- United States

- /

- IT

- /

- NYSE:EPAM

Will EPAM’s (EPAM) New AI Consulting Playbook Transform Its Enterprise Growth Narrative?

Reviewed by Sasha Jovanovic

- EPAM Systems recently announced the launch of AI/Run™. Transform Playbook, a comprehensive framework designed to accelerate enterprise-wide AI transformation by integrating strategic consulting, engineering, and proprietary tools for clients.

- This initiative signals EPAM’s intent to position itself as a key enabler for organizations aiming to transition into fully AI-native enterprises, using unified methodologies and specialized talent to generate new revenue streams.

- Now, we'll explore how the introduction of a unified AI consulting playbook could reshape EPAM’s investment narrative and future growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

EPAM Systems Investment Narrative Recap

To consider being a shareholder in EPAM Systems, you need to believe the company can successfully transition from traditional IT services to becoming an essential partner in large-scale, enterprise AI transformation, despite ongoing competition and pressure on operating margins. The launch of the AI/Run™. Transform Playbook strengthens EPAM’s bid to capitalize on clients’ rapid AI adoption, addressing the most important near-term catalyst, but it does not materially resolve the underlying risk that widespread use of generative AI tools may lessen demand for EPAM’s bespoke consulting and engineering services.

Among recent announcements, EPAM’s rollout of the DIAL 3.0 GenAI orchestration platform earlier this year is particularly relevant, underlining the company’s ongoing effort to integrate AI into every layer of client engagement. Together, the DIAL initiative and the new AI/Run Playbook put EPAM in a position to win business from organizations seeking end-to-end, AI-native solutions, the same market where technology commoditization could erode traditional revenue streams over time.

By contrast, even as innovation accelerates, investors should be aware of the risk that…

Read the full narrative on EPAM Systems (it's free!)

EPAM Systems' outlook projects $6.5 billion in revenue and $582.4 million in earnings by 2028. This requires 8.8% annual revenue growth and a $181.2 million increase in earnings from the current $401.2 million.

Uncover how EPAM Systems' forecasts yield a $202.06 fair value, a 28% upside to its current price.

Exploring Other Perspectives

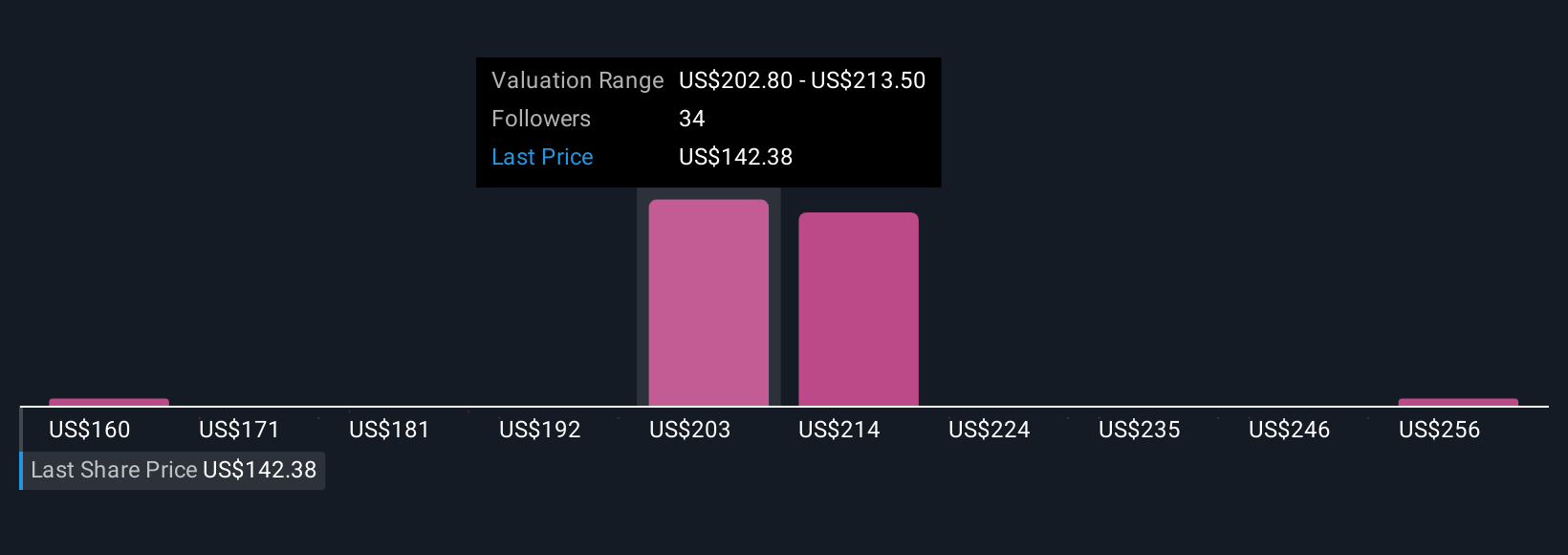

Simply Wall St Community members shared 9 fair value estimates on EPAM, ranging from US$160 to US$267 per share. Many are divided on future potential, particularly as rapid generative AI adoption could challenge EPAM's historical business model and growth prospects.

Explore 9 other fair value estimates on EPAM Systems - why the stock might be worth as much as 69% more than the current price!

Build Your Own EPAM Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EPAM Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EPAM Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EPAM Systems' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EPAM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPAM

EPAM Systems

Provides digital platform engineering and software development services worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives