- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AEIS

A Fresh Look at Advanced Energy Industries (AEIS) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Advanced Energy Industries (AEIS) has seen its stock gain 3% over the past month and 27% in the past three months. This performance has caught the attention of investors evaluating growth momentum and earnings trends in this tech sector player.

See our latest analysis for Advanced Energy Industries.

Momentum has certainly been building for Advanced Energy Industries, with its share price up nearly 70% year-to-date and the 1-year total shareholder return climbing to 71%. This reflects optimism about its growth potential and improving sentiment around its recent results.

If you’re tracking standout movers in tech, now’s the perfect moment to discover See the full list for free..

With shares trading below analyst price targets and surging on impressive recent gains, investors are left to wonder if Advanced Energy Industries is undervalued or if the market has already factored in all its future growth potential.

Most Popular Narrative: 4.8% Undervalued

With the most popular narrative placing Advanced Energy Industries’ fair value at $205.80, the figure sits just above the last close of $196. This narrow gap is shaping both bullish and bearish expectations about what comes next for the stock.

Sustained expansion in data center and cloud computing infrastructure, especially driven by AI workloads, is fueling robust demand for Advanced Energy's next-generation high-power density solutions. Strong design win momentum and customer forecasts suggest revenue growth in this segment will remain above historical averages into 2026 and beyond, providing significant top-line upside.

Want to see the full set of bold growth assumptions driving this valuation? A rapid expansion in key segments and ambitious profit margin targets could change everything. Uncover which surprising forecasts set the foundation for that price.

Result: Fair Value of $205.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to a handful of major data center clients and unpredictable semiconductor demand both present real risks that could disrupt Advanced Energy's growth story.

Find out about the key risks to this Advanced Energy Industries narrative.

Another View: How Does the Market Multiple Stack Up?

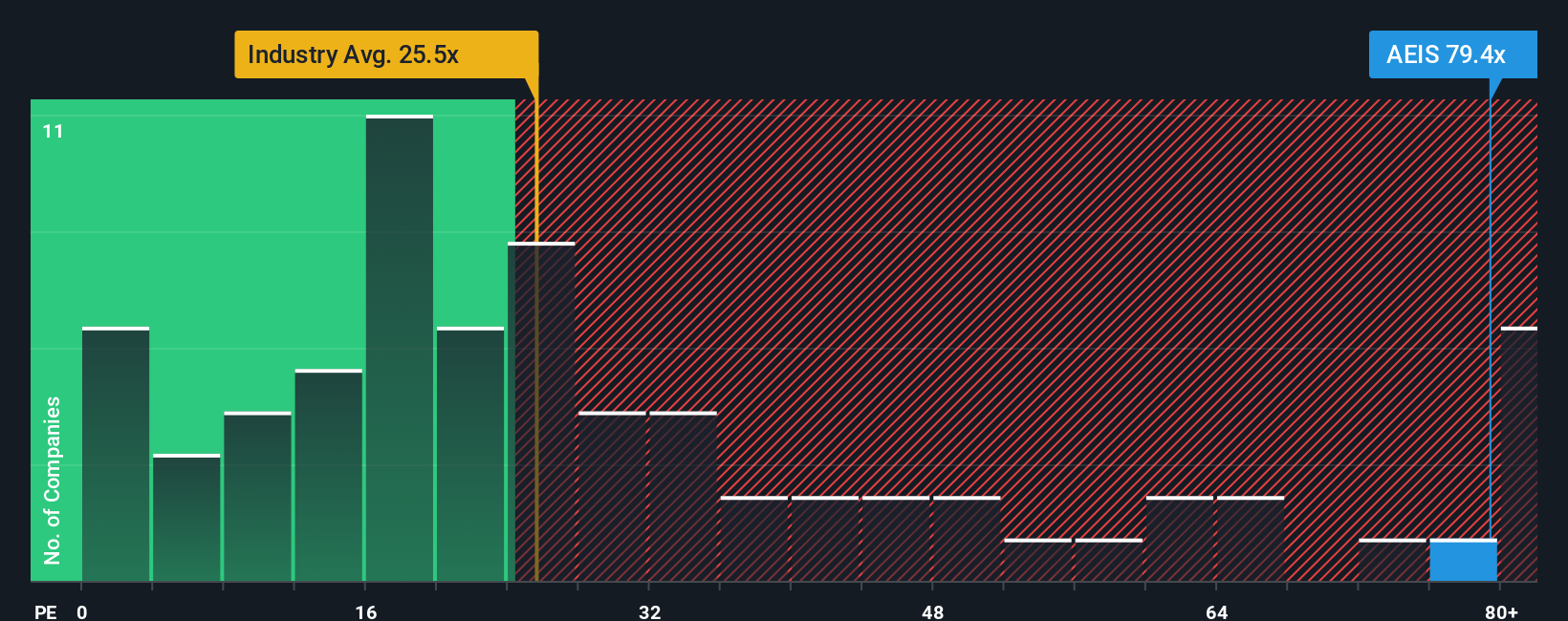

Taking a different approach, looking at price-to-earnings reveals Advanced Energy Industries trades on a ratio of 50.7x, well above both the US Electronic industry average (22.6x) and the peer average (28.6x). The fair ratio estimate sits at 41.6x, so the current premium points to a heightened valuation risk if growth stumbles. Is the market's optimism truly justified, or could expectations be getting ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Advanced Energy Industries Narrative

If you have a different perspective or want to dive deeper into the details, you can quickly put together your own story and see where the numbers take you. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Advanced Energy Industries.

Looking for More Investment Ideas?

Don’t let opportunity pass you by and expand your portfolio with handpicked stocks that could set you ahead of the crowd, all curated by Simply Wall Street’s smart screeners.

- Catch the next tech surge by checking out these 25 AI penny stocks that are unveiling new applications in artificial intelligence and industry innovation.

- Supercharge your passive income and protect your returns by selecting from these 17 dividend stocks with yields > 3% offering robust yields and consistent payouts.

- Ride the momentum in digital assets and blockchain advances by jumping into these 81 cryptocurrency and blockchain stocks tapping into the future of financial technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEIS

Advanced Energy Industries

Provides precision power conversion, measurement, and control solutions in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives