- United States

- /

- Communications

- /

- NasdaqGS:EXTR

The Bull Case For Extreme Networks (EXTR) Could Change Following IDC Leader Recognition for AI-Powered Platform

Reviewed by Sasha Jovanovic

- Extreme Networks was recently named a Leader in the IDC MarketScape: Worldwide Enterprise Wireless LAN 2025 Vendor Assessment, highlighted for its AI-powered Extreme Platform ONE, Universal Hardware flexibility, and expertise in high-density environments.

- This independent recognition underscores Extreme Networks' positioning as a provider of robust, scalable wireless LAN solutions across enterprise verticals such as education, healthcare, and hospitality.

- We’ll explore how IDC’s recognition of Extreme Networks’ expertise in AI-powered automation could influence the company's investment outlook going forward.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Extreme Networks Investment Narrative Recap

To be a shareholder in Extreme Networks, you really have to believe in the company's long-term ability to stay ahead in the competitive enterprise networking space, especially through AI-driven solutions and ongoing innovation. While the recent IDC MarketScape recognition strengthens Extreme’s credibility, its immediate impact on revenue growth remains secondary to the company’s exposure to potential volatility from large, nonrecurring government deals in APAC and EMEA, which is still a core risk to watch.

Among recent announcements, the July launch of Extreme Platform ONE, the platform highlighted in IDC’s report, directly ties into the biggest catalyst: broad enterprise adoption of cloud-managed, AI-powered networking. This product rollout coincides with expanding demand from clients like the NFL and education sector, providing a foundation for potentially more stable recurring revenues, even as the company manages concentration risk in core public verticals.

But on the other hand, investors should be aware that heavy reliance on large, sometimes unpredictable government contracts can create...

Read the full narrative on Extreme Networks (it's free!)

Extreme Networks' outlook projects $1.3 billion in revenue and $18.1 million in earnings by 2028. This requires 5.8% annual revenue growth and a $25.6 million increase in earnings from the current $-7.5 million level.

Uncover how Extreme Networks' forecasts yield a $23.83 fair value, a 18% upside to its current price.

Exploring Other Perspectives

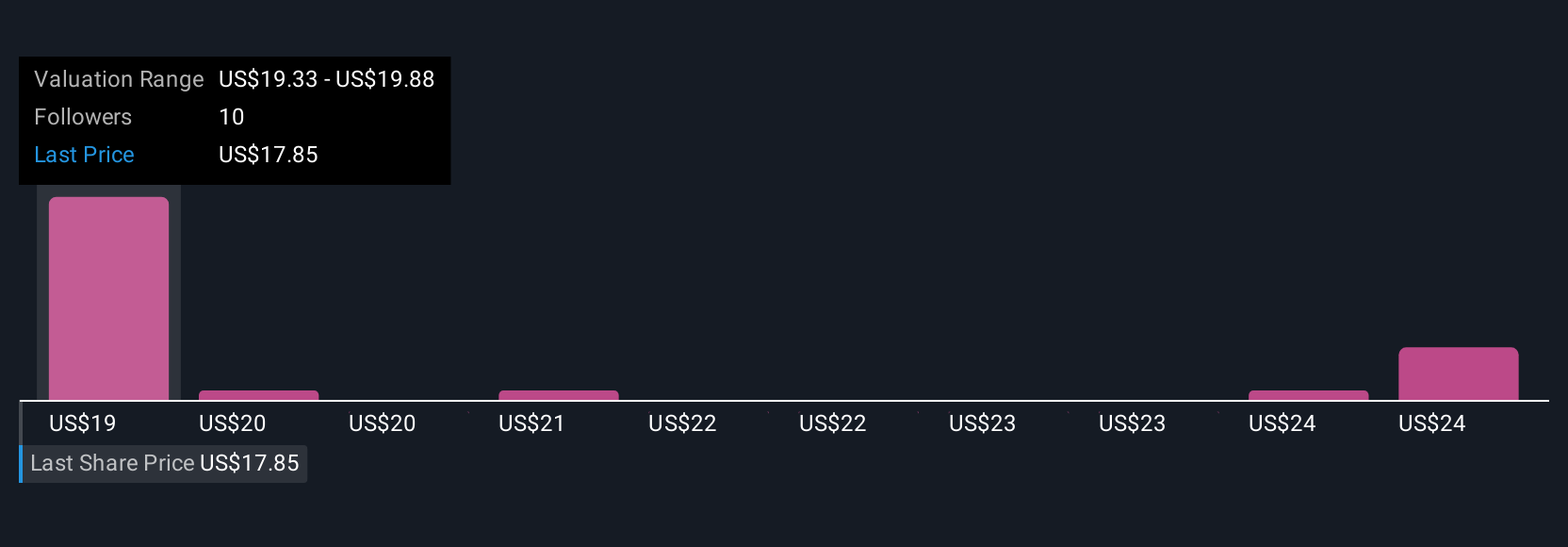

Six members of the Simply Wall St Community put fair values for Extreme Networks between US$17.17 and US$26.29 per share. Against this diversity of opinion, continued traction in AI-powered solutions remains a key point to watch for future financial consistency and competitive strength.

Explore 6 other fair value estimates on Extreme Networks - why the stock might be worth as much as 31% more than the current price!

Build Your Own Extreme Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Extreme Networks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Extreme Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Extreme Networks' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Extreme Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXTR

Extreme Networks

Develops, markets, and sells network infrastructure equipment and related software in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives