- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AEVA

Aeva Technologies (AEVA) Is Up After $100 Million Apollo Investment and D2 Partnership Announcement

Reviewed by Sasha Jovanovic

- Aeva Technologies announced a US$100 million investment from Apollo Global Management and revealed an exclusive partnership with D2 Traffic Technologies to advance its 4D LiDAR-based smart infrastructure solutions in the United States.

- This move supports Aeva’s shift from a LiDAR component supplier to a provider of integrated sensing, perception, and analytics systems for traffic management.

- We’ll explore how Aeva’s exclusive partnership with D2 Traffic Technologies shapes its position in the evolving smart infrastructure market.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Aeva Technologies' Investment Narrative?

To own Aeva Technologies as a shareholder, you have to see potential in their transformation from a LiDAR component supplier to a solutions-driven provider in the smart infrastructure and autonomous sectors. The recent US$100 million investment from Apollo Global Management and the exclusive D2 Traffic Technologies partnership could prove significant, injecting capital for commercialization and expanding real-world deployments in US traffic management. These developments may accelerate Aeva’s ability to capture revenue growth, a key short-term catalyst given expectations of over 60% annual sales expansion. However, risks remain: AEVA’s price is well above industry averages based on sales multiples, the company is still unprofitable, and share price swings are frequent. With prior analyst consensus not accounting for this new capital and partnership, it’s worth watching to see if the strengthened runway materially alters near-term risk around ongoing losses and expensive valuation. Though growth may accelerate, high volatility and unprofitability remain risks investors should not ignore.

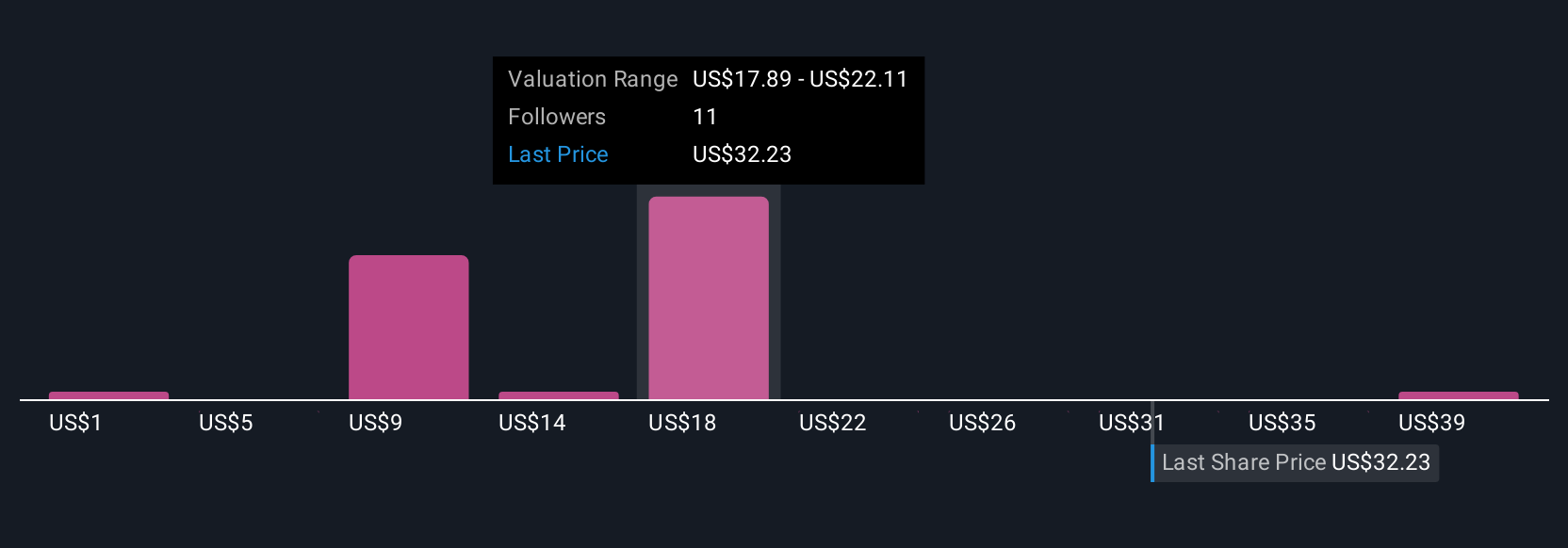

According our valuation report, there's an indication that Aeva Technologies' share price might be on the expensive side.Exploring Other Perspectives

Explore 10 other fair value estimates on Aeva Technologies - why the stock might be worth less than half the current price!

Build Your Own Aeva Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aeva Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Aeva Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aeva Technologies' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEVA

Aeva Technologies

Engages in the design, development, manufacture, and sale of LiDAR sensing systems, and related perception and autonomy-enabling software solutions in North America, Europe, the Middle East, Africa, and Asia.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives