does Lumentum Holdings' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Lumentum Holdings' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Lumentum Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Lumentum Holdings?

The only time you'd be truly comfortable seeing a P/S as steep as Lumentum Holdings' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 21% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 24% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 10%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Lumentum Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Lumentum Holdings have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Lumentum Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you take the next step, you should know about the 3 warning signs for Lumentum Holdings (1 is significant!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.