- United States

- /

- Communications

- /

- NasdaqGS:HLIT

Harmonic (HLIT) Margin Decline Challenges Bullish Valuation Narrative Despite Strong Growth Outlook

Reviewed by Simply Wall St

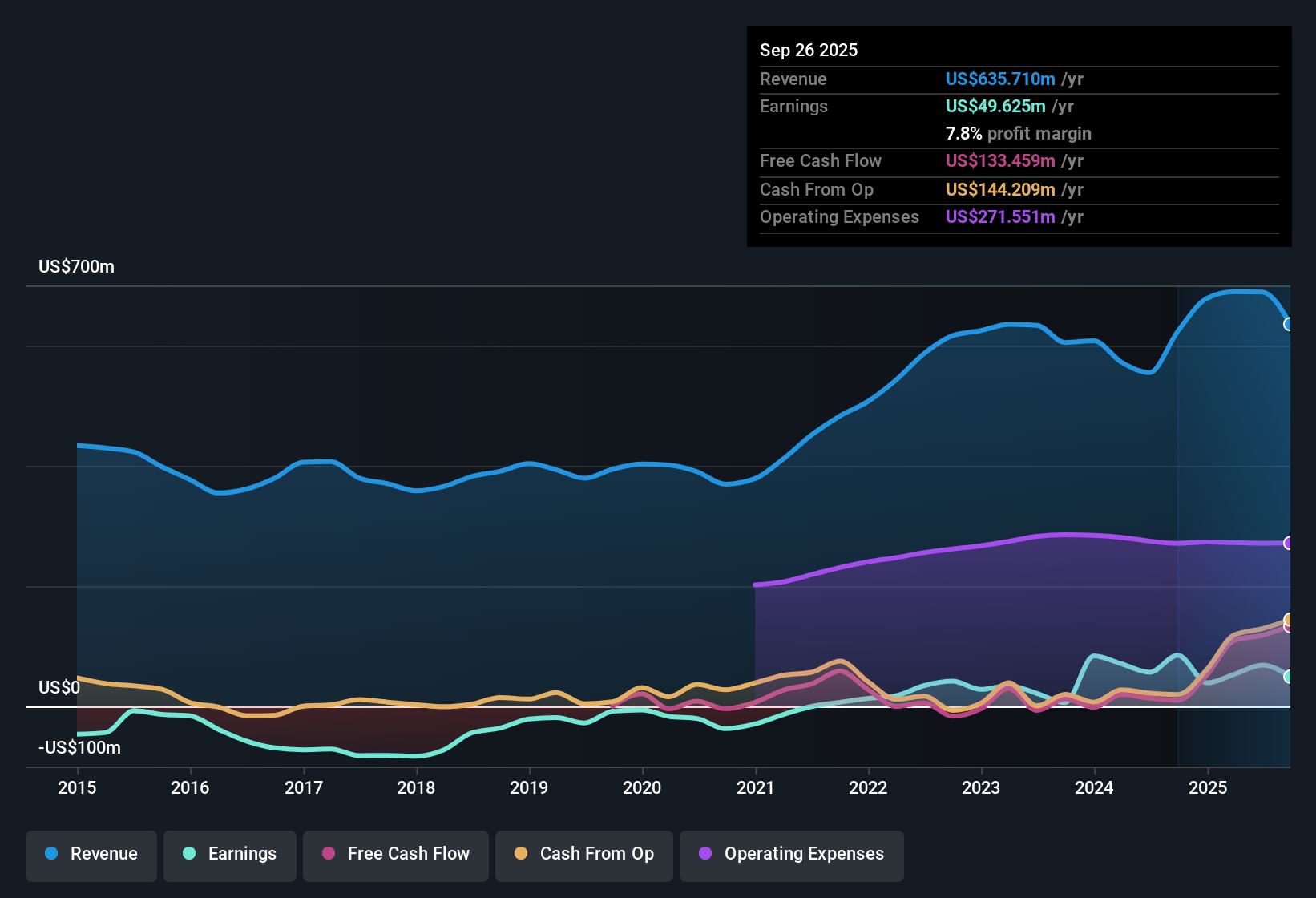

Harmonic (HLIT) reported a net profit margin of 7.8%, down from 13.6% the previous year, highlighting a decline in profitability. Despite this margin pressure, the company’s revenue is forecast to grow at 8.6% annually, which is slower than the broader US market’s 10.5%. While earnings growth over the last year was negative, Harmonic has posted an impressive 48.6% annualized earnings growth rate over the past five years, demonstrating substantial long-term gains. Looking forward, earnings are projected to expand at a robust 77.2% per year over the next three years, well ahead of the anticipated US market pace. However, investors should note that shares currently trade above discounted cash flow fair value, underscoring a nuanced outlook that balances profitability, growth, and valuation.

See our full analysis for Harmonic.Next, we’ll explore how these headline numbers compare to the most widely held narratives about Harmonic, highlighting where the consensus stands and where opinions might start to shift.

See what the community is saying about Harmonic

Broadband Diversification Drives New Growth

- Recent diversification efforts have reduced Harmonic's exposure to its largest customers. International expansion and upgraded broadband are now driving future sales rather than reliance on one or two major clients.

- Analysts' consensus view notes that upgrading global broadband and expanding international reach is expected to stabilize and grow revenue. New contracts and a multi-year upgrade cycle are building a stronger pipeline.

- A record order book of $504.5 million along with broader government incentives, such as OBBBA in the US, heavily support the optimistic consensus that Harmonic will reduce concentration risk while increasing long-term sales potential.

- Consensus narrative highlights that diversified growth prospects and increased revenue stability could lessen the impact of volatility from major clients.

- Analysts expect the number of shares outstanding to decline by 2.38% per year for the next three years, giving more ownership per share and potentially boosting future EPS growth.

See how Harmonic’s global expansion and revenue pipeline stack up against competitor expectations. Consensus sees diversified growth but challenges remain. 📊 Read the full Harmonic Consensus Narrative.

Recurring Revenue Model Lifts Margins

- The shift to higher-margin cloud and SaaS solutions, combined with strategic partnerships, is forecast to gradually improve net profit margins from 10.0% today to 10.1% in three years, despite short-term pressure.

- Analysts' consensus narrative highlights that momentum in SaaS and hybrid cloud is elevating gross margins and recurring earnings. A strong order book and new customer wins support the argument that ongoing innovation will deliver operating leverage.

- Partnerships with firms like Akamai and expanding Video SaaS are seen as catalysts that could turn current deferred revenue into stronger reported growth in coming quarters.

- Consensus analysts point to continued improvements in supply chain and cost management as critical for margin gains, even as sector competition intensifies.

Valuation Shows Modest Discount to Peers

- Harmonic trades at a price-to-earnings ratio of 23.6x, notably below both the industry average (31.1x) and peer average (27.4x). However, it is above its DCF fair value of $4.46 per share, with the current share price at $10.43.

- According to the analysts' consensus perspective, the narrow gap between Harmonic’s share price and the analyst price target of 11.21 signals a broadly fair valuation. This balances strong earnings forecasts and margin pressure with sector-level optimism.

- Analysts caution that, for upward price movement, investors need to believe in achieving $70.6 million earnings and a 19.1x PE ratio by 2028, a bar set below prevailing industry multiples.

- This valuation context supports long-term optimism but signals less dramatic upside until current margin and growth momentum converts more clearly into cash flow and earnings.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Harmonic on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from another angle? Share your interpretation and build your own narrative in just a few minutes. Do it your way

A great starting point for your Harmonic research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite solid long-term growth, Harmonic faces near-term margin pressure and trades above its intrinsic value. This makes upside less certain without clear improvement.

If you prefer opportunities where value and future gains line up more clearly, check out these 842 undervalued stocks based on cash flows for a shortlist of companies trading below their fair value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmonic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLIT

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives