- United States

- /

- Software

- /

- NYSE:S

A Look at SentinelOne’s Valuation as New AI Security Launches Signal Broader Strategic Push

Reviewed by Simply Wall St

SentinelOne (NYSE:S) made a series of strategic moves at its OneCon 2025 conference, unveiling a range of AI-focused security products and services. The rollouts target automation, cloud security, and generative AI defense, all in direct response to rapidly evolving enterprise needs.

See our latest analysis for SentinelOne.

Over the past year, SentinelOne’s total shareholder return has slipped by 37.8% as broader market anxiety and bouts of profit-taking have weighed on high-growth tech names, especially after last year’s AI-driven rally. Still, the company’s momentum has perked up more recently, buoyed by its headline-making AWS partnership and a steady rollout of new AI-powered offerings. This suggests investors are hunting for signs of a turnaround that could unlock longer-term growth potential.

If SentinelOne’s new AI launches have you curious about where innovation might spark the next big move, consider discovering See the full list for free.

With all the recent innovation and partnerships, does SentinelOne’s current share price reflect a bargain on future growth or has the market already factored in its AI-driven strategy? Could there still be a real buying opportunity here?

Most Popular Narrative: 28% Undervalued

SentinelOne’s most widely followed narrative suggests the security innovator’s fair value sits well above its last close of $16.92, indicating that the market may not fully appreciate its growth plans just yet.

SentinelOne's robust innovation in AI-driven, autonomous security, highlighted by substantial enterprise adoption of Purple AI and the AI-native SIEM platform, strongly positions the company to capture growing budgets as cyber threats become more sophisticated. This is likely to drive sustained revenue growth and improve gross margins as their differentiated offerings enable premium pricing.

Want to peek under the hood of this bullish view? The real secret behind the headline is a set of projections built around rapid international expansion, bold margin assumptions, and a future profit profile that rivals industry standouts. If you’re wondering what data powers this aggressive future, the full narrative holds the answers.

Result: Fair Value of $23.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on large partners and economic uncertainty could disrupt revenue growth. This could potentially challenge SentinelOne's upbeat longer-term outlook.

Find out about the key risks to this SentinelOne narrative.

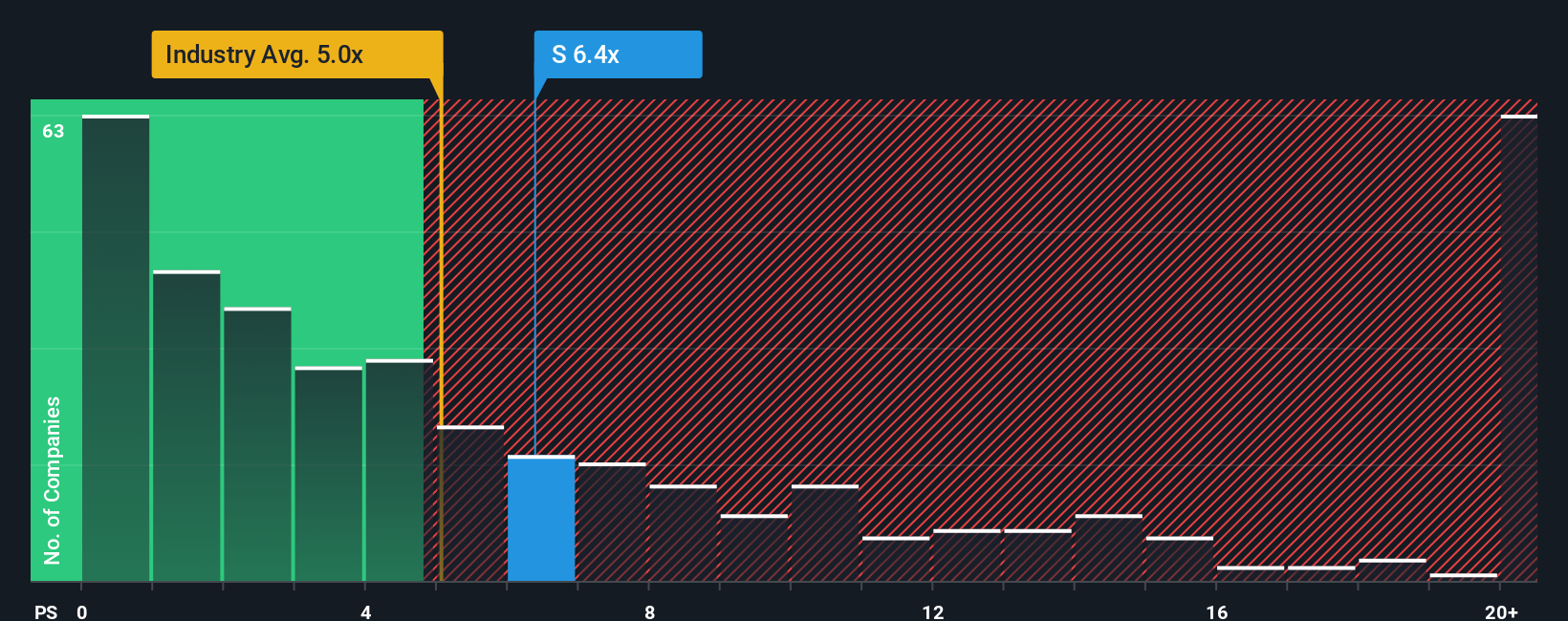

Another View: Market Comparisons May Tell a Different Story

Looking at SentinelOne’s valuation through a sales-based multiple paints a more cautious picture. The company trades at a price-to-sales ratio of 6.2x, higher than the US Software industry average of 4.8x, yet it is under the peer average of 9x. The fair ratio, calculated to be 6.9x, suggests the current valuation could still have room to run, but it also leaves little margin for error. Is this premium pricing a sign of future leadership, or are investors paying up for ambition that is not yet realized?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SentinelOne Narrative

If you see things differently, or want to dig into the numbers yourself, you can build your own perspective in under three minutes. Do it your way

A great starting point for your SentinelOne research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don't let the best opportunities slip through your fingers. Use the Simply Wall Street Screener today and set yourself up for sharper, more strategic investing.

- Tap into tomorrow’s breakthroughs by checking out these 25 AI penny stocks, which are making waves in artificial intelligence and automation technology.

- Power up your portfolio with steady cash flow by exploring these 16 dividend stocks with yields > 3%, which offer attractive yields above 3%.

- Seize value opportunities and spot potential bargains among these 884 undervalued stocks based on cash flows, selected for their strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:S

SentinelOne

Operates as a cybersecurity provider in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives