- United States

- /

- IT

- /

- NYSE:UIS

Unisys (UIS) Loss Reduction Slows but Profitability Remains Elusive Versus Market Expectations

Reviewed by Simply Wall St

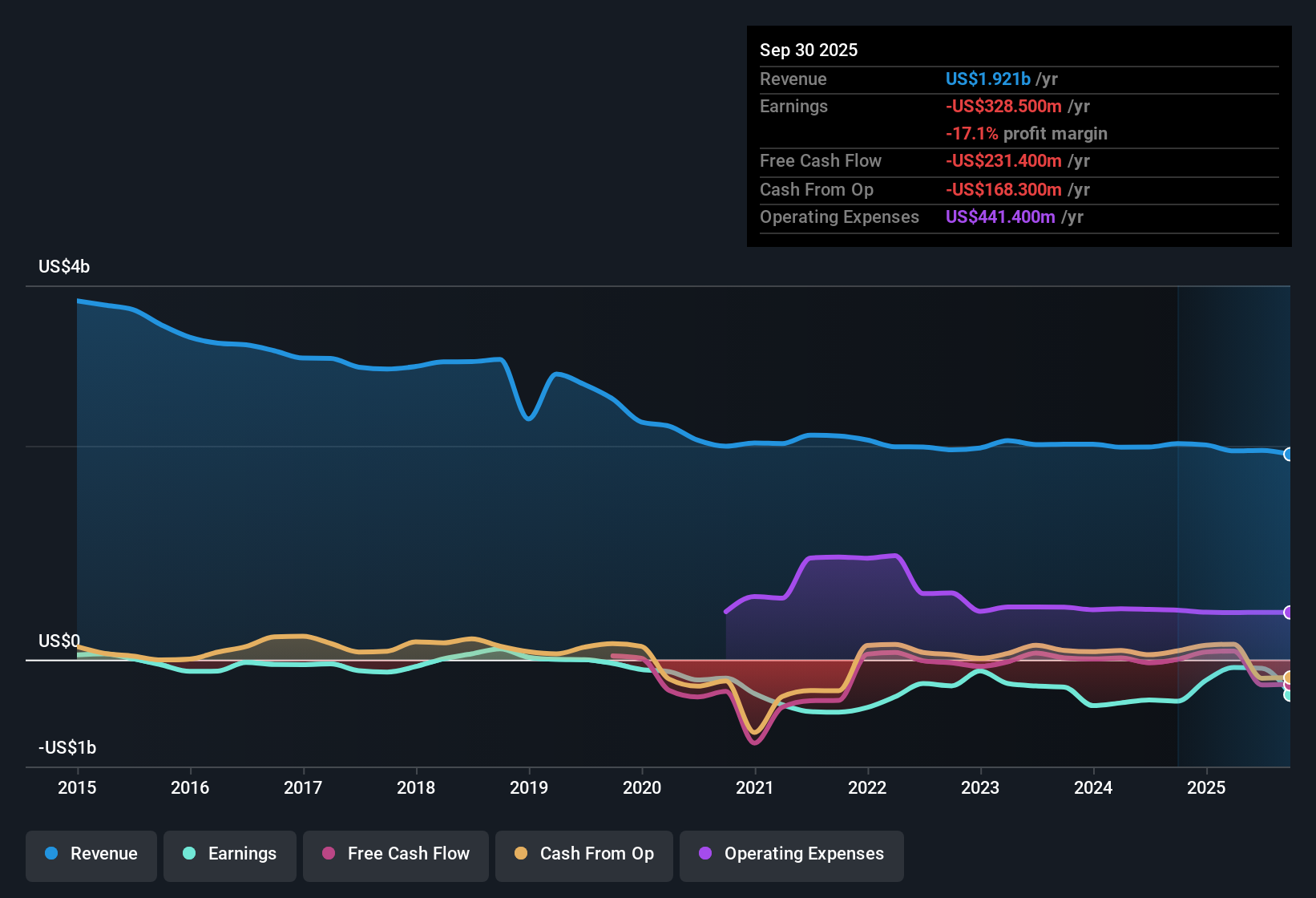

Unisys (UIS) posted revenue growth forecasts of 4.3% per year, lagging behind the broader US market’s 10.4% annual expectation. The company remains unprofitable, but has managed to narrow its losses at a 9.4% annual rate over the last five years, and shares are currently trading at $2.69, well below the estimated fair value of $20.76. Investors are weighing the progress in shrinking losses and attractive sales multiples against sustained unprofitability and subdued growth projections, with net profit margins yet to turn positive.

See our full analysis for Unisys.Next, we’ll see how these results match up against the main narratives shaping sentiment in the market. Some storylines could be confirmed, while others might get shaken up.

See what the community is saying about Unisys

Recurring Revenue Margin Expands as Losses Narrow

- Unisys has been reducing its annual losses by 9.4% over the last five years, even though it is still unprofitable.

- According to the analysts' consensus view, enhanced demand for advanced security, cloud, and AI-driven services is supporting higher-margin, recurring revenue streams for Unisys.

- Operations have benefited from efforts to modernize proprietary software like Stealth and ClearPath Forward. This anchors the bullish case for eventual margin improvement.

- However, the company is forecast to remain in the red for at least the next three years, a reminder that expanding margins have not yet translated to bottom-line profitability.

- To see if the consensus perspective still holds after this update, check the full narrative and dive into the numbers for yourself. 📊 Read the full Unisys Consensus Narrative.

P/S Ratio Discounts Risk, Not Just Value

- Unisys trades at a price-to-sales ratio of just 0.1x, far below both the US IT industry average (2.5x) and the peer average (4.6x).

- Consensus narrative highlights that this deep discount reflects market caution over muted demand in key segments and ongoing challenges moving away from legacy platforms.

- Despite streamlined capital structures and growth investments, the steep P/S valuation gap underscores investor skepticism surrounding Unisys's prospects for returning to profit.

- Analysts are still not expecting profitability in the next three years, reinforcing market doubt about the speed of any potential turnaround.

DCF Fair Value Gap Remains Wide

- The current Unisys share price of $2.69 is well below its DCF fair value estimate of $20.76, highlighting a major disconnect between market price and modeled valuation.

- Consensus narrative points out this gap combines analyst optimism in future cash flows and margin recovery with persistent bearishness due to slow projected revenue growth (4.3% vs 10.4% for the market) and a history of unprofitable operations.

- For the current share price to close in on the DCF fair value, Unisys would need to show clear steps toward sustained profit, which is not yet reflected in market expectations.

- If the company achieves the outlined turnaround, the low valuation may eventually work in favor of patient investors. Otherwise, the gap signals continued risk premiums priced in by the market.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Unisys on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on these results? You can create your own narrative and share your outlook in just a few minutes. Do it your way

A great starting point for your Unisys research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Unisys continues to face persistent losses, an uncertain path to profitability, and slow projected revenue growth compared to peers and the broader market.

If consistent growth and proven performance is what you’re after, use stable growth stocks screener (2079 results) to find companies that deliver reliable earnings and revenue expansion across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UIS

Unisys

Operates as an information technology solutions company in the United States, the United Kingdom, and internationally.

Undervalued with very low risk.

Similar Companies

Market Insights

Community Narratives