- United States

- /

- Communications

- /

- NasdaqGS:EXTR

Extreme Networks (EXTR) Turns Profitable, Challenging Bearish Narratives on Earnings Quality

Reviewed by Simply Wall St

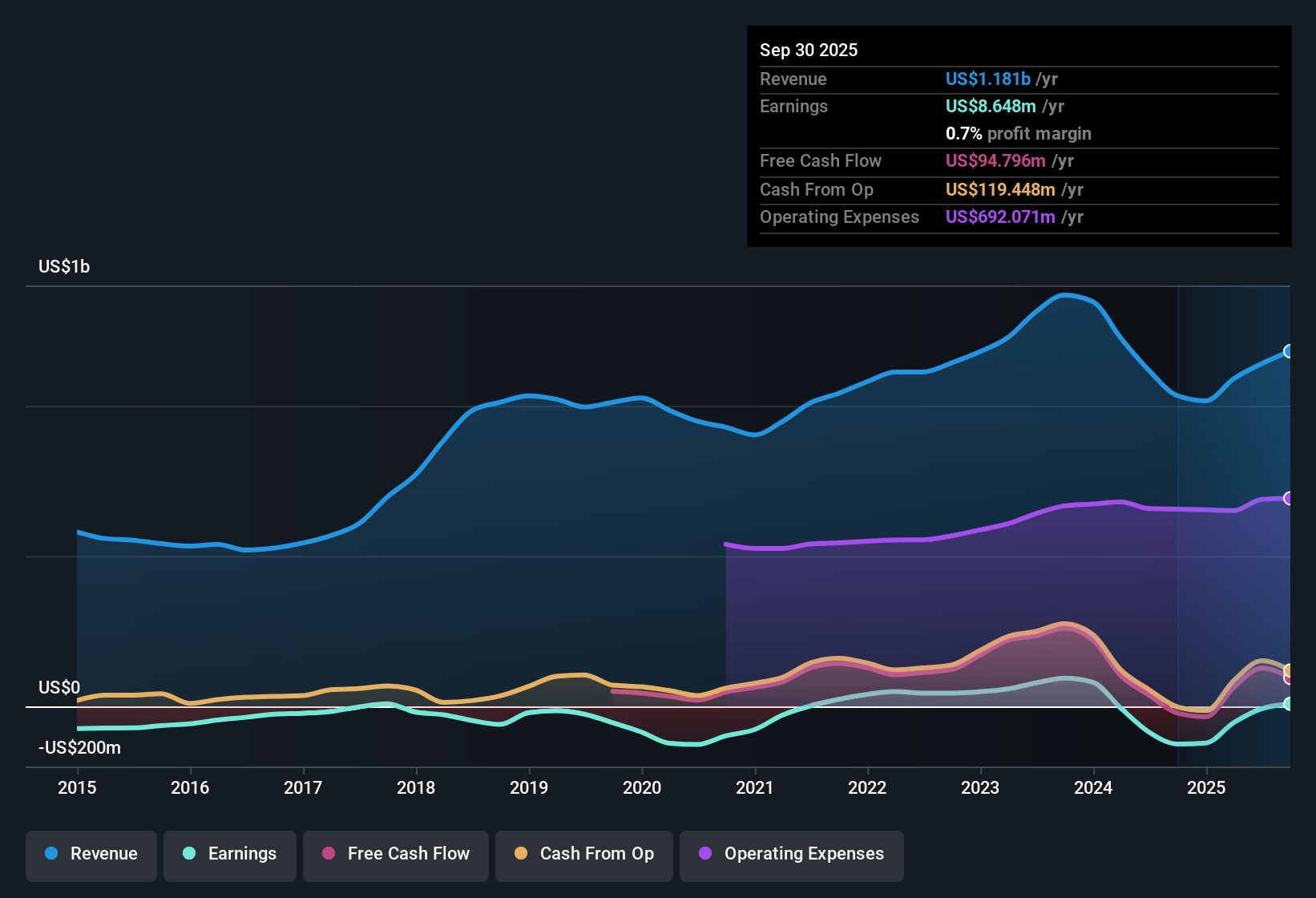

Extreme Networks (EXTR) has turned the corner to profitability, with its net profit margin swinging into positive territory over the past year. Although the company averaged -8.1% annual earnings growth over the last five years, forecasts now see earnings surging by 41.4% per year, well outpacing the broader US market’s 15.9% expected growth rate. Revenue, meanwhile, is projected to grow at a more modest 7.7% per year, trailing the 10.3% market average. Shares currently trade at $19.02, significantly below the assessed fair value of $35.13. For investors, these figures highlight a business in transition, where forward sentiment centers on margin improvement, earnings leverage, and attractive relative valuation.

See our full analysis for Extreme Networks.Next, we’ll line up these earnings results alongside the community-driven narratives to see which market perspectives are confirmed and which may be due for a rethink.

See what the community is saying about Extreme Networks

Margin Turnaround: Net Profits Swing Positive

- Extreme Networks’ net profit margin flipped into positive territory within the past year after years of negative growth, highlighting a tangible shift in earnings quality beyond just revenue expansion.

- According to the analysts' consensus narrative:

- They see margin growth being fueled by expansion of AI, cloud, and advanced wireless technologies, particularly as adoption drives higher SaaS annual recurring revenue and better cross-selling among enterprise and government clients.

- However, heavy reliance on large, sometimes one-off government contracts in APAC and EMEA could make margins volatile, creating tension with the story of smooth, sustained improvement.

- Curious whether these margin gains will last or if the consensus is too optimistic? Analysts highlight several long-term shifts at play. Read the full consensus view for the detailed breakdown. 📊 Read the full Extreme Networks Consensus Narrative.

Recurring Revenue Ramps Up, but Growth Lags Peers

- Forecasts call for annual revenue growth of 7.7%, noticeably below the broader market’s 10.3% average, even with recurring revenues and subscription-based models gaining traction.

- The analysts' consensus narrative weighs expansion momentum:

- Paced by new launches like Extreme Platform 1, recurring SaaS and cloud-managed revenue streams are expected to boost stability, retention, and visibility. This is seen as a positive sign as high-margin offerings grow as a share of the mix.

- Yet, the risk remains that recent spikes in APAC and EMEA sales were driven by major government wins that may not repeat, suggesting that top-line growth could be lumpy rather than steadily accelerating ahead of peers.

Valuation Gap: Trading Far Below DCF Fair Value

- With shares at $19.02, Extreme Networks trades at a substantial 46% discount to its DCF fair value estimate of $35.13 and sits below the industry on certain peer metrics, such as its 2.2x Price-To-Sales ratio.

- According to the analysts' consensus narrative:

- The consensus analyst price target is $24.29, about 28% above the current share price, suggesting modest upside even using conservative forecasts, with the market potentially overlooking either earnings durability or the extent of future margin expansion.

- Still, hitting the consensus target would require Extreme Networks to trade at a lofty 219.0x PE by 2028, far outpacing the US Communications industry’s 25.6x. This injects caution into the relative value case.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Extreme Networks on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the data? Shape your perspective into a unique narrative in just a few minutes. Do it your way

A great starting point for your Extreme Networks research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Extreme Networks’ revenue growth is inconsistent and lags the broader market. Recent sales volatility has been tied to one-off government deals, raising questions on long-term stability.

If you're seeking companies with more reliable momentum, our stable growth stocks screener (2100 results) highlights businesses that consistently deliver steady expansion and smoother trajectories through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Extreme Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXTR

Extreme Networks

Develops, markets, and sells network infrastructure equipment and related software in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives