- United States

- /

- Software

- /

- OTCPK:ABXX.F

Assessing Abaxx Technologies (OTCPK:ABXX.F) Valuation Following Launch of Germany’s First Wind Futures Contract

Reviewed by Simply Wall St

Abaxx Technologies (OTCPK:ABXX.F) is grabbing attention after announcing the upcoming launch of Enwex German Wind Futures, the first wind futures contract built on Enwex indices in Germany. This euro-denominated product targets weather risk management in renewables.

See our latest analysis for Abaxx Technologies.

Momentum around Abaxx Technologies has been building quickly, with notable product announcements fueling a surge that has delivered a 286.6% year-to-date share price return and a 244.1% total shareholder return over the past year. Investors are starting to take notice, as excitement grows for both near-term catalysts and the company’s long-term strategy.

If Abaxx’s rapid growth has you looking for other big movers, broaden your search and discover fast growing stocks with high insider ownership

After such a dramatic surge in share price, the big question is whether Abaxx Technologies is now trading above its true value or if investors are looking at a genuine buying opportunity before the next phase of growth is realized.

Price-to-Book of 33.3x: Is it justified?

Abaxx Technologies is trading at a price-to-book ratio of 33.3x, far above its industry peers. At the last close of $31.66, the stock looks expensive on this basis relative to the sector.

The price-to-book ratio compares a company's market value to its net assets. This measure is particularly relevant for assessing valuation in asset-light sectors such as software and technology, where book values can understate intangible potential. However, a significantly higher ratio often suggests elevated investor expectations for future growth.

In this case, the US Software industry averages just 3.7x price-to-book, placing Abaxx’s valuation in the spotlight. The company's premium raises questions as to whether the market is overestimating the pace or scale of future profitability relative to established peers or simply pricing in its rapid growth prospects. There is no fair ratio available for reference, making peer comparisons especially important when assessing justification for this premium.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Preferred multiple of 33.3x price-to-book (OVERVALUED)

However, slower revenue growth or missing aggressive profitability targets could quickly challenge the optimism that is currently driving Abaxx Technologies' elevated valuation.

Find out about the key risks to this Abaxx Technologies narrative.

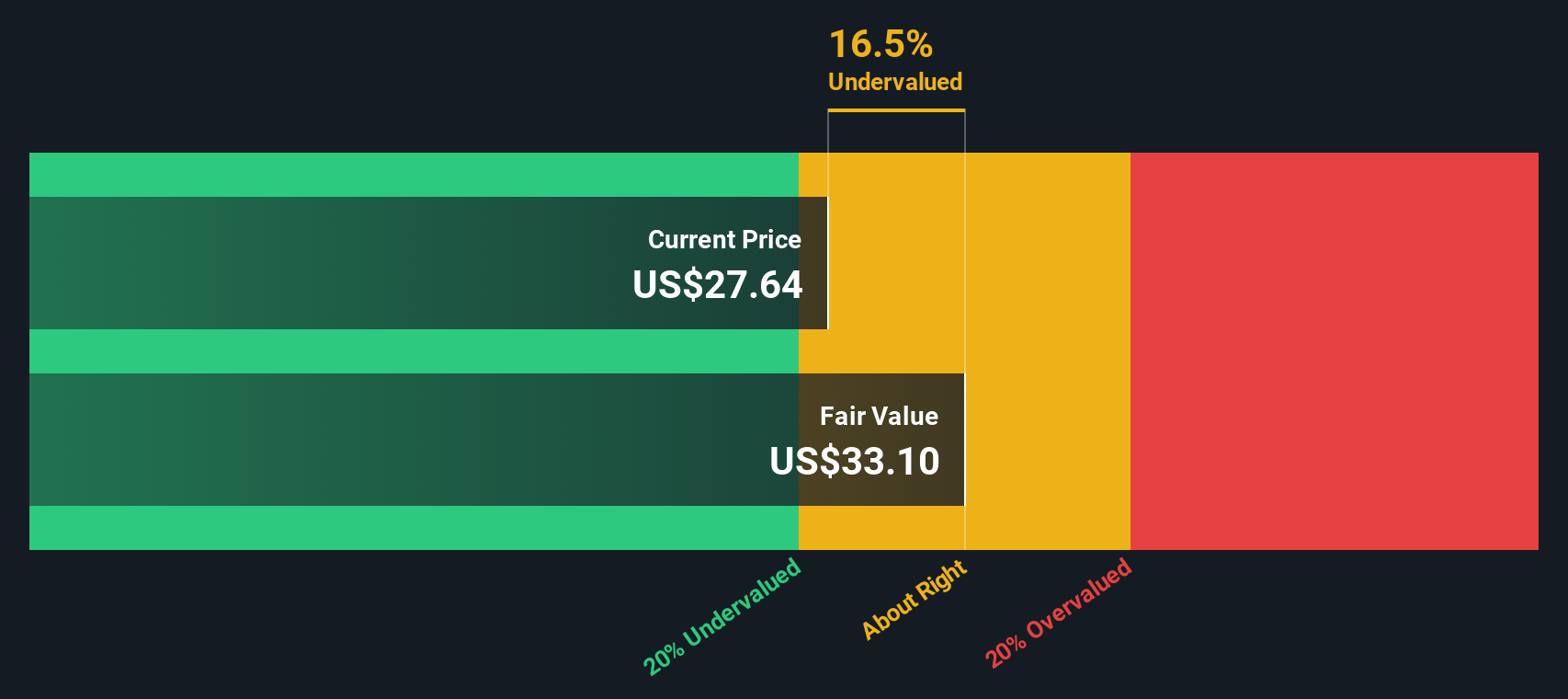

Another View: SWS DCF Model Suggests Mild Undervaluation

Taking a different approach, our SWS DCF model estimates that Abaxx Technologies is trading about 3.4% below its fair value of $32.76 per share. This method looks at future cash flows instead of book value, and it suggests that the market price may not be as stretched as it first appears. The question remains, though: which story will play out, multiples or future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Abaxx Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Abaxx Technologies Narrative

If you want to take a different angle or prefer hands-on research, you can easily create your own narrative based on the data in just a few minutes. Do it your way

A great starting point for your Abaxx Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means not just watching single stocks but staying ahead of exciting trends. Why risk missing the next breakout performer or sector leader?

- Tap into the future of medicine by uncovering health-focused opportunities through these 32 healthcare AI stocks. These companies are making waves in medical innovation and AI-powered diagnostics.

- Boost your portfolio’s resilience and income with these 16 dividend stocks with yields > 3%, which features options that offer reliable yields exceeding 3% and demonstrate time-tested financial strength.

- Get ahead of the financial revolution with these 82 cryptocurrency and blockchain stocks companies leading in blockchain advancement and digital asset innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:ABXX.F

Abaxx Technologies

Engages in developing software tools which enable commodity traders and finance professionals to communicate, trade, and transact in Canada.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives