- United States

- /

- Software

- /

- NYSE:IOT

Samsara (IOT): Exploring Valuation After Strategic Partnership With Allianz UK for Fleet Safety Solutions

Reviewed by Simply Wall St

Samsara (IOT) just announced a strategic partnership with Allianz UK, giving Allianz’s fleet insurance clients special access and discounts on Samsara’s AI-powered safety technology. This collaboration could help expand Samsara’s reach within the UK’s commercial fleet sector.

See our latest analysis for Samsara.

Samsara’s recent partnership news comes as its share price has bounced around this year, with a 1-day gain of 1.9% but still down 11.7% year-to-date. While the latest deal hints at renewed commercial momentum, the 1-year total shareholder return remains deep in negative territory at -26%. However, longer-term investors are still well ahead, with a standout 3-year total return above 280%. This is a sign that early believers have been rewarded even as near-term sentiment wavers.

If Samsara’s evolving story interests you, this could be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

Given this recent partnership boost and a share price still down for the year, is Samsara offering an attractive entry point for investors, or is the market already factoring in all the future growth potential?

Most Popular Narrative: 19.4% Undervalued

Samsara’s most widely followed narrative indicates the fair value sits notably above its last close of $38.83, hinting at strong embedded growth expectations that set it apart from peers. The narrative draws on forward-looking revenue expansion, major enterprise wins, and accelerating platform adoption as major supports for this valuation.

Samsara is experiencing strong growth in annual recurring revenue (ARR), evidenced by a 32% year-over-year increase. This growth is primarily driven by their success in landing large enterprise customers, indicating future revenue expansion opportunities with existing clients. Impact: Revenue growth.

Want to know what projections are fueling this double-digit upside? The most popular narrative bets on explosive recurring revenue and big profit swings most investors aren’t expecting. Curious about the numbers supporting this bold fair value? Dive in to uncover the key assumptions and surprises.

Result: Fair Value of $48.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, with long enterprise sales cycles and uncertainty around commercializing new AI products, Samsara’s ambitious growth assumptions still face meaningful and real-world challenges.

Find out about the key risks to this Samsara narrative.

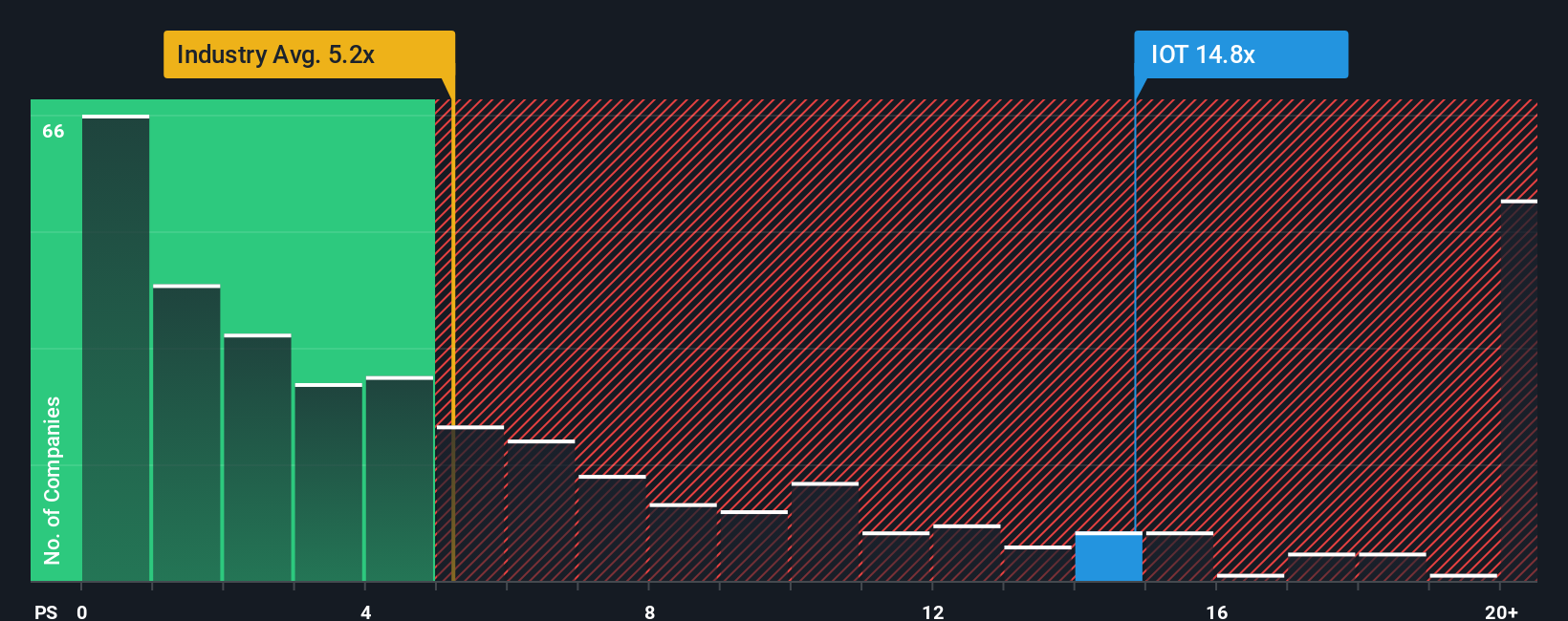

Another View: Multiples Tell a Different Story

While the consensus narrative highlights Samsara’s potential, a look at its price-to-sales ratio brings things back to earth. Samsara trades at 15.6 times sales, much higher than the US Software industry’s average of 4.8 times and also above the peer group average of 8.3 times. The fair ratio is estimated at 11.4 times.

This wide gap suggests investors are already pricing in significant optimism. Could the excitement outpace near-term reality, or will growth catch up and justify today’s premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Samsara Narrative

If you see things differently or want to dig into the data yourself, you can quickly craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Samsara research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your chance to uncover your next top stock. Simply Wall Street’s powerful tools make it easy to find standout growth, value, and future trends.

- Seize opportunities in tomorrow’s healthcare with these 32 healthcare AI stocks, featuring companies harnessing AI to transform diagnostics, treatment, and patient care.

- Tap into lasting income streams with these 16 dividend stocks with yields > 3%, built for investors seeking stocks offering robust dividend yields and stable returns.

- Accelerate your search for hidden market gems by reviewing these 883 undervalued stocks based on cash flows, packed with businesses trading beneath their intrinsic value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives