- United States

- /

- Tech Hardware

- /

- NasdaqCM:BOXL

Boxlight Corporation's (NASDAQ:BOXL) Share Price Boosted 166% But Its Business Prospects Need A Lift Too

The Boxlight Corporation (NASDAQ:BOXL) share price has done very well over the last month, posting an excellent gain of 166%. The last month tops off a massive increase of 117% in the last year.

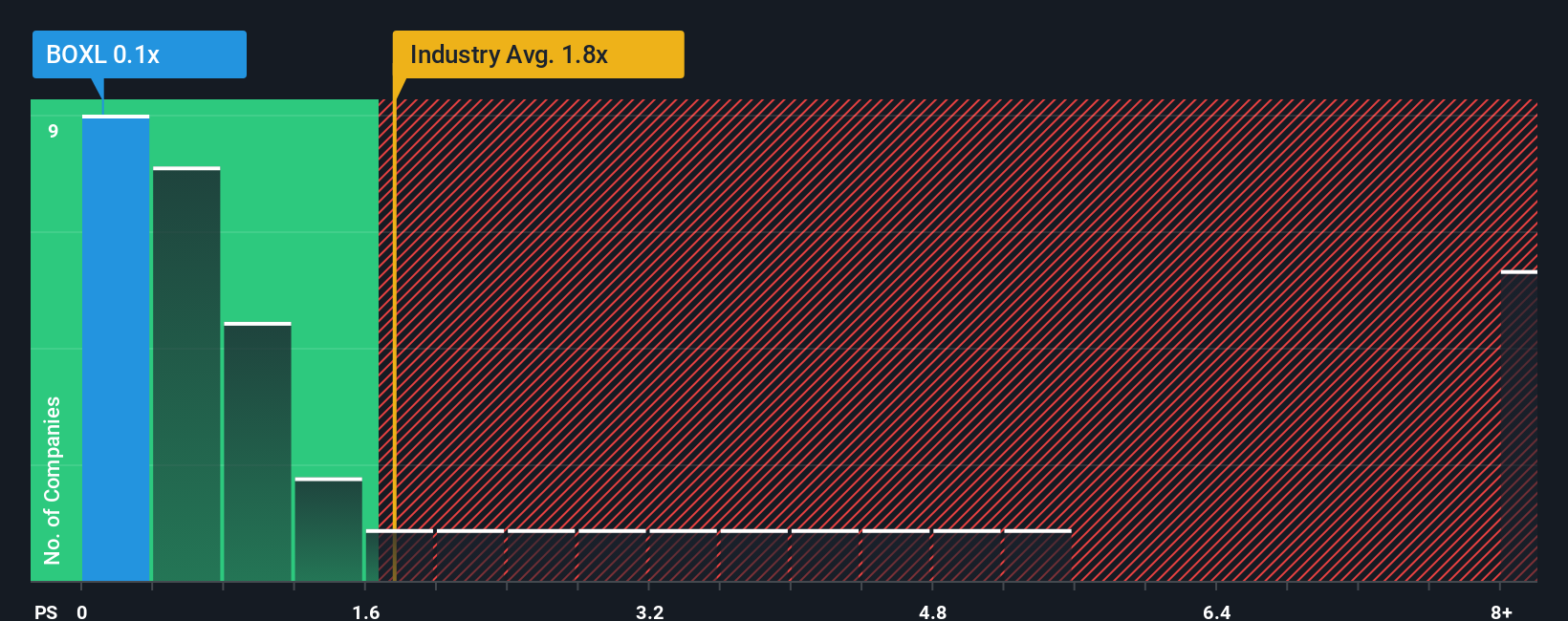

Even after such a large jump in price, Boxlight may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Tech industry in the United States have P/S ratios greater than 1.8x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Boxlight

How Boxlight Has Been Performing

While the industry has experienced revenue growth lately, Boxlight's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Boxlight.How Is Boxlight's Revenue Growth Trending?

Boxlight's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 47% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 1.4% per year during the coming three years according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 6.8% per year, which is noticeably more attractive.

With this information, we can see why Boxlight is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

The latest share price surge wasn't enough to lift Boxlight's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Boxlight's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 4 warning signs for Boxlight (3 don't sit too well with us!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Boxlight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BOXL

Boxlight

Designs, produces, and distributes interactive technology solutions for the education, health, corporate, military, and government sectors in the Americas, Europe, the Middle East, Africa, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives