- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:BELF.A

Assessing Bel Fuse After 22.8% Surge and Analyst Upgrades in 2025

Reviewed by Bailey Pemberton

- Wondering if Bel Fuse is the sort of stock that's still undervalued after such a dramatic run up? You are not alone, especially with so much noise in the tech sector.

- Bel Fuse’s share price has surged 22.8% in the past month and is up a remarkable 57.0% year-to-date, racking up a total gain of 42.5% over the last year and an extraordinary 1063.8% in five years.

- Recent analyst upgrades and growing buzz around the company’s strategic partnerships have brought Bel Fuse into the spotlight. This attention has fuelled optimism about continued expansion, as industry watchers note its innovative tech solutions are getting a fresh round of recognition.

- On our value checks, Bel Fuse scores a 3 out of 6 for being undervalued. This sets up an intriguing case for a closer look at how the market is pricing this business. Let’s take a tour through the different ways to value Bel Fuse and stick around as we cover the approach that really gives you the full picture at the end.

Find out why Bel Fuse's 42.5% return over the last year is lagging behind its peers.

Approach 1: Bel Fuse Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today's value, reflecting the time value of money. This approach is especially useful for companies like Bel Fuse, where both current performance and future growth expectations play a role in valuation.

Currently, Bel Fuse generates free cash flow (FCF) of $45.99 million. Analyst estimates suggest that FCF will grow steadily, reaching $103.45 million by 2026. Although most direct analyst estimates stop at the five-year mark, projections for the following years are extended using industry-accepted methodologies. By 2035, Simply Wall St estimates Bel Fuse could generate as much as $172.92 million in free cash flow.

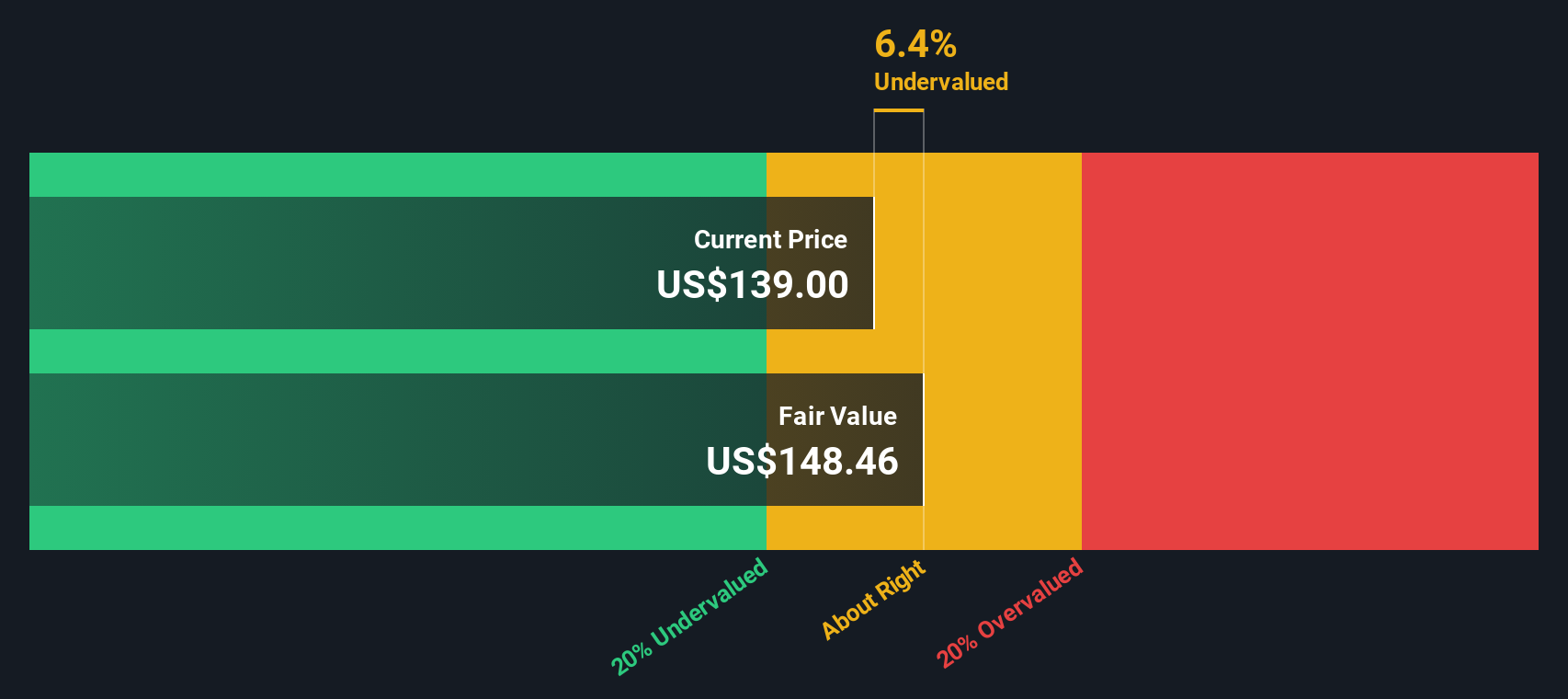

Running these cash flows through a DCF calculation yields an estimated intrinsic value of $181.55 per share. This figure is notably higher than the stock’s current market price, suggesting the shares are trading at a 23.3% discount to their intrinsic value. Based on this DCF analysis, Bel Fuse appears significantly undervalued relative to its current fundamentals and projected growth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bel Fuse is undervalued by 23.3%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Bel Fuse Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Bel Fuse because it directly compares a company’s current share price to its earnings per share. This highlights how much investors are willing to pay for each dollar of earnings. For consistently profitable businesses, the PE ratio offers a straightforward benchmark for what the market thinks the company’s future growth and risks are worth.

Growth expectations and risk profiles have a significant impact on what is considered a “normal” or “fair” PE ratio. Fast-growing or lower-risk companies typically command higher PE ratios, while those with uncertain prospects or elevated risks trade closer to or below industry norms.

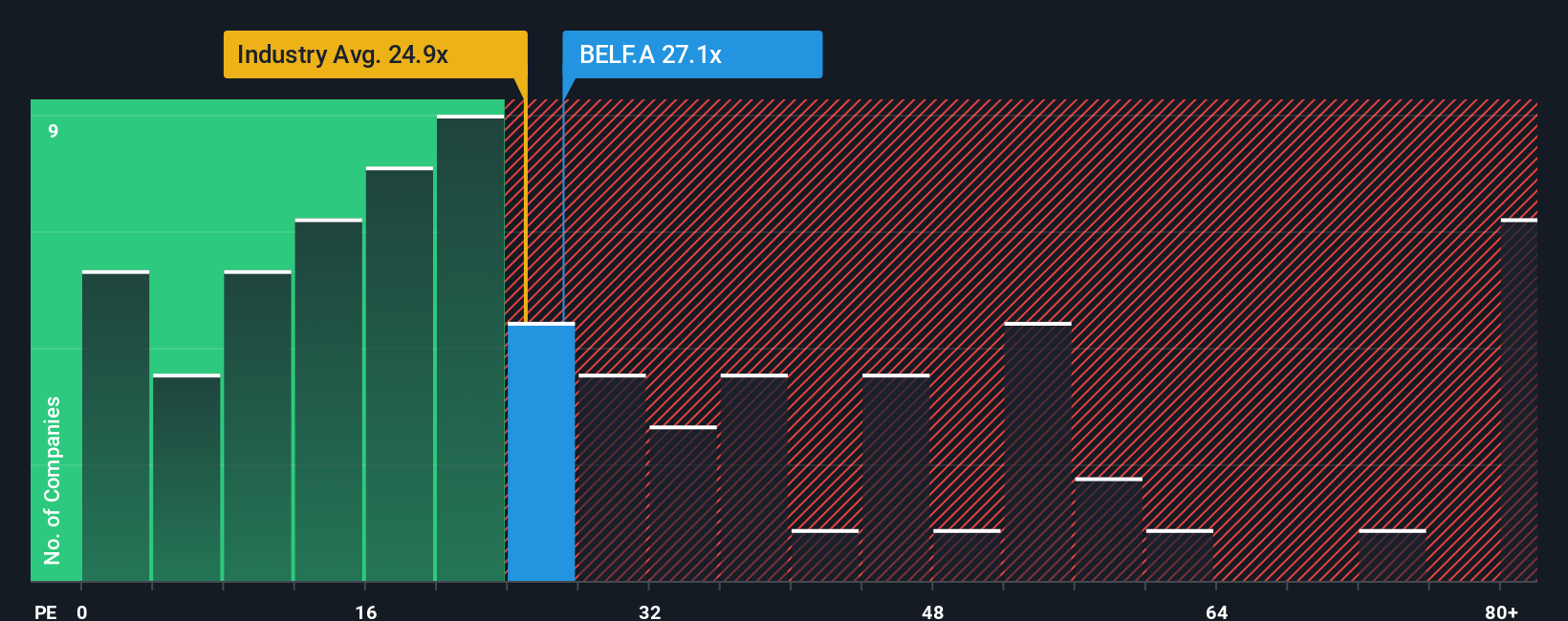

Bel Fuse currently trades at a PE ratio of 27.0x. This is above the Electronic industry average of 25.0x and somewhat lower than the peer group average of 37.5x. However, rather than simply comparing to these benchmarks, Simply Wall St’s proprietary “Fair Ratio” goes further by calculating a tailored benchmark of 24.4x for Bel Fuse. This calculation is based on factors such as its earnings growth outlook, risk profile, profit margin, industry niche, and company size.

The Fair Ratio approach is a more advanced way to judge valuation because it considers the company’s unique circumstances instead of relying only on broad industry or peer averages. This gives a more nuanced perspective on whether the stock is attractively priced.

With Bel Fuse trading near its Fair Ratio, the valuation appears reasonable and balanced against the company’s growth, quality, and risks.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bel Fuse Narrative

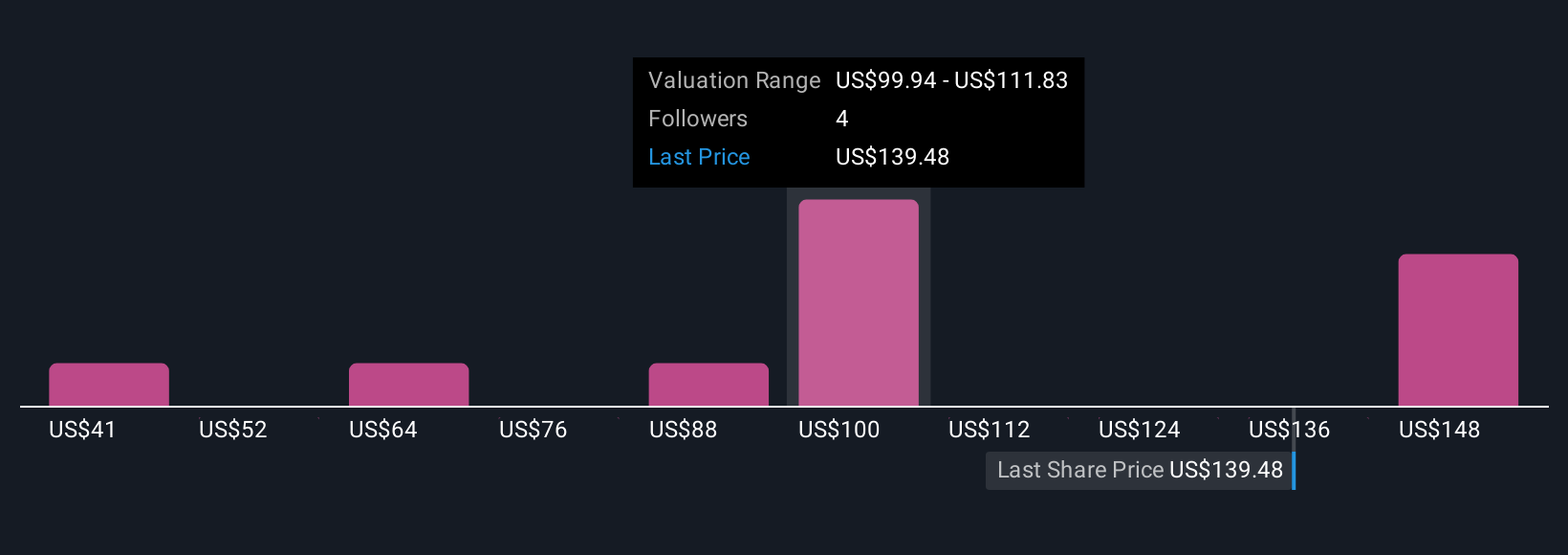

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal investment story: your perspective on Bel Fuse that connects what the company does, the reasons behind its performance, and your beliefs about its future growth, all translated into numbers such as fair value, projected earnings, and expected profit margins.

Narratives bridge the gap between a company’s story and its financial outlook by linking your assumptions to a fair value. This makes it easier to see exactly how your views translate into investment decisions. On Simply Wall St’s Community page, millions of investors use Narratives as a simple, interactive tool to visualize whether Bel Fuse is a buy or sell by comparing their Fair Value to the current share price.

Whenever the facts change, such as a new earnings report or breaking news, your Narrative is automatically updated so your investment thesis always reflects the latest information. This helps you stay agile and informed.

For example, one investor may see major growth potential from Bel Fuse's aerospace and India moves and assign a high fair value, while another may focus on margin volatility risks and set a lower figure.

Do you think there's more to the story for Bel Fuse? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bel Fuse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BELF.A

Bel Fuse

Designs, manufactures, markets, and sells products that power, protect, and connect electronic circuits.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives