- United States

- /

- Communications

- /

- NasdaqGS:DGII

Digi International (DGII): Evaluating Valuation Following Launch of New XBee 3 Global LTE Cat 4 Modem

Reviewed by Simply Wall St

Digi International (DGII) just rolled out its latest XBee 3 Global LTE Cat 4 cellular modem, aiming to make high-bandwidth IoT connectivity easier and faster for a range of industries. This modular approach is likely to catch the attention of device manufacturers.

See our latest analysis for Digi International.

Digi International's latest modem launch comes as enthusiasm for the stock has been gradually building. After a strong 23.8% share price return year to date and an impressive 105% total shareholder return over five years, recent price action still suggests investors are weighing growth prospects against short-term volatility.

If the pace of Digi’s innovation has you looking for more potential tech standouts, it might be time to explore the market’s next movers in our See the full list for free.

But with shares not far below analyst targets and performance metrics exceeding many peers, the question remains: is Digi International trading at a discount to its intrinsic value, or has the market already factored in its future growth?

Most Popular Narrative: 10.4% Undervalued

With Digi International closing at $36.27 and the most widely followed narrative placing fair value at $40.50, the story for upside is in full focus as investors weigh guidance, growth, and the longer-term outlook.

"The accelerating transition of customers to Digi's subscription-based and recurring revenue solutions, including higher attach rates on IoT products such as cellular routers and infrastructure management devices, points to ongoing double-digit annual recurring revenue (ARR) growth and improved profit margins. This supports both revenue stability and long-term earnings."

Curious what unlocks Digi’s premium? The narrative leans on recurring revenue growth, richer margins, and assumptions about future profit expansion. Think transformation, but the underlying financial leap might surprise you. Want to know what’s driving that fair value calculation? Find out what makes this forecast stand out from the rest.

Result: Fair Value of $40.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, flat revenue guidance for 2025 and regional demand uncertainty, especially in Europe and Asia, could still test the strength of Digi’s positive outlook.

Find out about the key risks to this Digi International narrative.

Another View: Market Multiples Add a Note of Caution

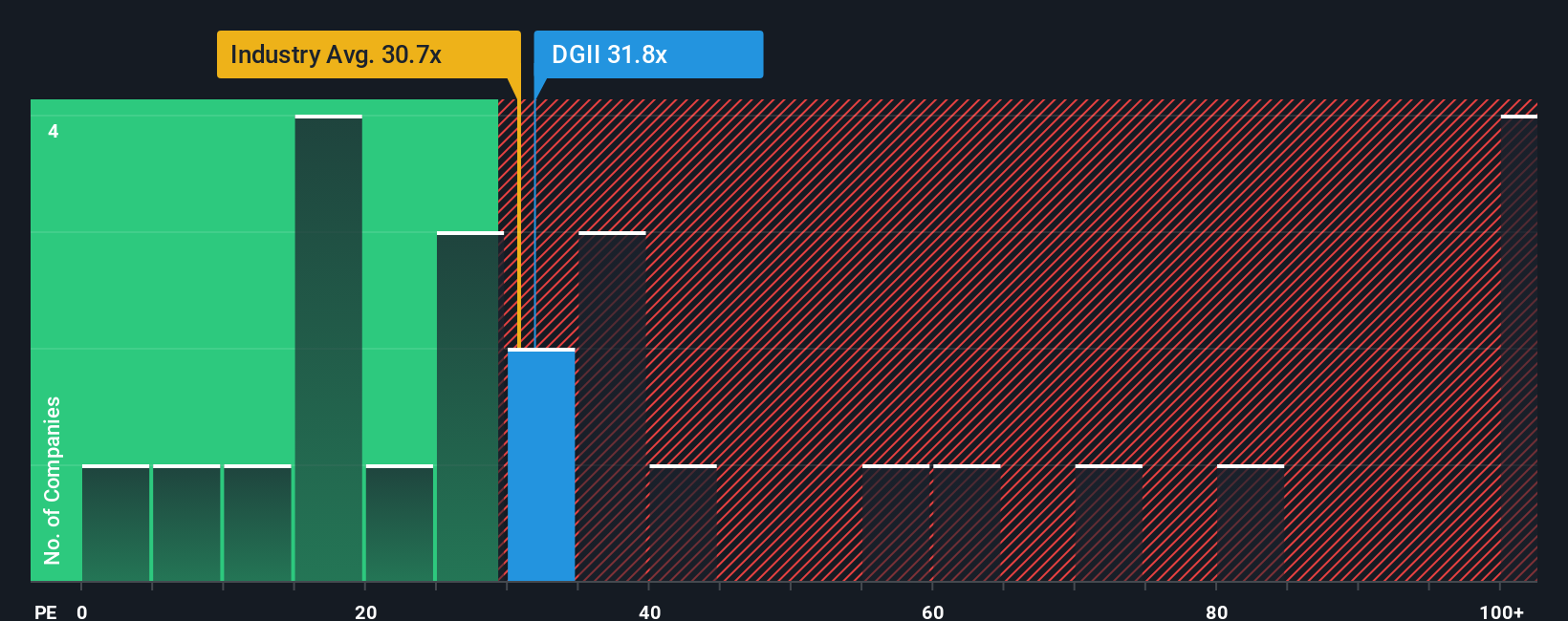

While the fair value model puts Digi International at a discount, the market’s go-to valuation metric tells a different story. Digi’s price-to-earnings ratio of 31.5x stands above both the sector average (31x) and peers (25.7x), and is well above its own fair ratio of 26.7x. This signals potential overvaluation, raising a practical question: will the market keep paying a premium, or is there a risk of a pullback?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Digi International Narrative

Whether you want to challenge these assumptions or dive deeper into the numbers yourself, it’s easy to build your own Digi International story in minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Digi International.

Looking for More Investment Ideas?

Don’t let smart opportunities slip by. Now is the time to broaden your strategy with more innovative stocks using the Simply Wall Street Screener.

- Capitalize on breakthrough companies tapping into artificial intelligence advances by acting on these 26 AI penny stocks now, before the next wave surges.

- Secure steady passive income for your portfolio by locking in these 20 dividend stocks with yields > 3%, offering solid yields above 3% in today’s market.

- Unleash big growth potential that the mainstream might have missed with these 3603 penny stocks with strong financials, showing strong financials and upside others overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DGII

Digi International

Provides business and mission-critical Internet of Things (IoT) connectivity products, services, and solutions in the United States, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives