- United States

- /

- Communications

- /

- NasdaqGM:AAOI

Should AOI’s US$150 Million Texas Expansion Prompt a Closer Look From AAOI Investors?

Reviewed by Sasha Jovanovic

- In October 2025, the City of Sugar Land and Applied Optoelectronics announced that AOI would expand its U.S. manufacturing by onshoring part of its international operations to Sugar Land, Texas, which includes a capital investment of over US$150 million and plans to create more than 500 new jobs.

- This expansion will make AOI's Sugar Land location the largest producer of AI-focused datacenter optical transceivers in the United States, underscoring the company's commitment to domestic tech manufacturing and regional economic growth.

- We'll examine how this US$150 million Texas expansion positions AOI for increased domestic production capacity and long-term competitiveness.

Find companies with promising cash flow potential yet trading below their fair value.

Applied Optoelectronics Investment Narrative Recap

To be excited about Applied Optoelectronics, an investor needs to believe in the long-term demand for high-speed optical products in AI-focused data centers, and AOI’s ability to scale up US-based manufacturing efficiently. The recent US$150 million Texas expansion directly targets the most important short-term catalyst, increasing domestic capacity required by major customers, while also amplifying the company’s main risk: elevated capital spending and the pressure this creates on free cash flow as AOI invests aggressively ahead of anticipated growth.

Among AOI’s recent moves, the US$150 million equity offering filed in August 2025 is most relevant, as it provides essential funding to support this scale of capital investment. This fresh capital should be viewed in context with both AOI’s rapid manufacturing expansion and the ongoing need to sustain competitive positioning during a period of industry change and margin sensitivity.

Yet, in contrast to this growth story, anyone considering AOI today should be aware of what sustained heavy capital requirements might mean if free cash flow stays tight and ...

Read the full narrative on Applied Optoelectronics (it's free!)

Applied Optoelectronics' narrative projects $1.3 billion revenue and $111.0 million earnings by 2028. This requires 51.5% yearly revenue growth and a $266.7 million increase in earnings from -$155.7 million today.

Uncover how Applied Optoelectronics' forecasts yield a $28.40 fair value, a 20% downside to its current price.

Exploring Other Perspectives

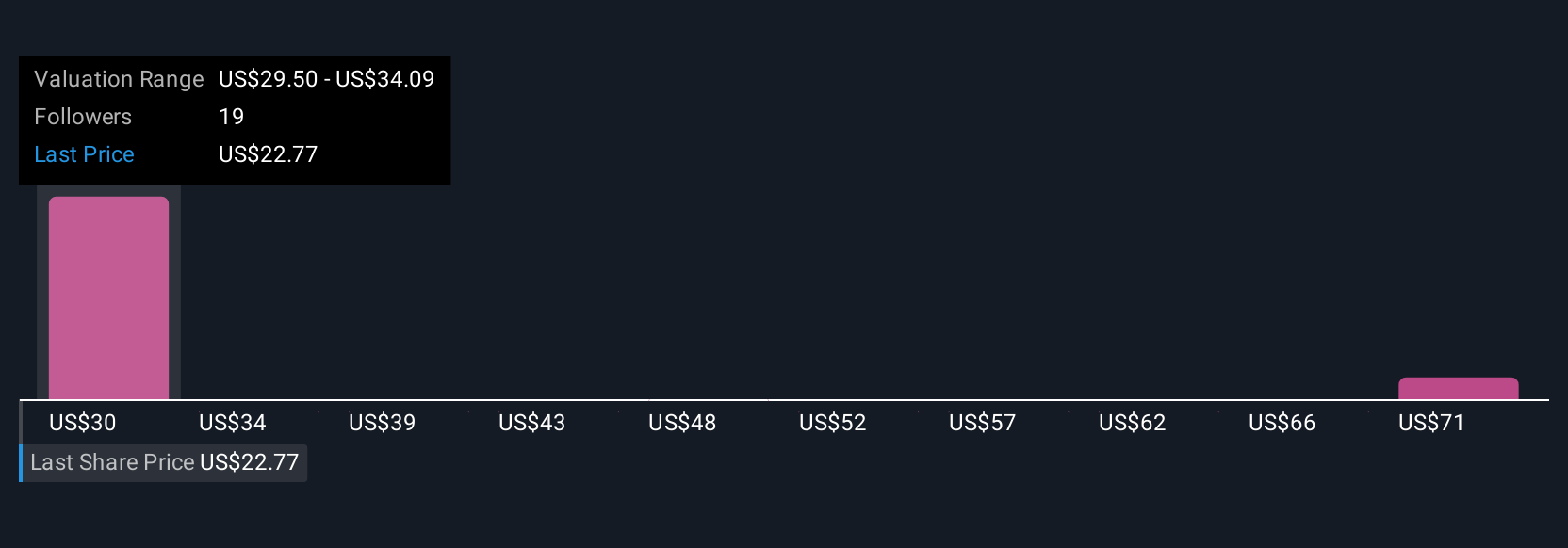

Seven fair value estimates from the Simply Wall St Community span a wide range, from US$28.40 to US$75.38 per share. These diverse opinions highlight how supply chain risks and capital needs could drive sharply different expectations for AOI’s future performance, consider both sides as you compare perspectives.

Explore 7 other fair value estimates on Applied Optoelectronics - why the stock might be worth 20% less than the current price!

Build Your Own Applied Optoelectronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Applied Optoelectronics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Applied Optoelectronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Applied Optoelectronics' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AAOI

Applied Optoelectronics

Designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives