- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AVT

Avnet (AVT): Valuation Insights After Recent Share Price Uptick

Reviewed by Simply Wall St

Avnet (AVT) shares recently saw a small uptick at the close, adding 0.03%. While there has not been a major event moving the stock, investors might be watching current valuation signals and recent performance trends closely.

See our latest analysis for Avnet.

After a notable 3.49% jump in Avnet's share price over the last day, investors may be recalibrating their outlook as broader momentum remains under pressure. The stock has a year-to-date share price return of -11.13% and a one-year total shareholder return of -13.46%. While the stock has shown strong gains for patient investors in recent years, recent price action suggests caution is setting in as markets reassess near-term risks and rewards for the company.

If you're keeping an eye on these shifts and want to discover what else is catching investor interest this season, now could be the perfect moment to check out fast growing stocks with high insider ownership.

With Avnet’s shares lagging recently and trading at a notable discount to some analyst price targets, the question for investors is whether the current weakness signals an undervalued opportunity or if future growth is already reflected in the price.

Most Popular Narrative: 13.4% Undervalued

At $45.92, Avnet’s share price sits noticeably below the narrative’s fair value estimate. This gap has caught attention as the market weighs Avnet’s cyclical stabilization against forward growth expectations.

Expanded investment in digital infrastructure, proprietary customer platforms, and improved e-commerce capabilities, particularly at Farnell, strengthen customer experience and retention. These efforts enhance Avnet's ability to capture market share in high-growth sectors such as cloud/AI, industrial automation, and EVs. This expansion is expected to drive higher-margin recurring revenues and operating leverage.

Curious how bold revenue expansion and margin improvement could justify this price edge? The narrative teases surprising upgrade cycles and competitive advantages that drive its bullish fair value. Find out what’s powering Avnet’s potential re-rating and which trends could push it even higher.

Result: Fair Value of $53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure from weaker EMEA demand and regional sales shifts could challenge Avnet’s ability to convert revenue gains into stronger profitability.

Find out about the key risks to this Avnet narrative.

Another View: Check the Discounted Cash Flow

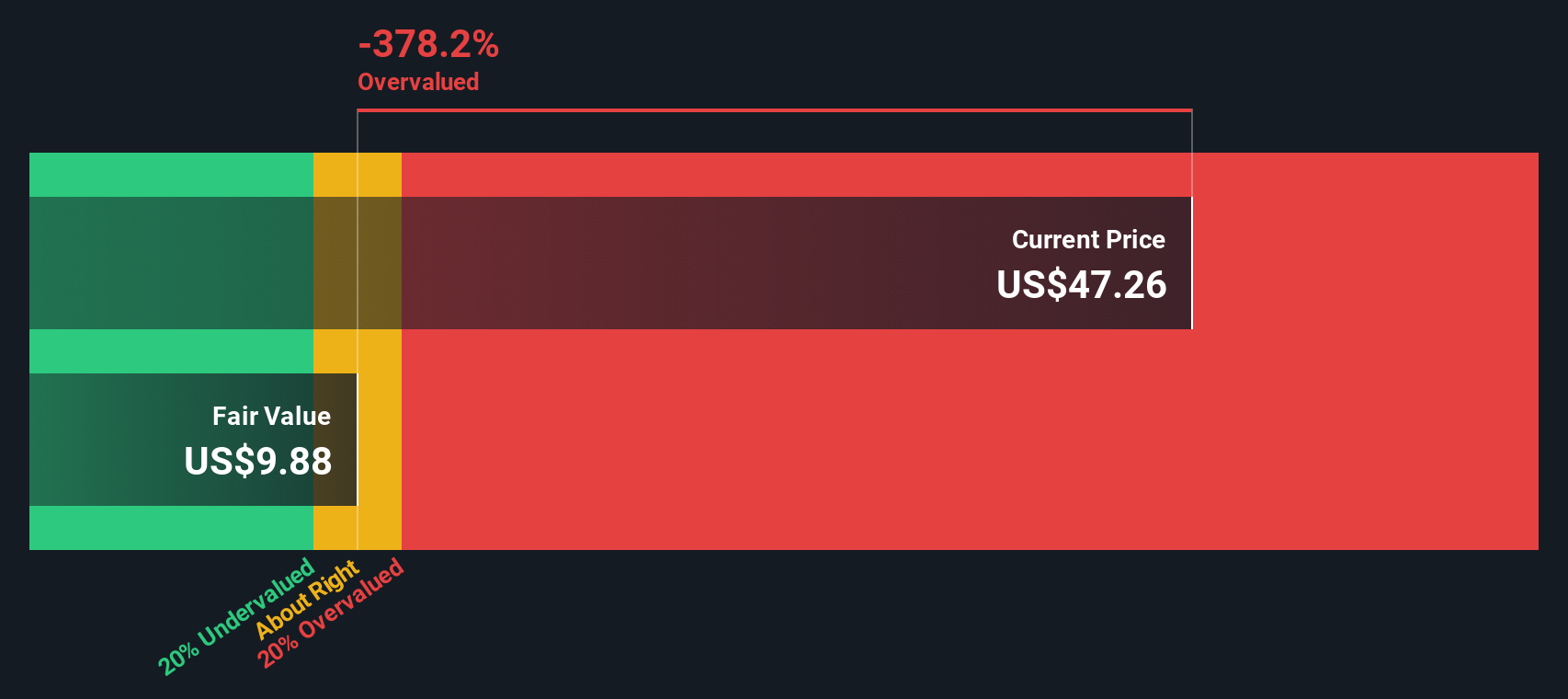

While analyst price targets suggest Avnet is undervalued at recent prices, our SWS DCF model offers a very different take. This cash flow-based approach estimates fair value closer to $9.79 per share, which is well below the current price. This points toward potential downside if cash generation expectations do not shift.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avnet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avnet Narrative

If you see the numbers differently or want to put your own spin on Avnet’s story, you can easily build your own view in just minutes with Do it your way.

A great starting point for your Avnet research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for Even More Investment Opportunities?

The market keeps moving, and missing out on tomorrow’s standouts is never an option. Make your next smart move by checking out these powerful stock ideas:

- Fuel your search for income and stability with these 17 dividend stocks with yields > 3%, which is topping the charts for consistent yields above 3%.

- Seize the explosive potential of next-generation technology with these 25 AI penny stocks, featuring companies pushing the envelope in artificial intelligence.

- Tap into value with these 917 undervalued stocks based on cash flows, uncovering stocks overlooked by the crowd but packed with upside based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVT

Avnet

Distributes electronic component technology in the Americas, Europe, the Middle East, Africa, and Asia/Pacific.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives