- United States

- /

- Communications

- /

- NasdaqGS:COMM

How CommScope’s Return to Profitability (COMM) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- CommScope Holding Company reported third quarter and nine-month 2025 earnings, revealing sales of US$1.63 billion and US$4.13 billion, respectively, with a shift from net losses to net profits compared to the prior year.

- The company’s improved profitability and stronger earnings metrics, including a move from negative to positive earnings per share, highlight a clear turnaround in business performance compared to the same periods last year.

- We'll examine how CommScope’s return to quarterly profitability could reshape the company’s investment narrative amid its recent business transformation.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CommScope Holding Company Investment Narrative Recap

To be a CommScope shareholder today, you need conviction in the company’s ability to deliver consistent profitability after a period of transformation, with the ANS and RUCKUS segments driving future performance. The recent return to net profitability in the third quarter demonstrates progress but does not materially alter the central short-term catalyst: ongoing adoption and spending on DOCSIS 4.0 products, while the largest risk remains the unpredictability tied to project-driven revenue streams and customer concentration in ANS.

The most relevant recent announcement to these results was the extraordinary shareholders meeting to vote on the US$10 billion sale of the Connectivity and Cable Solutions (CCS) segment. This divestiture, if approved, fundamentally reshapes CommScope into a narrower business focused on more cyclical markets, directly amplifying both the revenue catalyst linked to DOCSIS 4.0 momentum and the risk from less diversified revenue streams.

In contrast, investors should be aware that with CCS leaving, CommScope’s reliance on just a handful of anchor ANS clients could become...

Read the full narrative on CommScope Holding Company (it's free!)

CommScope Holding Company's outlook anticipates $6.7 billion in revenue and $139.1 million in earnings by 2028. This scenario requires 12.3% annual revenue growth and a $48.8 million earnings increase from current earnings of $90.3 million.

Uncover how CommScope Holding Company's forecasts yield a $19.67 fair value, a 25% upside to its current price.

Exploring Other Perspectives

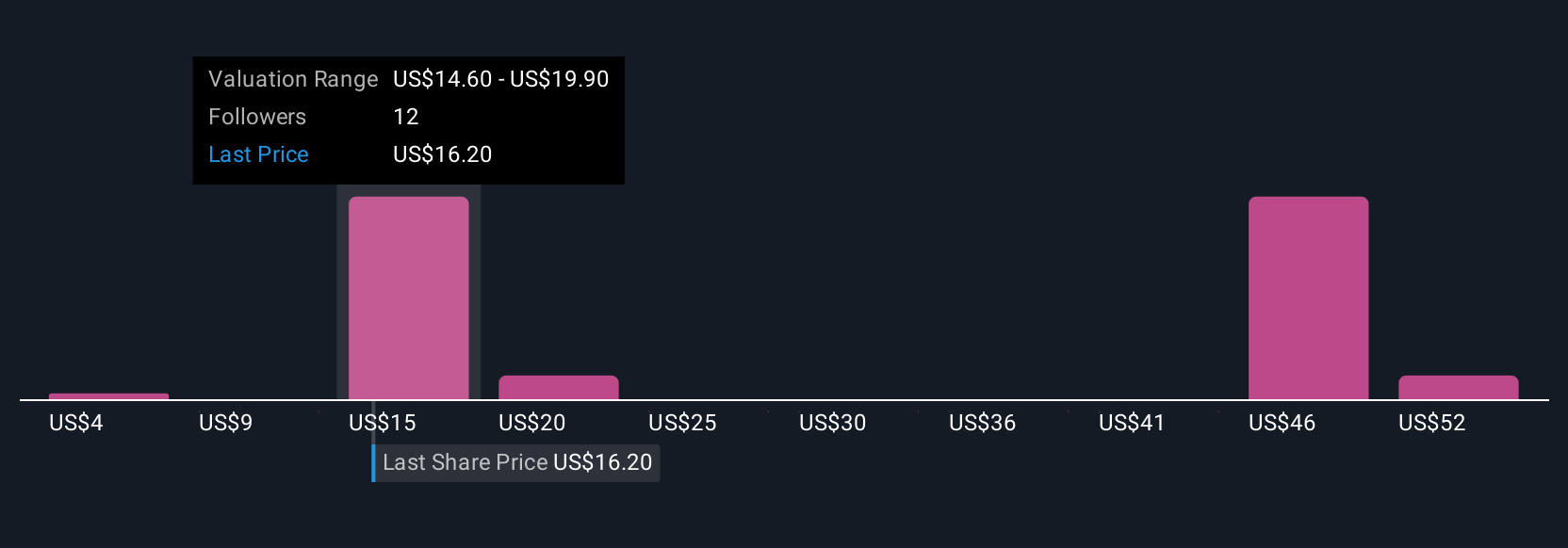

Eight private investors in the Simply Wall St Community estimate CommScope’s fair value between US$4 and US$56.99 per share. While these views vary, remember that future ANS project cycles and customer concentration continue to weigh on reliability, making it valuable to explore multiple viewpoints before making decisions.

Explore 8 other fair value estimates on CommScope Holding Company - why the stock might be worth less than half the current price!

Build Your Own CommScope Holding Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CommScope Holding Company research is our analysis highlighting 4 key rewards and 5 important warning signs that could impact your investment decision.

- Our free CommScope Holding Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CommScope Holding Company's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COMM

CommScope Holding Company

Provides infrastructure solutions for communications, data center, and entertainment networks.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives