- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:BELF.A

Bel Fuse (BELFA) Earnings Growth Slows, Underscoring Shift Toward Value Narrative

Reviewed by Simply Wall St

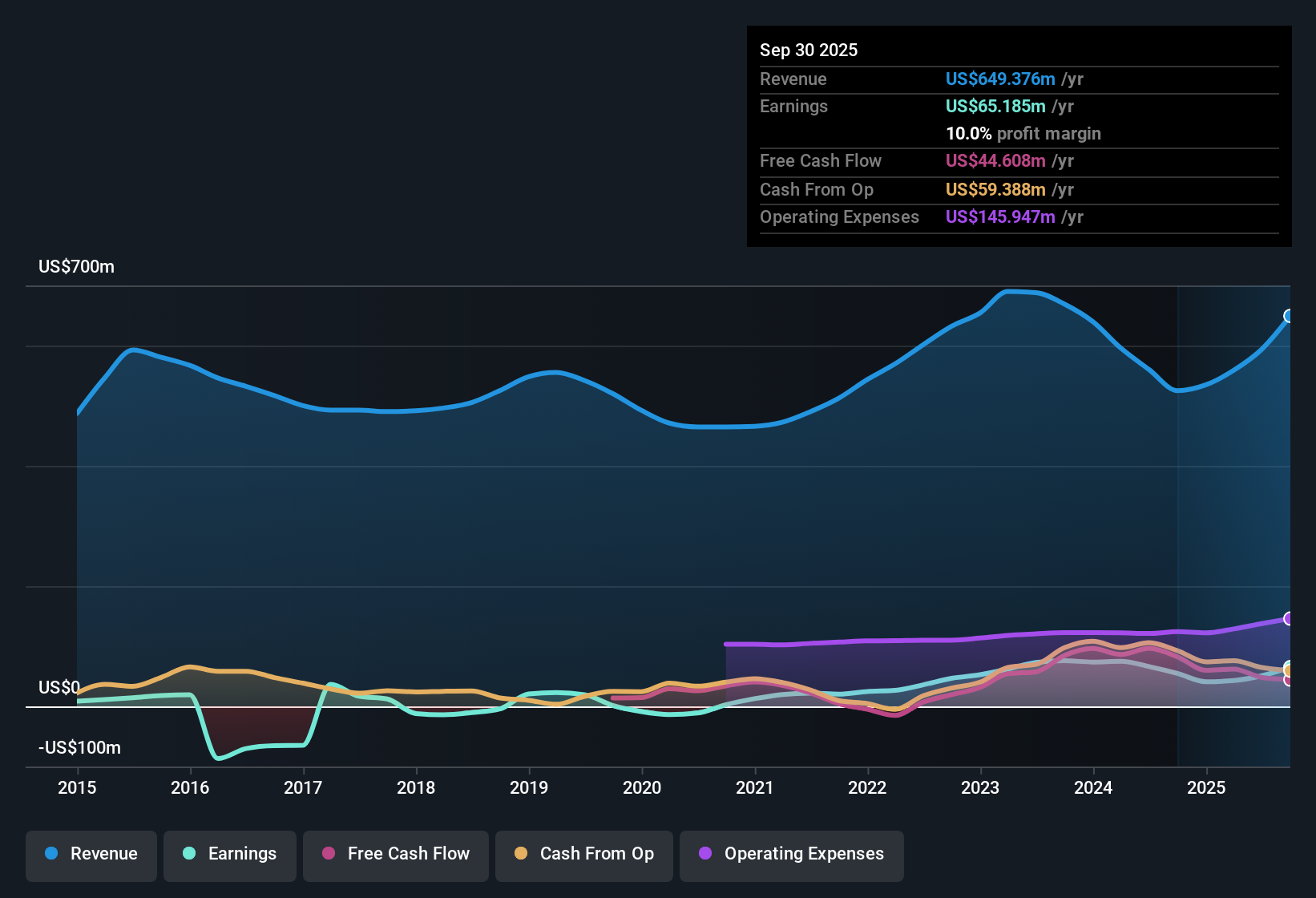

Bel Fuse (BELFA) reported a 19% increase in earnings over the past year, trailing its five-year average annual growth rate of 24%. Net profit margins came in at 10%, slightly lower than last year’s 10.4%, while future earnings and revenue are forecast to grow more slowly than the broader US market. With this steady expansion but moderating pace, investors are weighing the historic growth against more tempered future expectations.

See our full analysis for Bel Fuse.Next, we will see how this set of numbers holds up against the prevailing stories and market narratives as some assumptions may be reinforced while others are put to the test.

See what the community is saying about Bel Fuse

Power Segment Gains from Enercon Acquisition

- Enercon contributed $32.4 million to Bel Fuse’s Power segment sales in Q1 2025, representing a new source of diversification and revenue stability for the company within aerospace and defense.

- Analysts' consensus view notes that the Enercon acquisition directly supports Bel Fuse’s efforts to buffer against volatility in other markets,

- By diversifying end markets, the acquisition is expected to help maintain growth when networking, consumer, and e-mobility sales decline.

- The consensus also credits this deal with strengthening Bel Fuse’s ability to navigate sector challenges, especially in defense and AI, where Q1 2025 sales saw upward momentum.

- To see the full consensus breakdown on how diversification and M&A could influence Bel Fuse’s long-term outlook, don’t miss the in-depth narrative and what it means for shareholder value. 📊 Read the full Bel Fuse Consensus Narrative.

Manufacturing Shift Protects Margins

- Moving some production from China to India has offset the impact of US/China tariffs on roughly 25% of consolidated sales, helping preserve net profit margins despite headwinds.

- Analysts' consensus view highlights that strategic supply chain adjustments have provided resilience against margin volatility,

- Cost reduction programs improved gross margins in Q1 2025 by 110 basis points compared to Q1 2024, affirming that operational efficiencies are delivering tangible results.

- At the same time, ongoing tariff-related risks highlight how critical these shifts are. Any reversal could quickly reduce profitability. This emphasizes management’s proactive stance as a key buffer.

Valuation: Discount to Fair Value Persists

- Bel Fuse trades at $131.77 per share, notably below its DCF fair value of $171.69, and carries a price-to-earnings ratio of 25.6x, undercutting the peer group average of 37.4x.

- Analysts' consensus view interprets this valuation gap as a signal that, even with moderating growth forecasts (earnings growth of 8.55% per year vs. higher historic trends), current pricing does not overstate Bel Fuse’s prospects,

- The consensus notes that anticipated margin expansion (projected to grow from 7.7% to 12.9% in three years) justifies a premium if realized. However, market caution may linger due to growth being below the broader US market.

- This dynamic provides value-sensitive investors with a potential opportunity, given both the fair value discount and the company’s ongoing efforts to manage risk and boost efficiency.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bel Fuse on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from a unique angle? You can easily shape your own take and share a narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bel Fuse.

See What Else Is Out There

Despite Bel Fuse’s recent growth, its earnings outlook lags the broader US market, and revenue expansion is expected to moderate in coming years.

If you want to focus on companies that consistently deliver reliable results through changing conditions, check out our stable growth stocks screener (2108 results) for proven steady performers built for the long run.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bel Fuse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BELF.A

Bel Fuse

Designs, manufactures, markets, and sells products that power, protect, and connect electronic circuits.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives