- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ITRI

How Itron’s (ITRI) Staten Island Fleet Electrification Project Could Influence Its Grid Management Narrative

Reviewed by Sasha Jovanovic

- The Mobility House and Itron, Inc. recently launched a New York State project, backed by NYSERDA, to implement advanced flexible service connections for fleet electrification, integrating Itron's IntelliFLEX DERMS solution with The Mobility House’s ChargePilot system at a Staten Island school bus site.

- This collaboration marks the first deployment of these integrated technologies to tackle distribution grid capacity constraints as a barrier to large-scale electric fleet adoption.

- We’ll look at how Itron’s integration of real-time grid intelligence and automated charging management could shift its investment outlook.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Itron Investment Narrative Recap

To be an Itron shareholder, you have to believe that the shift toward digital and decarbonized utility infrastructure will steadily drive long-term demand for its smart grid solutions. The recent fleet electrification project in New York supports Itron’s positioning as an enabler of grid modernization, but is unlikely to materially accelerate the most important near-term catalyst, reacceleration of revenue from large project deployments, nor does it reduce the key risk of regulatory and utility budget delays hampering sales cycles in the quarters ahead. JP Morgan’s recent price target increase to US$155 reflects analyst confidence in Itron’s future, tying closely to ongoing technology deployments like the New York pilot which reinforce the revenue pipeline potential critical to the company’s outlook. This analyst action stands out as the most relevant recent announcement to the company's core growth catalysts, especially as investors watch for signs that backlog-driven revenues, and approvals, will resume momentum. On the other hand, investors should be aware that if regulatory decisions and utility capital planning delays persist much longer, then...

Read the full narrative on Itron (it's free!)

Itron's narrative projects $2.8 billion revenue and $388.8 million earnings by 2028. This requires 5.2% yearly revenue growth and an increase of $118.9 million in earnings from the current $269.9 million.

Uncover how Itron's forecasts yield a $144.40 fair value, a 8% upside to its current price.

Exploring Other Perspectives

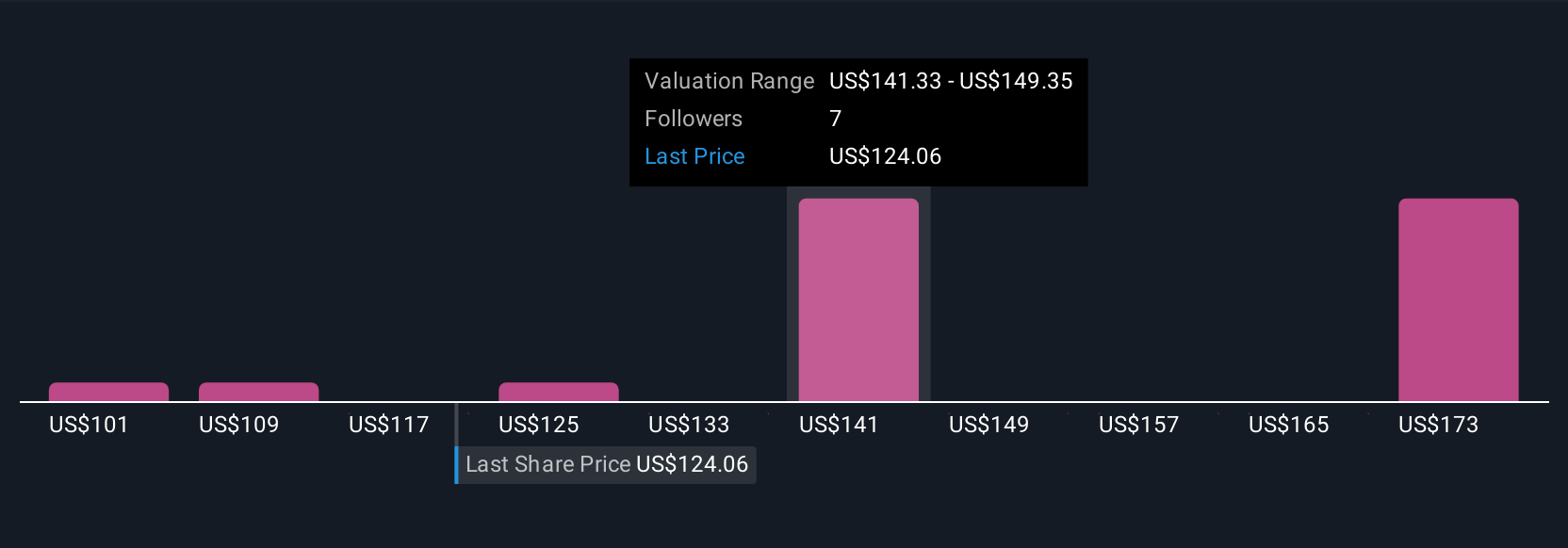

Five private investors in the Simply Wall St Community estimate Itron’s fair value between US$101 and US$177 per share. With regulatory delays still presenting a challenge for near-term growth, comparing these perspectives to analyst viewpoints can broaden your insight into potential scenarios for Itron's share price.

Explore 5 other fair value estimates on Itron - why the stock might be worth as much as 32% more than the current price!

Build Your Own Itron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Itron research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Itron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Itron's overall financial health at a glance.

No Opportunity In Itron?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ITRI

Itron

A technology, solutions, and service company, provides end-to-end solutions that help manage energy, water, and smart city operations worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

GameStop will ace the financial crisis wave with its strategic Bitcoin investment and cash reserves

BABA Analysis: Buying the Fear, Holding the Cloud

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale