- United States

- /

- Software

- /

- NYSE:NOW

ServiceNow (NYSE:NOW) jumps 4.1% this week, though earnings growth is still tracking behind five-year shareholder returns

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. Long term ServiceNow, Inc. (NYSE:NOW) shareholders would be well aware of this, since the stock is up 239% in five years. Also pleasing for shareholders was the 20% gain in the last three months.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for ServiceNow

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

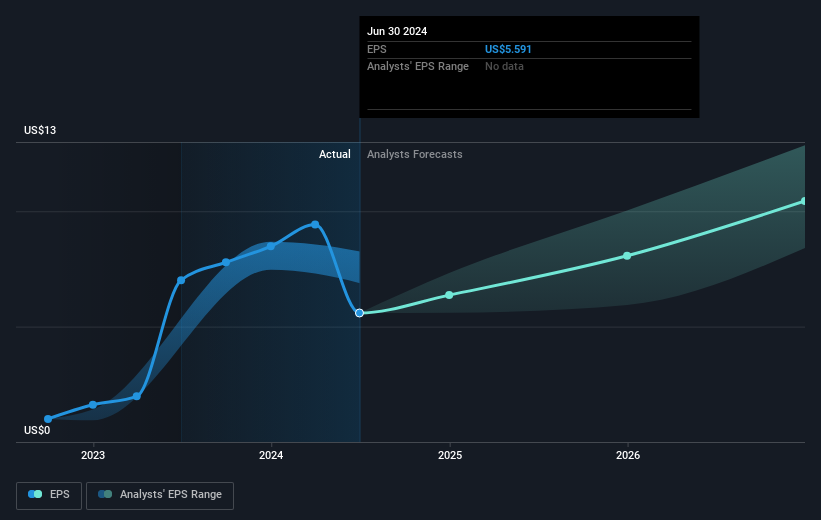

During five years of share price growth, ServiceNow achieved compound earnings per share (EPS) growth of 225% per year. This EPS growth is higher than the 28% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. Having said that, the market is still optimistic, given the P/E ratio of 164.84.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how ServiceNow has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at ServiceNow's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that ServiceNow shareholders have received a total shareholder return of 64% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 28% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with ServiceNow , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NOW

ServiceNow

Provides end to-end intelligent workflow automation platform solutions for digital businesses in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with high growth potential.