- United States

- /

- IT

- /

- NYSE:DXC

Does DXC (DXC) Winning the UK Police Contract Reveal a Shift in Public Sector Strategy?

Reviewed by Sasha Jovanovic

- DXC Technology was selected by London's Mayor's Office for Policing and Crime as the Master Vendor to deliver BPO, ERP, and resource management solutions for the Metropolitan Police Service in the UK, with a 7+1+1 year contract aimed at driving internal transformation and digital modernization.

- The contract underlines DXC’s recognized leadership in digital transformation and AI services for public sector organizations, supported further by recent accolades from industry analysts such as ISG and IDC MarketScape.

- We'll explore how DXC’s major win with the UK Metropolitan Police Service could impact its investment narrative and future prospects.

Find companies with promising cash flow potential yet trading below their fair value.

DXC Technology Investment Narrative Recap

To own shares of DXC Technology, I think you would need to believe the company’s turnaround efforts, including securing large digital transformation deals, can stabilize revenue while overcoming competitive and industry headwinds. The Metropolitan Police contract is a visible catalyst, but with ongoing declines in core revenue and tough industry trends, its impact on near-term performance does not appear material enough to shift the main risk: continued top-line contraction remains the critical factor to watch.

Among recent announcements, DXC’s recognition as a Leader in AI services by IDC MarketScape stands out because it complements their UK public sector win, showing progress in repositioning towards higher-value digital and AI opportunities. This kind of validation is important to supporting DXC’s investment case, especially as investors wait for bookings strength to translate into actual revenue growth and margin improvement.

However, investors should be mindful that despite visible contract wins, DXC’s largest revenue segment is still shrinking…

Read the full narrative on DXC Technology (it's free!)

DXC Technology's narrative projects $12.1 billion revenue and $208.6 million earnings by 2028. This requires a 1.7% annual revenue decline and a $170.4 million decrease in earnings from $379.0 million currently.

Uncover how DXC Technology's forecasts yield a $14.50 fair value, a 19% upside to its current price.

Exploring Other Perspectives

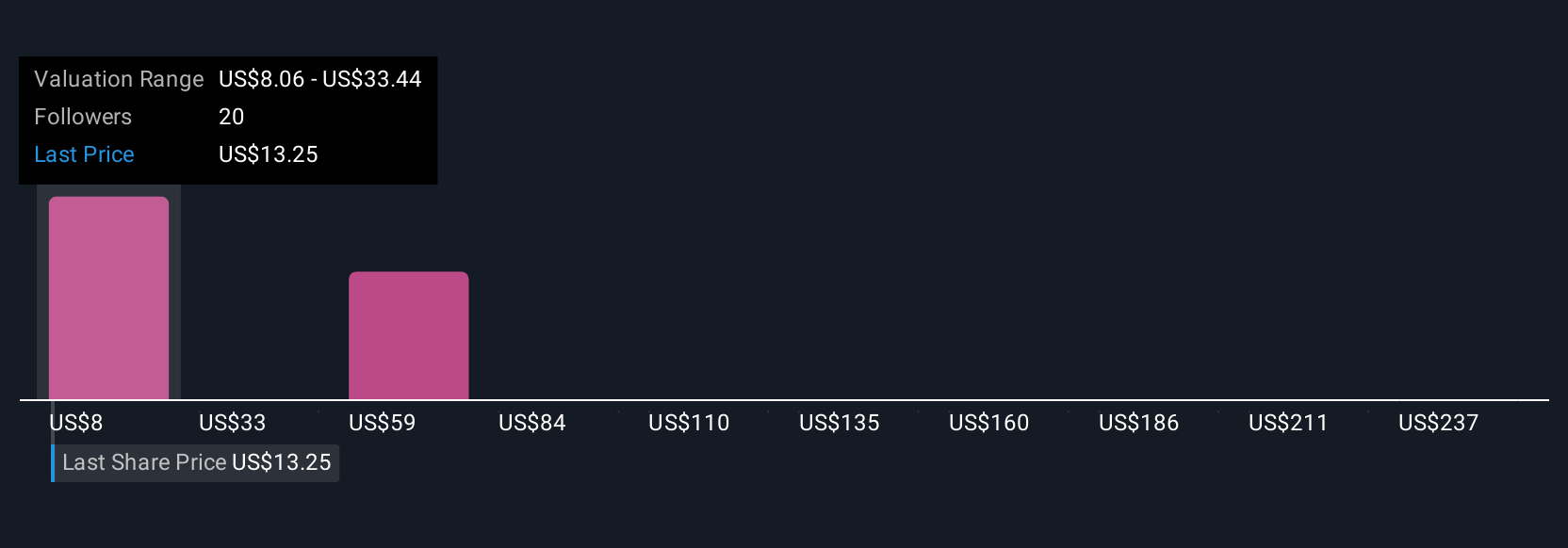

Six Simply Wall St Community members provided fair value estimates for DXC ranging from US$8.06 to US$261.89, reflecting broad disagreement on potential upside. While some see opportunity, the persistent decline in organic revenue highlights why future expectations can vary so widely.

Explore 6 other fair value estimates on DXC Technology - why the stock might be worth 34% less than the current price!

Build Your Own DXC Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DXC Technology research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DXC Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DXC Technology's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DXC

DXC Technology

Provides information technology services and solutions in the United States, the United Kingdom, the rest of Europe, Australia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives