- United States

- /

- IT

- /

- NYSE:SNOW

How Investors May Respond to Snowflake (SNOW) AI Partnerships Amid Revenue Guidance Controversy

Reviewed by Sasha Jovanovic

- Following a high-profile interview in early November 2025, Snowflake filed an SEC 8-K to clarify that its Chief Revenue Officer was not authorized to discuss future financial results after he publicly predicted revenues exceeding company guidance, sparking intense debate across investor circles.

- Concurrently, Snowflake unveiled a series of major AI-focused product launches and partnerships, including new AI developer tools, advanced lakehouse features, and deep integrations with SAP and Deloitte, highlighting a shift toward AI-powered data solutions and enterprise-ready interoperability.

- We'll examine how the wave of AI innovation and these significant partnerships affect Snowflake's investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Snowflake Investment Narrative Recap

To own shares of Snowflake today, an investor needs confidence that enterprise AI adoption and rapid cloud migration will keep fueling platform demand, outweighing intense competition and the risks of decelerating workload expansion. The company's recent SEC filing clarifying unauthorized executive commentary is unlikely to materially impact the near-term focus on AI-driven product adoption, but it does reinforce the importance of disciplined communication during a period of heightened expectations and scrutiny.

Snowflake’s new SAP collaboration stands out as especially relevant: by integrating deeply with SAP Business Data Cloud, Snowflake is addressing both customer interoperability needs and the trend toward AI-powered enterprise data management. This partnership highlights how Snowflake's platform is evolving to meet complex customer demands, tying into key catalysts like sustained workload migration and AI feature expansion.

In contrast, investors should be aware of emerging risks from hyperscaler competition, particularly as rivals step up their native analytics and AI offerings and potentially challenge Snowflake’s pricing power and margins...

Read the full narrative on Snowflake (it's free!)

Snowflake's narrative projects $7.8 billion revenue and $497.5 million earnings by 2028. This requires 23.8% yearly revenue growth and a $1.9 billion increase in earnings from -$1.4 billion today.

Uncover how Snowflake's forecasts yield a $263.43 fair value, in line with its current price.

Exploring Other Perspectives

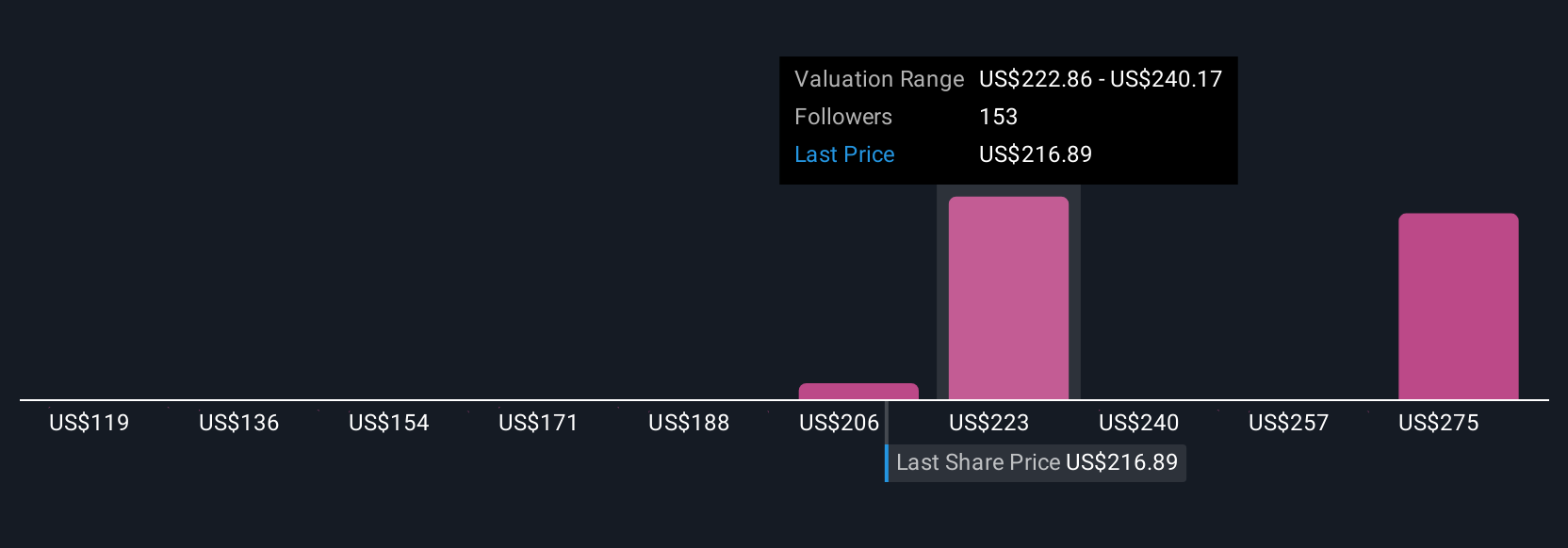

Fifteen fair value estimates from the Simply Wall St Community span a wide US$132.50 to US$263.43 range. While broad adoption of AI and analytics continues to act as a key growth driver, differing views highlight the importance of understanding how migration trends and competitive challenges may shape Snowflake's long-term earnings power.

Explore 15 other fair value estimates on Snowflake - why the stock might be worth as much as $263.43!

Build Your Own Snowflake Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Snowflake research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Snowflake research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Snowflake's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives