Stock Analysis

- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

I Built A List Of Growing Companies And FLEETCOR Technologies (NYSE:FLT) Made The Cut

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like FLEETCOR Technologies (NYSE:FLT). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for FLEETCOR Technologies

How Fast Is FLEETCOR Technologies Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. It certainly is nice to see that FLEETCOR Technologies has managed to grow EPS by 28% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

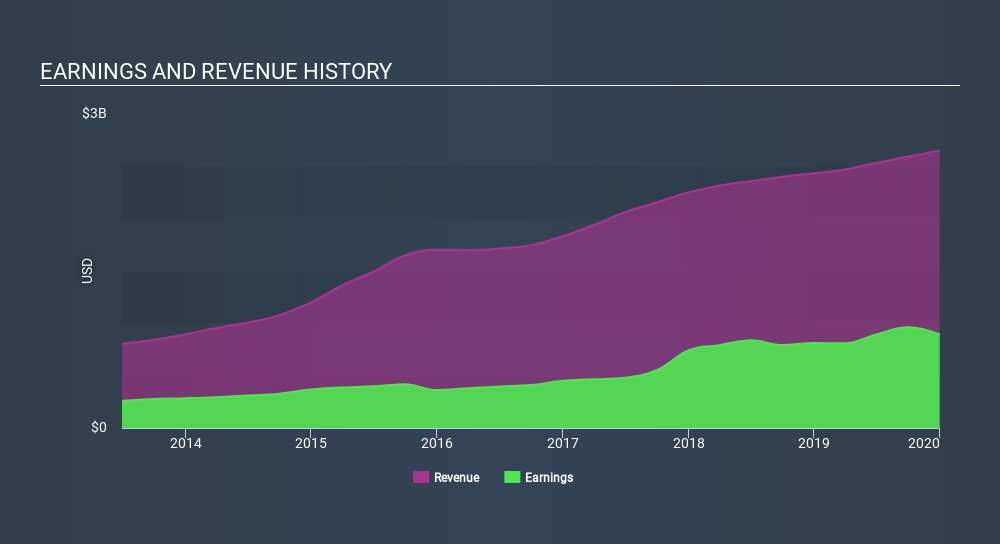

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. FLEETCOR Technologies shareholders can take confidence from the fact that EBIT margins are up from 45% to 49%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of FLEETCOR Technologies's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are FLEETCOR Technologies Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$21b company like FLEETCOR Technologies. But we do take comfort from the fact that they are investors in the company. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$371m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like FLEETCOR Technologies, with market caps over US$8.0b, is about US$12m.

FLEETCOR Technologies offered total compensation worth US$7.8m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add FLEETCOR Technologies To Your Watchlist?

For growth investors like me, FLEETCOR Technologies's raw rate of earnings growth is a beacon in the night. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. This may only be a fast rundown, but the takeaway for me is that FLEETCOR Technologies is worth keeping an eye on. It is worth noting though that we have found 2 warning signs for FLEETCOR Technologies that you need to take into consideration.

Although FLEETCOR Technologies certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

Proven track record with adequate balance sheet.