- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:KTCC

Slowing Rates Of Return At Key Tronic (NASDAQ:KTCC) Leave Little Room For Excitement

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. However, after investigating Key Tronic (NASDAQ:KTCC), we don't think it's current trends fit the mold of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Key Tronic is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.038 = US$10m ÷ (US$432m - US$161m) (Based on the trailing twelve months to April 2023).

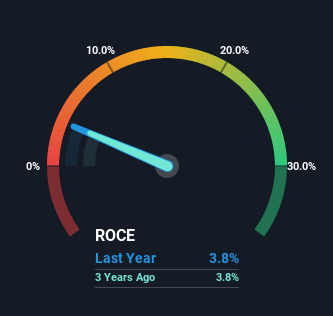

Therefore, Key Tronic has an ROCE of 3.8%. In absolute terms, that's a low return and it also under-performs the Electronic industry average of 13%.

See our latest analysis for Key Tronic

Historical performance is a great place to start when researching a stock so above you can see the gauge for Key Tronic's ROCE against it's prior returns. If you'd like to look at how Key Tronic has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

SWOT Analysis for Key Tronic

- Earnings growth over the past year exceeded the industry.

- Debt is well covered by .

- Interest payments on debt are not well covered.

- KTCC's financial characteristics indicate limited near-term opportunities for shareholders.

- Lack of analyst coverage makes it difficult to determine KTCC's earnings prospects.

- Debt is not well covered by operating cash flow.

What Can We Tell From Key Tronic's ROCE Trend?

The returns on capital haven't changed much for Key Tronic in recent years. The company has consistently earned 3.8% for the last five years, and the capital employed within the business has risen 79% in that time. Given the company has increased the amount of capital employed, it appears the investments that have been made simply don't provide a high return on capital.

The Bottom Line

As we've seen above, Key Tronic's returns on capital haven't increased but it is reinvesting in the business. And in the last five years, the stock has given away 30% so the market doesn't look too hopeful on these trends strengthening any time soon. All in all, the inherent trends aren't typical of multi-baggers, so if that's what you're after, we think you might have more luck elsewhere.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 3 warning signs for Key Tronic (of which 1 is concerning!) that you should know about.

While Key Tronic may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Key Tronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:KTCC

Key Tronic

Provides contract manufacturing services for original equipment manufacturers in the United States and internationally.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success