- United States

- /

- Software

- /

- NYSE:ZETA

Is Now the Right Time to Revisit Zeta Global After Its AI Partnerships and 8% Price Surge?

Reviewed by Bailey Pemberton

- Wondering whether Zeta Global Holdings is a value play or just another tech name with buzz? You are not alone, especially if you are eager to see whether the current price is a compelling entry point.

- The stock has been on a rollercoaster lately, jumping 8.4% in the last week and up 6.0% over the past month, but still down 45.2% over the last year. This comes even after a strong 122.5% rise over the past three years.

- Recent headlines have spotlighted Zeta’s strategic partnerships and expansion in the artificial intelligence marketing space, grabbing attention from growth-focused investors. Analysts and the market alike have started to revisit their assumptions about the company's long-term potential as a result.

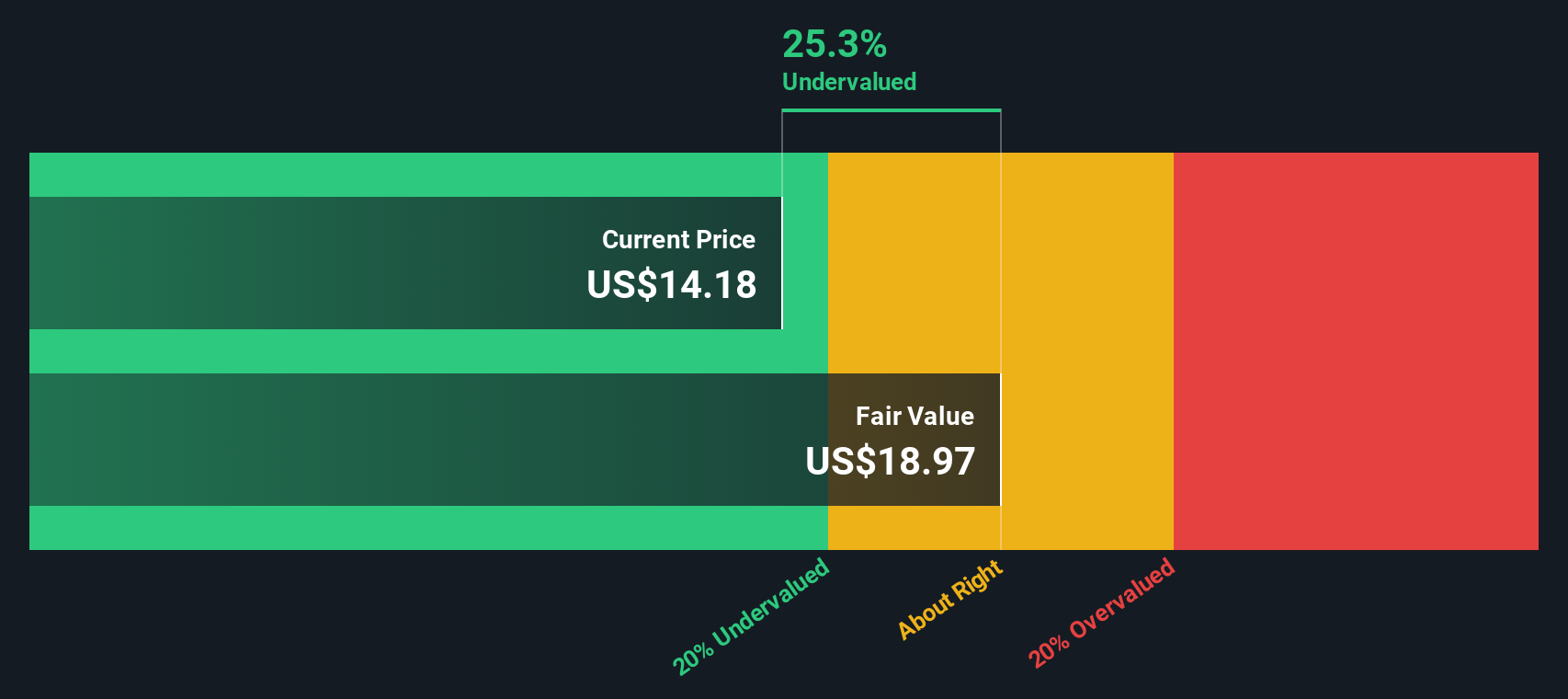

- Right now, Zeta Global Holdings has a valuation score of 5 out of 6, indicating it is undervalued by most checks. Over the next sections, we will explore what drives this score, compare valuation methods, and reveal a smarter way to gauge value by the end of the article.

Find out why Zeta Global Holdings's -45.2% return over the last year is lagging behind its peers.

Approach 1: Zeta Global Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) valuation approach estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today's value. For Zeta Global Holdings, this model incorporates analyst forecasts for the next five years and extends them through extrapolation to form a long-term outlook.

Currently, Zeta Global Holdings generates $129.5 Million in free cash flow. Analysts estimate steady growth, with projections reaching $262.95 Million by the end of 2027. In addition, these cash flows are expected to continue growing, with ten-year projections pointing toward over $491 Million by 2035. All figures are presented in USD.

The DCF model used here is the "2 Stage Free Cash Flow to Equity" method, which is standard for technology firms experiencing early growth before stabilizing. Using this approach, Zeta's intrinsic value is estimated at $27.07 per share. This is approximately 27.9% above its current market price. According to the model’s cash flow and discounting assumptions, the stock appears undervalued by a significant margin.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zeta Global Holdings is undervalued by 27.9%. Track this in your watchlist or portfolio, or discover 875 more undervalued stocks based on cash flows.

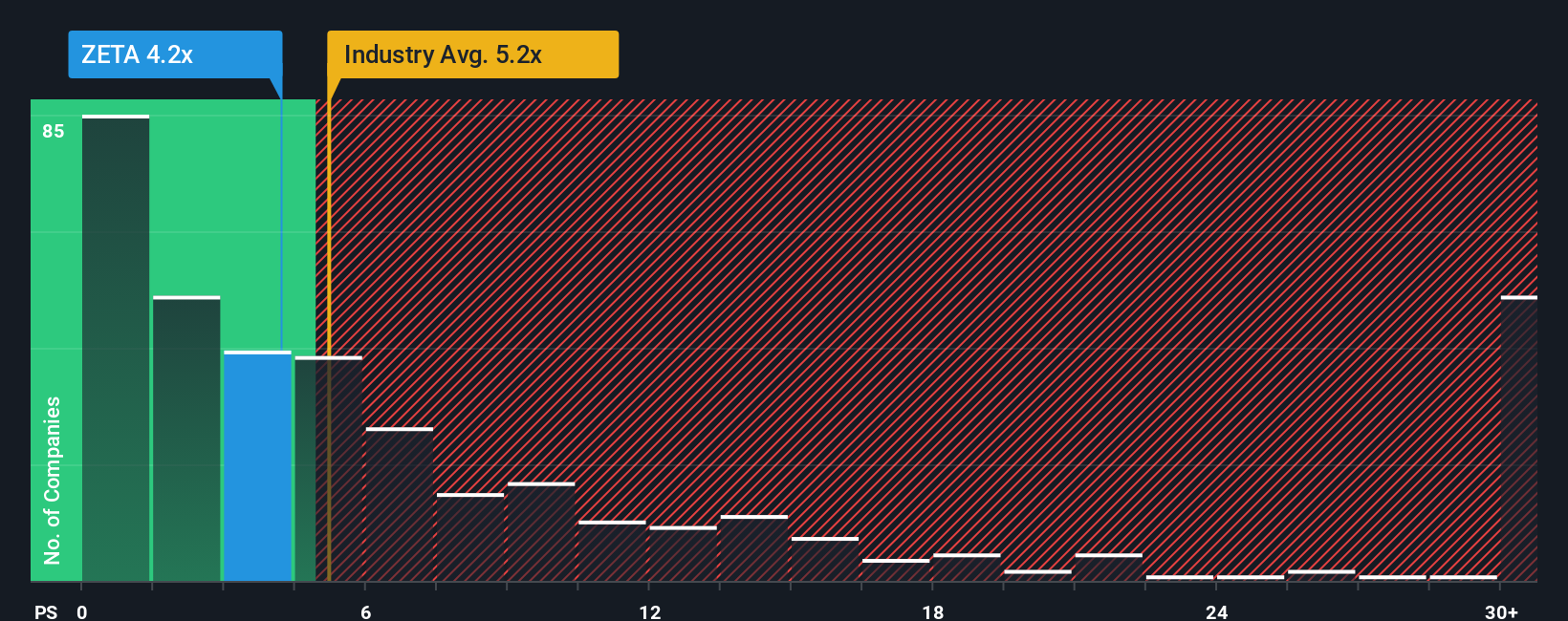

Approach 2: Zeta Global Holdings Price vs Sales

Price-to-Sales (P/S) is a preferred metric for valuing technology companies, especially those not yet consistently profitable. For firms like Zeta Global Holdings, which may reinvest heavily in growth rather than posting steady earnings, P/S offers a useful measure of how much investors are willing to pay for each dollar of revenue. This makes it a practical tool for comparison.

The appropriate P/S multiple will be influenced by growth prospects and industry risks. High-growth companies can command higher P/S ratios because investors expect future revenue to translate to substantial profits. However, premium valuations should be justified by clear competitive advantages and manageable risk. Otherwise, elevated multiples may signal over-optimism.

Currently, Zeta trades at a 3.83x P/S multiple, which is below both its industry average of 4.76x and the peer group average of 10.33x. Simply Wall St's proprietary "Fair Ratio" for Zeta is 6.53x. This Fair Ratio adjusts for company-specific factors such as revenue growth outlook, market capitalization, operating margins, and risk profile, offering a more tailored benchmark compared to blunt industry averages or peer multiples.

By comparing Zeta's actual multiple to the Fair Ratio, the stock appears undervalued on a price-to-sales basis. The current market price is well below what you would expect for a company with Zeta's revenue profile and sector characteristics.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zeta Global Holdings Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives.

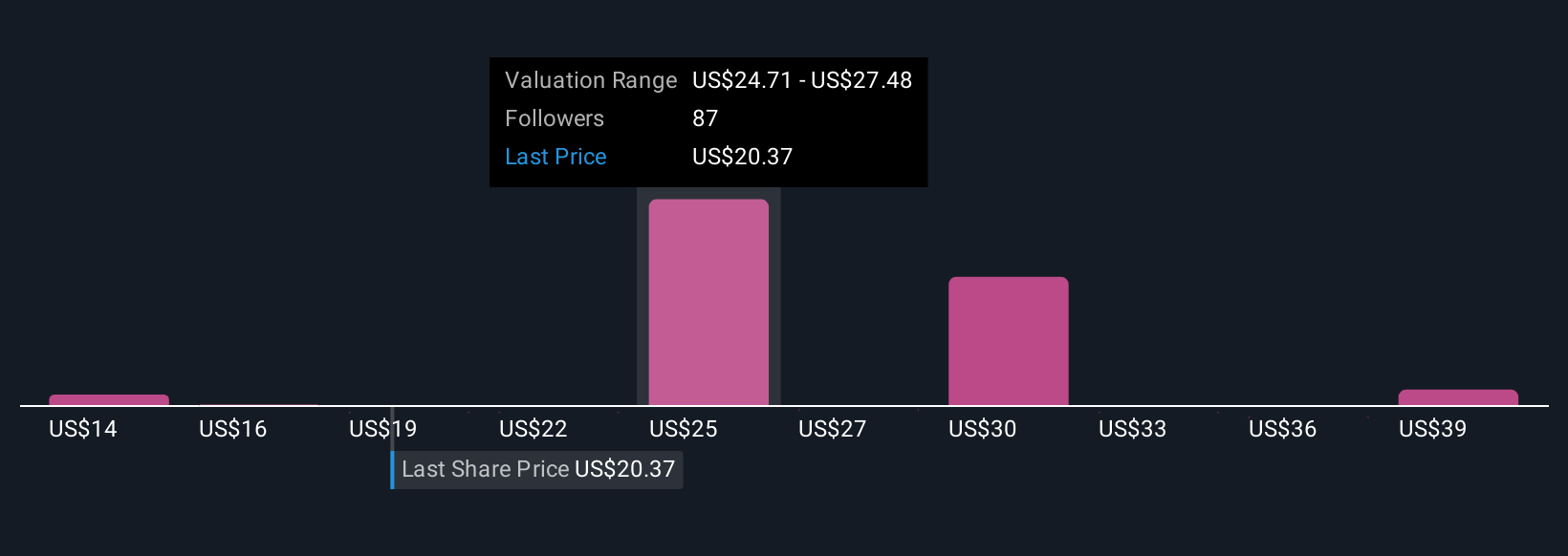

Narratives are a unique approach that lets you connect the story you believe about a company, such as its growth prospects, risks, and market trends, directly to financial forecasts and an estimate of fair value. Instead of just relying on preset models or analyst opinions, you can easily bring your own perspective to life by creating or choosing a Narrative for Zeta Global Holdings within the Simply Wall St Community page (where millions of investors share views).

This helps you see not just what the numbers are, but why they make sense for your view, linking the company’s business outlook to real assumptions about future revenue, profit margins, and what the stock should be worth. Narratives are dynamic, so they automatically update whenever fresh news, earnings, or major developments are announced, keeping your investment view current.

For example, some investors think Zeta can achieve its most bullish price target of $44.00 by sustaining rapid AI-driven adoption and expanding profitability, while others foresee headwinds and use the lowest target of $18.00 based on stricter privacy regulations or intensified competition. Your Narrative lets you set your own assumptions and quickly see if today’s price matches your story.

Do you think there's more to the story for Zeta Global Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives