- United States

- /

- IT

- /

- NYSE:GDDY

Is There Now an Opportunity in GoDaddy After This Year’s 32% Share Price Drop?

Reviewed by Bailey Pemberton

- Thinking about whether GoDaddy is a bargain right now? Let's break down the story behind the stock's price and what its valuation might mean for you.

- The stock has bounced 3.3% this week and holds steady for the month, but with a year-to-date drop of 32% and a 1-year slide of 19.4%, investors are watching closely for signs of a turnaround or shifting risk appetite.

- GoDaddy's price swings have been set against a backdrop of industry shifts and evolving competition, as the company continues pushing into digital business tools and investing in new partnerships. Recent headlines highlight both the challenges and the opportunities in the domain and web services sector, making those price moves especially noteworthy for investors.

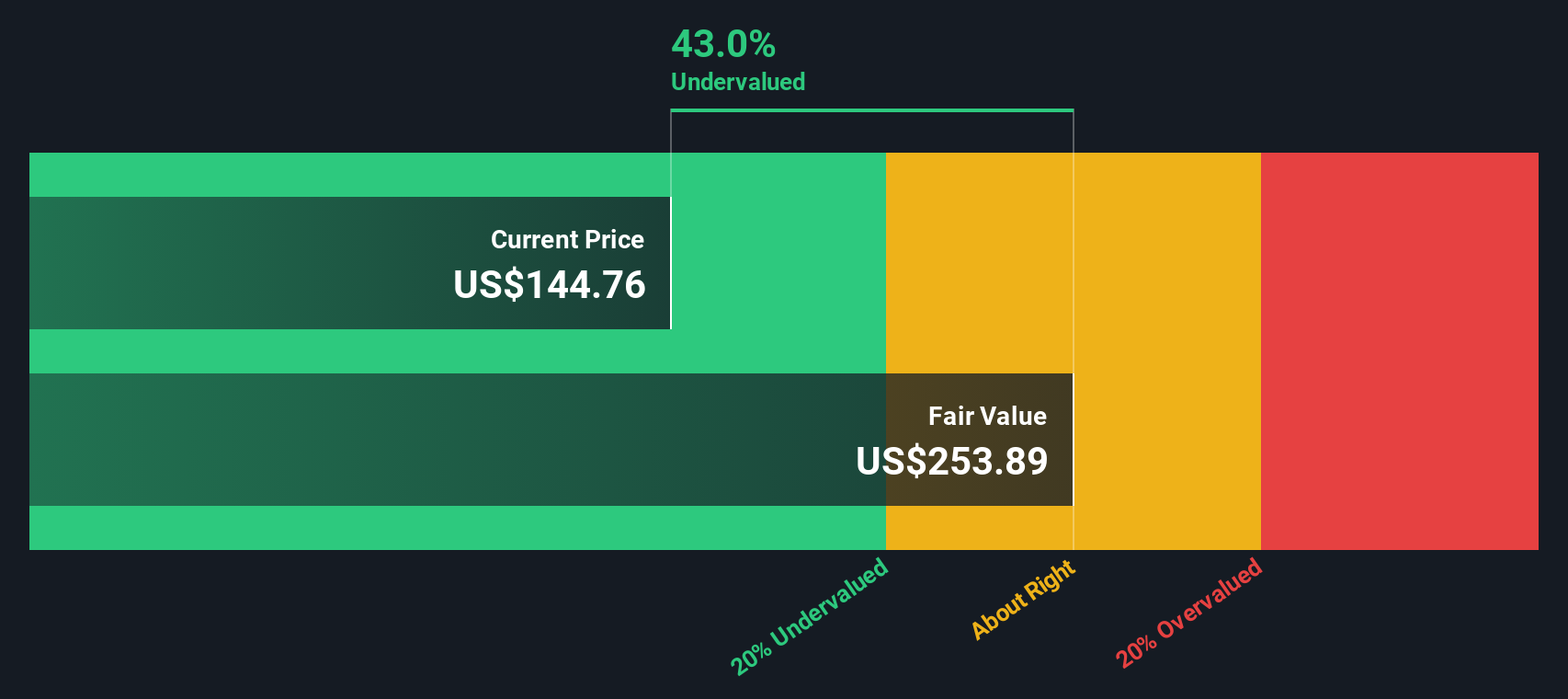

- On our latest checklist of value factors, GoDaddy earns a 5 out of 6 for being undervalued. This is an impressive result that is worth unpacking. Ahead, we will look at the various ways to judge what GoDaddy is really worth, and toward the end, reveal a deeper approach to finding the right valuation method for you.

Find out why GoDaddy's -19.4% return over the last year is lagging behind its peers.

Approach 1: GoDaddy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and bringing them back to today's value. It is a popular tool among investors because it helps anchor the stock price in what GoDaddy is expected to actually generate in cash over time.

For GoDaddy, the latest-twelve-month Free Cash Flow stands at $1.52 billion, and analysts expect this figure to grow over the coming years. Projections, using a 2 Stage Free Cash Flow to Equity model, stretch out to 2029, targeting a future FCF of around $2.3 billion. Importantly, while analysts provide estimates for up to five years, the following years' figures are extrapolated beyond 2029 to map out a longer-term trajectory.

According to this DCF model, GoDaddy's fair value is calculated at $254.73 per share. That is a compelling 46.9% discount to its current market price, suggesting the stock may be meaningfully undervalued based on these forward-looking cash flow estimates.

This large intrinsic discount points to substantial upside, provided expectations hold and the company executes on its growth strategy.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GoDaddy is undervalued by 46.9%. Track this in your watchlist or portfolio, or discover 844 more undervalued stocks based on cash flows.

Approach 2: GoDaddy Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular and effective way to value profitable companies like GoDaddy because it directly relates a company's market value to its current earnings. Investors often use the PE ratio to quickly gauge whether a stock is expensive or cheap relative to its earnings power, making it a go-to metric for many stock pickers.

Of course, what counts as a “normal” or “fair” PE ratio depends on several things. Companies with higher expected growth, better profitability, or lower risk tend to justify higher PE multiples, while slower-growing or riskier companies may trade at a discount to the sector.

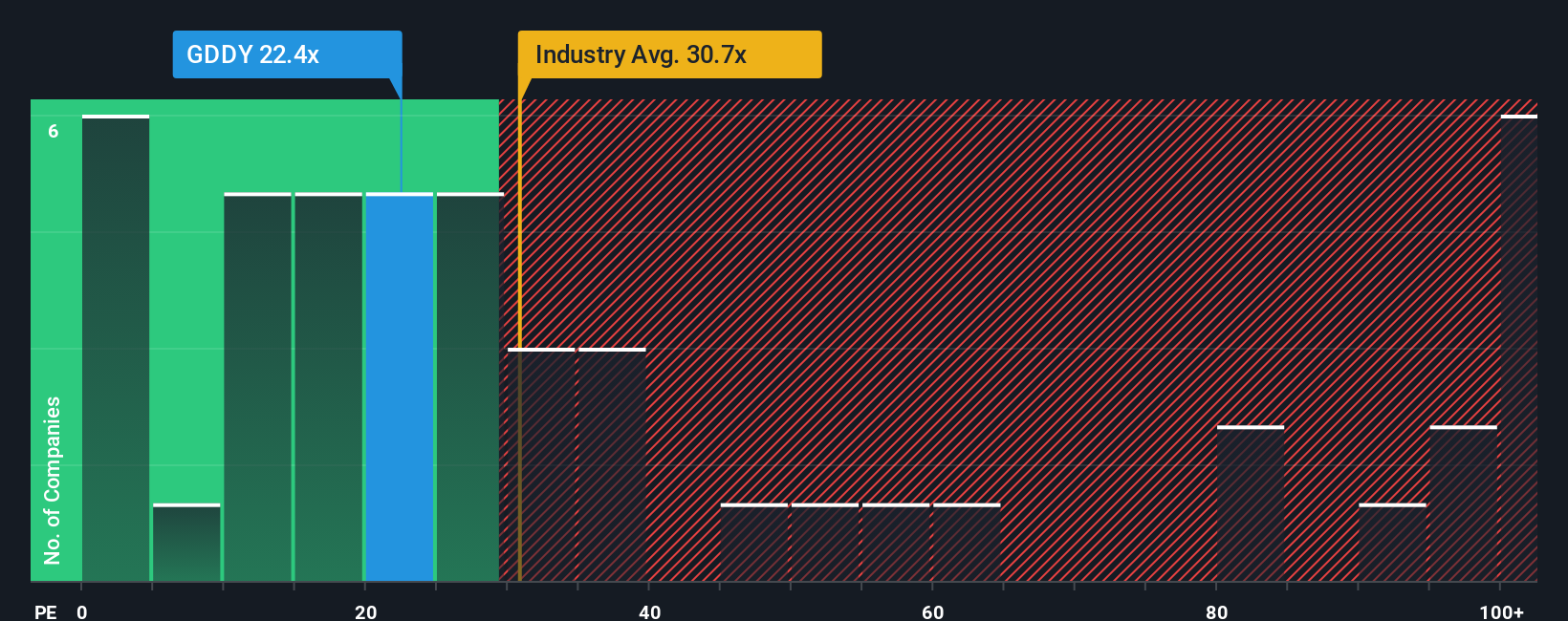

GoDaddy is currently trading at a PE ratio of 22x. That is noticeably below both the IT industry average of 29.6x and the peer group average of 78.3x. At first glance, this might make GoDaddy seem attractively priced relative to its competition.

However, benchmarking against industry or peers alone can be misleading. It does not account for company-specific drivers like growth rates, market capitalization or margin profile. That's where Simply Wall St's proprietary “Fair Ratio” comes in. The Fair Ratio for GoDaddy currently stands at 34.4x, reflecting these nuanced factors all at once, including company growth, profit margins, market cap and sector-specific risks. This approach offers a more balanced and robust benchmark than a simple industry average.

Comparing GoDaddy's actual PE ratio of 22x to its Fair Ratio of 34.4x shows a significant discount, suggesting the stock is undervalued based on these comprehensive inputs.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GoDaddy Narrative

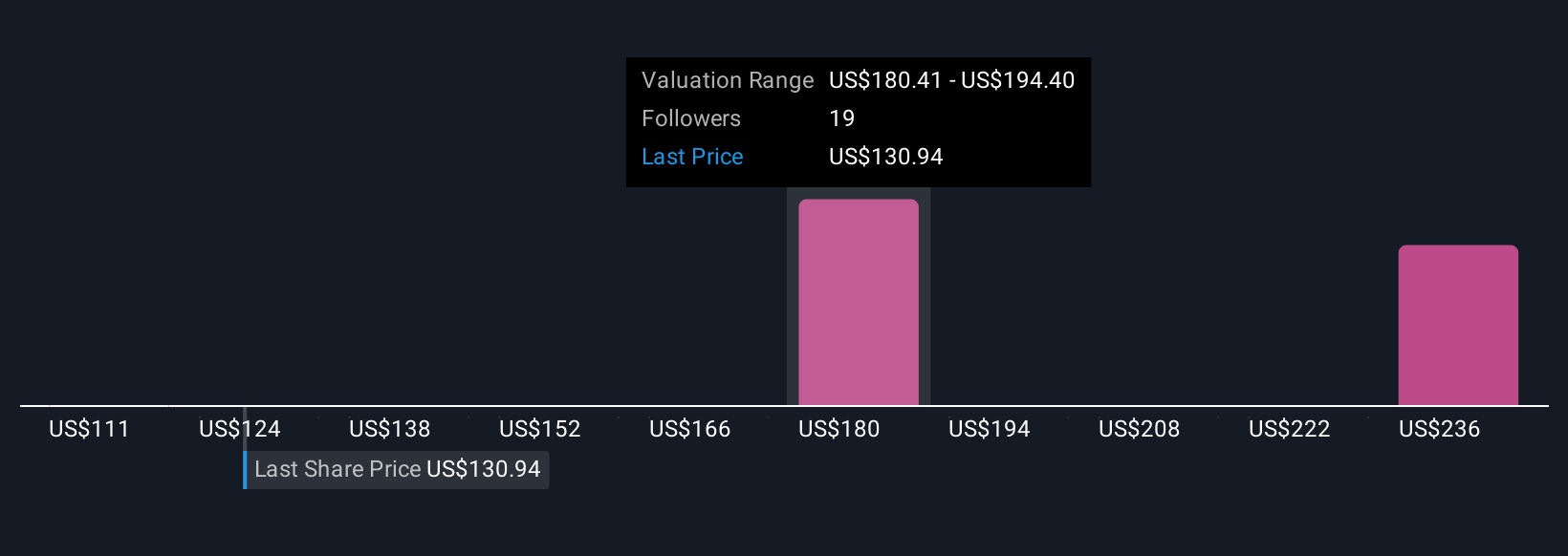

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply your personal story for a company, the way you connect GoDaddy’s business outlook, industry trends, and risks to your own estimates for things like Fair Value, future revenue, and profit margins. Narratives bridge the gap between financial forecasts and the real-world stories investors believe in, making it easier to justify your investment decisions.

Narratives are available to everyone on Simply Wall St’s Community page. Millions of investors use them to simplify and strengthen their research. With a Narrative, you can clarify why you think GoDaddy is undervalued or overvalued by linking your assumptions to your fair value calculation, and then quickly compare those results to the stock’s current price to decide whether it’s time to buy, sell, or hold.

Whenever major news, earnings, or industry developments happen, Narratives update quickly so your perspective stays current. For example, some investors currently see GoDaddy’s fair value as high as $250 per share, reflecting optimism about AI expansion and ecosystem growth. Others are more conservative, targeting just $150 due to competitive and execution risks. Narratives make these viewpoints transparent, dynamic, and actionable for smarter investing.

Do you think there's more to the story for GoDaddy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GDDY

GoDaddy

Engages in the design and development of cloud-based products in the United States and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives