- United States

- /

- Communications

- /

- NasdaqGS:HLIT

How Weaker Q3 Results at Harmonic (HLIT) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Harmonic Inc. released its Q3 2025 earnings on November 3, reporting year-over-year declines in both revenue and earnings as anticipated by analysts.

- This release comes after a previous quarter in which the company outperformed expectations, yet now faces lower analyst estimates and warnings about potential financial distress.

- We'll explore how heightened analyst caution and financial risk concerns shape Harmonic's investment narrative heading into 2026 and beyond.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Harmonic Investment Narrative Recap

To invest in Harmonic right now, one needs conviction in the growing global demand for high-speed broadband and the company's role in next-generation network rollouts. The weak Q3 2025 results and analyst warnings about financial risk add weight to near-term concerns, but these do not materially change the central investment catalysts or the greatest risk: ongoing reliance on major customers like Comcast for a large share of revenue.

One recent announcement that aligns closely with these catalysts is Harmonic's expanded collaboration with Comcast to deploy fiber broadband for multi-gigabit access. This partnership underscores Harmonic's positioning at the heart of the industry’s broadband upgrade cycle, even as short-term results draw heightened scrutiny.

In contrast, investors should be aware of the volatility that can arise if a single large customer like Comcast were to reduce orders or shift priorities...

Read the full narrative on Harmonic (it's free!)

Harmonic's narrative projects $695.5 million in revenue and $70.6 million in earnings by 2028. This requires a 0.3% annual revenue decline and a $2 million earnings increase from the current earnings of $68.6 million.

Uncover how Harmonic's forecasts yield a $10.50 fair value, in line with its current price.

Exploring Other Perspectives

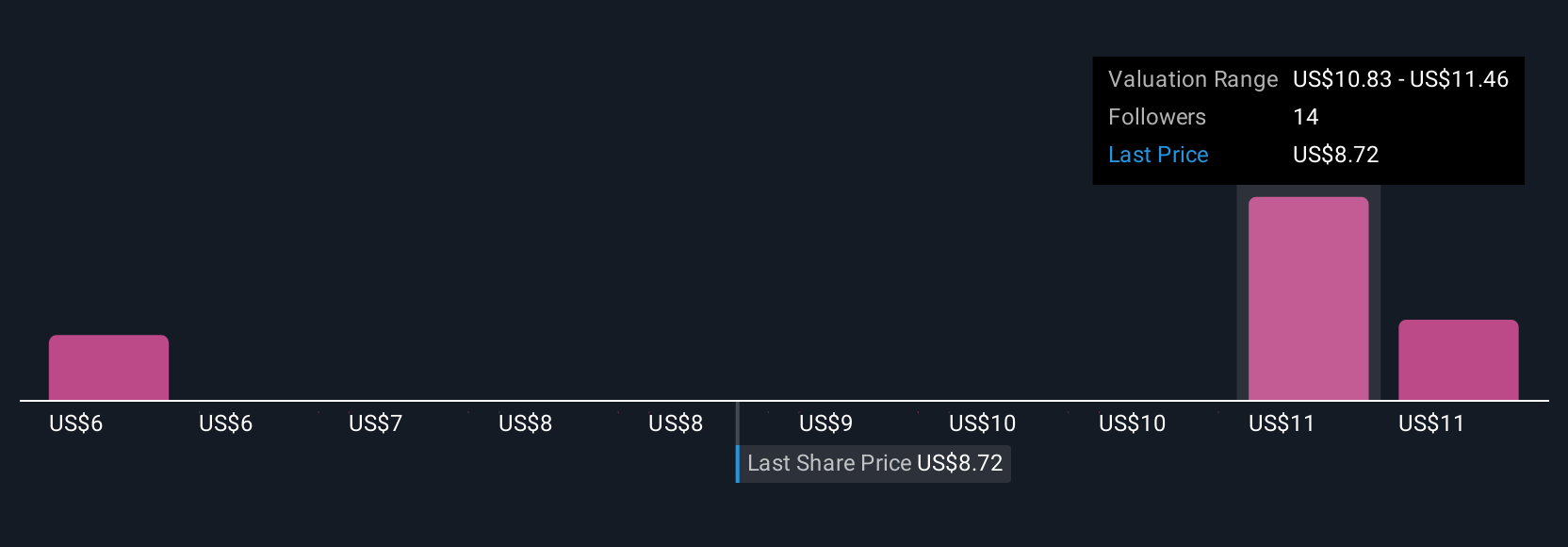

Three fair value estimates from the Simply Wall St Community range from US$10.50 to US$17.47 per share, offering a broad spread of perspectives. With analysts warning about revenue concentration, make sure to consider how such risks could affect Harmonic’s long-term market position as you review these diverse valuations.

Explore 3 other fair value estimates on Harmonic - why the stock might be worth as much as 63% more than the current price!

Build Your Own Harmonic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harmonic research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Harmonic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harmonic's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmonic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLIT

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives