- United States

- /

- Software

- /

- NYSE:ZETA

Zeta Global (ZETA) Is Up 18.6% After Raising 2025-26 Revenue Guidance and Narrowing Losses Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Zeta Global Holdings recently reported third quarter results showing US$337.17 million in revenue and a significantly reduced net loss, alongside raised revenue guidance for 2025 and new projections for 2026, which include an anticipated 21% year-over-year revenue increase.

- The company’s updated outlook coincided with analyst upgrades and suggests ongoing improvements in both business performance and management confidence, signaling potential momentum in its operational execution.

- We’ll examine how Zeta Global’s raised 2025 and 2026 revenue guidance and narrowing losses influence its investment narrative and future growth outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Zeta Global Holdings Investment Narrative Recap

For investors to see Zeta Global Holdings as a promising opportunity, the belief must center on the company's ability to maintain strong double-digit revenue growth and accelerate its path toward consistent profitability, even as it faces ongoing competitive and regulatory pressures in digital marketing and AI. The recent third quarter results, including raised full-year revenue guidance and decreasing net losses, may help support confidence in near-term business momentum, but do not materially alter the key short-term catalyst, sustained client adoption of Zeta's AI-powered platform remains most critical, while the biggest risk continues to be persistent GAAP net losses and the associated pressure on reaching lasting profitability.

The most relevant update in light of these catalysts is Zeta’s increased full-year 2025 and new 2026 revenue guidance, with expectations now for US$1.54 billion in 2026, a 21% year-over-year rise. This continued top-line growth projection, supported by a narrowing net loss in the latest quarter, is a clear signal of management’s confidence in the company’s value proposition and its ability to gain share against competitors, but the ability to shift from revenue growth to sustained net profit still shapes the investment narrative.

However, while optimism around revenue and guidance is high, investors should also be aware that persistent net losses could...

Read the full narrative on Zeta Global Holdings (it's free!)

Zeta Global Holdings is projected to reach $1.9 billion in revenue and $106.5 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 18.3% and an earnings increase of $143.1 million from current earnings of -$36.6 million.

Uncover how Zeta Global Holdings' forecasts yield a $28.27 fair value, a 43% upside to its current price.

Exploring Other Perspectives

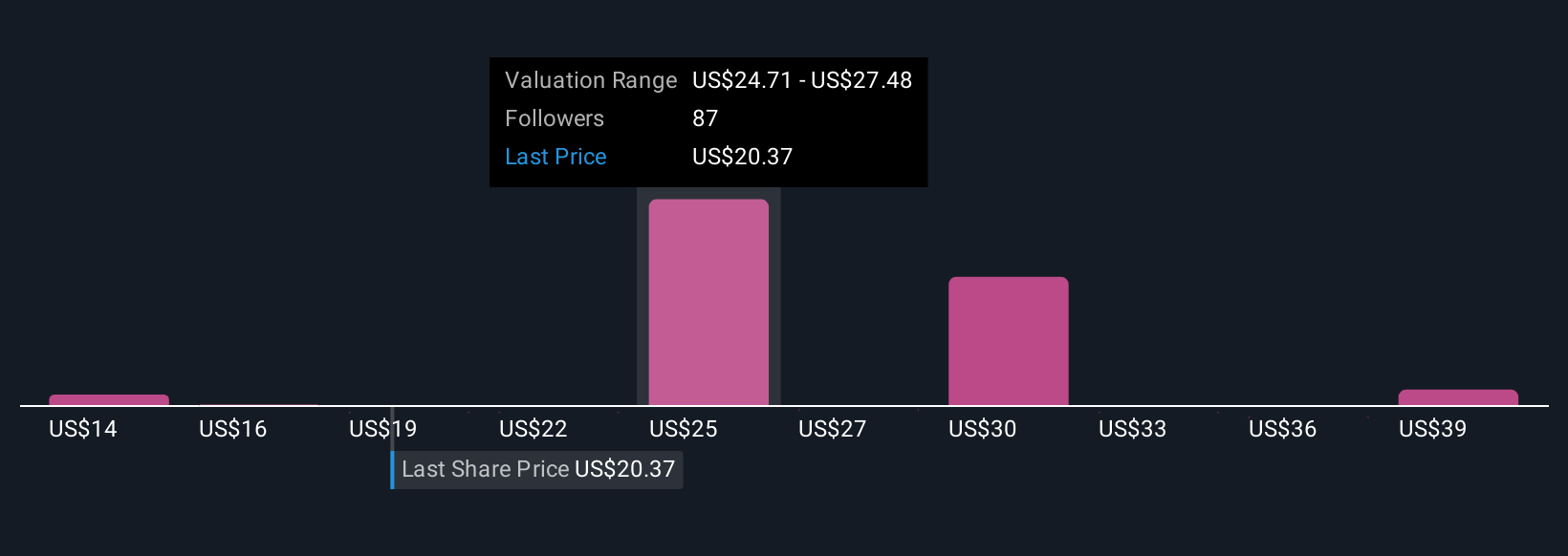

The Simply Wall St Community has contributed 30 unique fair value estimates for Zeta Global Holdings, ranging widely from US$13.63 to US$41.34 per share. With this breadth of opinion, you can see how investors weigh strong revenue growth against ongoing profitability challenges, explore the full spectrum of community viewpoints to inform your perspective.

Explore 30 other fair value estimates on Zeta Global Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Zeta Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zeta Global Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zeta Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zeta Global Holdings' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives