- United States

- /

- Communications

- /

- NasdaqGS:CSCO

Cisco (CSCO): Assessing Valuation as AI-Powered Expansion and New Partnerships Drive Growth Narrative

Reviewed by Simply Wall St

Cisco Systems (CSCO) recently launched an AI-Powered Security Operations Centre at its Toronto Innovation Centre. This move highlights how the company is integrating AI across its product lines and digital infrastructure offerings. These developments are drawing fresh attention from investors.

See our latest analysis for Cisco Systems.

After a year of steady progress, Cisco’s share price has gained 20.8% year-to-date, underpinned by a wave of new AI-driven partnerships and product rollouts. Momentum is clearly building, highlighted by a robust 32.5% total shareholder return over the past twelve months and a strong five-year total return of 130%, reflecting confidence in Cisco’s ongoing digital transformation story.

If the surge in AI-focused innovation has you watching tech leaders more closely, it is a great time to explore the full landscape with See the full list for free.

With Cisco’s shares setting new highs on the back of AI momentum, the key question for investors is whether the stock’s valuation still offers room for upside or if the market has already priced in the next leg of growth.

Most Popular Narrative: 5.8% Undervalued

With Cisco Systems closing at $71.39 and the most popular narrative seeing fair value at $75.81, there is still perceived upside in these numbers. The foundation for this view lies in critical business drivers and future assumptions that set Cisco apart from its peers.

Catalysts

The rapid acceleration in AI infrastructure investment, highlighted by record AI infrastructure orders from webscale/cloud customers (doubling targets to $2B in FY25) and continued strength in order pipeline, positions Cisco to benefit from surging demand for high-performance, AI-optimized networking hardware. This is expected to drive both revenue and margin expansion as next-generation networks scale globally.

What is the secret formula behind Cisco’s valuation edge? The narrative is built on bold expectations for future earnings, margin increases, and the impact of ramped-up AI infrastructure spending. Can these ambitious projections stand up to real-world tests? Only a full dive into the details will reveal just how strong those underlying numbers really are.

Result: Fair Value of $75.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including the potential for slower order growth and rising competition. Both of these factors could limit Cisco’s future earnings power.

Find out about the key risks to this Cisco Systems narrative.

Another View: DCF Model Offers a Different Perspective

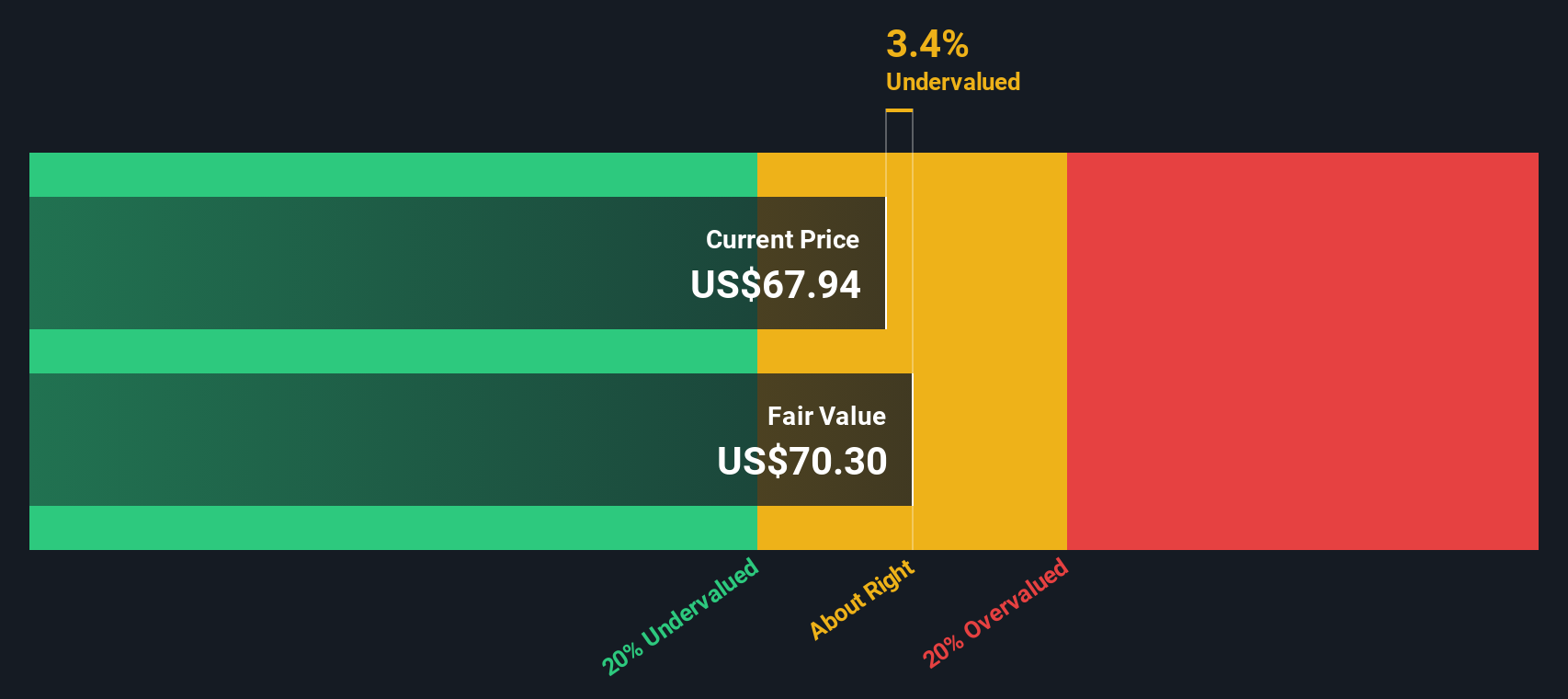

Looking at Cisco Systems through the lens of our DCF model gives a slightly different take. While share price and analyst targets suggest undervaluation, the SWS DCF model estimates Cisco’s fair value at $70.42, just below the current market price. This could indicate that the market’s excitement around AI and future growth is already reflected in the valuation. Does this create a valuation ceiling for now, or is there more upside ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cisco Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cisco Systems Narrative

If you want to take the reins and draw your own conclusions, you can build a custom investment view in just a few minutes, your way with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cisco Systems.

Looking for more investment ideas?

Stock markets move fast, but smart investors keep their edge by scanning fresh opportunities. Stay one step ahead with these handpicked stock ideas, all waiting for you now.

- Uncover serious income potential by tracking these 19 dividend stocks with yields > 3%, which offers yields above 3% and can boost portfolios with reliable cash flow.

- Catch the next AI breakthrough by evaluating these 27 AI penny stocks featuring strong growth supported by innovative technology and market leadership.

- Tap into tomorrow’s most intriguing digital trends and expand your horizons by checking out these 80 cryptocurrency and blockchain stocks, positioned for the next surge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSCO

Cisco Systems

Designs, developes, and sells technologies that help to power, secure, and draw insights from the internet in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives