- United States

- /

- Software

- /

- NYSE:S

SentinelOne (S): Assessing Valuation After Strategic European AI Cybersecurity Partnership with Schwarz Digits

Reviewed by Simply Wall St

If you’re holding or eyeing SentinelOne (NYSE:S), today’s news may feel like a tipping point. The company just revealed a strategic pairing with Schwarz Digits to roll out an AI-powered cybersecurity solution across Europe, directly targeting data sovereignty, compliance, and the rising need for operational resilience. For investors, this partnership is more than just another logo on a press release. It signals SentinelOne’s readiness to serve heavily regulated industries and governments that demand both cutting-edge security and ironclad jurisdictional control over data. In a sector where trust and compliance drive purchasing decisions, this move could unlock a lucrative new market while deepening existing relationships.

The past year has asked tough questions of SentinelOne. The stock is down nearly 19% so far this year and just above that for the trailing twelve months, though shares have rebounded more than 6% over the past month. Short-term momentum may be returning after a weak stretch. The Schwarz Digits announcement follows new integrations and partnerships, reflecting a strategy shift towards embedding deeper within essential enterprise tech stacks. Even so, the company is not far removed from a lengthy period of skepticism related to profitability and revenue trajectory.

So after a challenging year and this fresh push into the European compliance market, is SentinelOne now trading at a discount, or are investors already factoring in the promise of growth ahead?

Most Popular Narrative: 22% Undervalued

According to the most widely followed narrative, SentinelOne is currently trading well below its projected fair value, suggesting notable upside based on forward-looking financial expectations and ongoing product innovation.

SentinelOne's robust innovation in AI-driven, autonomous security, highlighted by substantial enterprise adoption of Purple AI and the AI-native SIEM platform, strongly positions the company to capture growing budgets as cyber threats become more sophisticated. This is likely to drive sustained revenue growth and improve gross margins as their differentiated offerings enable premium pricing.

How is this sharp difference between market price and valuation explained? At the heart of it all are some aggressive projections regarding future revenue growth, margin improvement, and ambitious profitability targets. Want to peek under the hood and see what surprising assumptions are moving the needle for SentinelOne’s fair value? The details might just reshape your outlook on what is next for this cybersecurity innovator.

Result: Fair Value of $23.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, SentinelOne remains exposed to shifting macroeconomic conditions and regulatory hurdles, both of which could quickly alter its growth trajectory.

Find out about the key risks to this SentinelOne narrative.Another View: Industry Comparisons Tell a Different Story

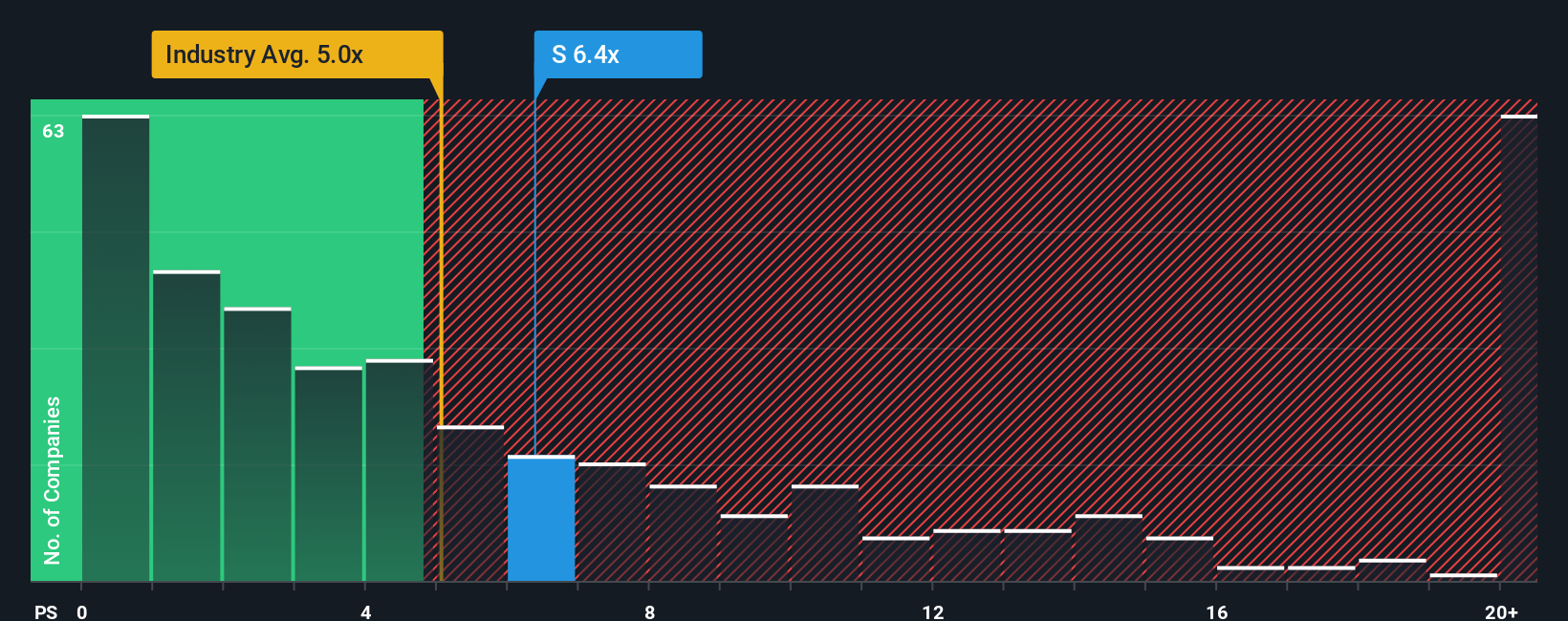

Looking through a different lens, the latest market ratios suggest SentinelOne is pricier than many of its software peers. This raises questions about whether optimism has already been baked into the stock. Is growth enough to justify it, or is there less upside than it seems?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SentinelOne Narrative

If these perspectives do not fully reflect your own or you want to run your own numbers, it only takes a few minutes to build a personalized view. Do it your way.

A great starting point for your SentinelOne research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Don’t let your investment journey end here. The Simply Wall Street Screener uncovers fresh angles and hidden potential you may have missed. Unlock the next big idea now.

- Spot value gems early by seizing opportunities with undervalued stocks based on cash flows that deliver solid fundamentals overlooked by the market.

- Boost your search for reliable income by zeroing in on dividend stocks with yields > 3% that offer strong yields and consistent payouts.

- Ride the AI innovation wave by targeting rapid growth with AI penny stocks packed with future-focused disruptors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:S

SentinelOne

Operates as a cybersecurity provider in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives