- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:EVLV

How a Board Investigation into Financial Reporting at Evolv Technologies Holdings (EVLV) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Bragar Eagel & Squire, P.C. recently announced an investigation into Evolv Technologies Holdings after a class action complaint alleged board-level breaches of fiduciary duties tied to financial statement misstatements and revenue recognition issues from Q2 2022 to Q2 2024.

- This investigation points to potential weaknesses in the company’s internal controls and highlights concerns about undisclosed sales terms with a major channel partner.

- We'll explore how heightened scrutiny over Evolv Technologies' financial practices could impact the company's investment narrative and outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Evolv Technologies Holdings Investment Narrative Recap

To be an Evolv Technologies shareholder right now, you need to believe that the company's strong revenue growth and expanding client base in public safety tech outweigh short-term risks stemming from financial controls and recent controversy over revenue recognition. The latest class action investigation and related stock volatility bring Evolv's near-term risk profile sharply into focus but do not materially change the most important catalyst: continued expansion of long-term contracts, particularly in education and healthcare. However, ongoing legal scrutiny is a key risk to monitor in the coming quarters.

Against this backdrop, Evolv's recent announcement of a new multi-year subscription agreement with the Buffalo Sabres stands out. Such deals underscore persistent market demand and the company's operational momentum in deploying advanced security solutions, supporting its thesis for recurring revenue growth even as financial transparency faces heightened scrutiny. Despite this, it is critical for investors to recognize that unresolved questions around revenue recognition and internal controls still linger...

Read the full narrative on Evolv Technologies Holdings (it's free!)

Evolv Technologies Holdings is projected to reach $208.0 million in revenue and $18.8 million in earnings by 2028. This outlook assumes annual revenue growth of 19.8% and a $107.2 million increase in earnings from the current level of -$88.4 million.

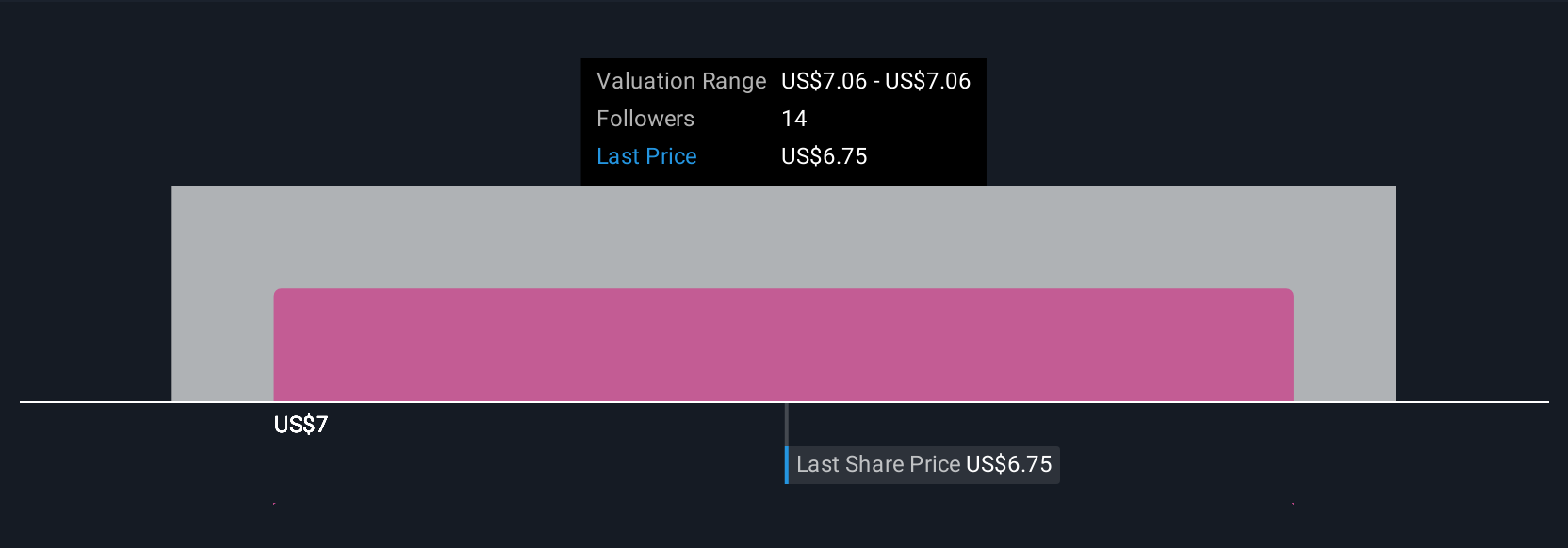

Uncover how Evolv Technologies Holdings' forecasts yield a $9.50 fair value, a 15% upside to its current price.

Exploring Other Perspectives

One member of the Simply Wall St Community estimates Evolv Technologies’ fair value at US$9.50 per share. While recent legal and internal control concerns may weigh on market confidence, ongoing contract wins could shape sentiment in different directions, check out how investor opinions and underlying business developments can lead to wide variations in outlooks.

Explore another fair value estimate on Evolv Technologies Holdings - why the stock might be worth as much as 15% more than the current price!

Build Your Own Evolv Technologies Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evolv Technologies Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Evolv Technologies Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evolv Technologies Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolv Technologies Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EVLV

Evolv Technologies Holdings

Provides artificial intelligence (AI)-based weapons detection for security screening in the United States and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives