- United States

- /

- IT

- /

- NYSE:DOCN

DigitalOcean (DOCN): Is the Cloud Challenger Undervalued After Recent Share Price Gains?

Reviewed by Simply Wall St

DigitalOcean Holdings (DOCN) has seen its stock post a 14% gain over the past month, building on an impressive performance since the start of the year. Investors are paying close attention to these returns as the company’s fundamentals evolve.

See our latest analysis for DigitalOcean Holdings.

DigitalOcean Holdings has seen strong momentum build throughout 2024, reflected in its 1-month share price return of 13.81% and a robust 90-day gain of 38.75%. This consistent upward trend has helped propel the company’s total shareholder return to nearly 16% over the last year and more than 63% over the past three years. These figures point to growing optimism around its growth potential and fundamentals.

If you’re curious what other fast-moving opportunities are out there, now’s the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares currently trading below analyst price targets and ambitious growth expectations in play, the big question for investors is whether DigitalOcean remains undervalued or if the market has already factored in its future potential.

Most Popular Narrative: 15.8% Undervalued

DigitalOcean's most popular narrative estimates a fair value significantly above its last closing price, suggesting investor expectations are running ahead of where the market currently sits.

Accelerating adoption among digital native enterprises and AI-native customers, coupled with robust product innovation (over 60 new products/features released in the quarter and strong uptake of recent releases by top customers), is expanding DigitalOcean's addressable market and driving higher incremental annual recurring revenue. This is impacting future top-line revenue and customer retention.

Want to discover the bold thinking behind this valuation? The calculation centers on dynamic revenue expansion, transformative product rollouts, and ambitious forecasts that challenge conventional wisdom. Dive in to see what assumptions power this bullish narrative.

Result: Fair Value of $53.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the rapid rise of hyperscale cloud competitors and potential challenges in scaling new AI offerings could temper DigitalOcean’s strong growth outlook.

Find out about the key risks to this DigitalOcean Holdings narrative.

Another View: What Do Multiples Say?

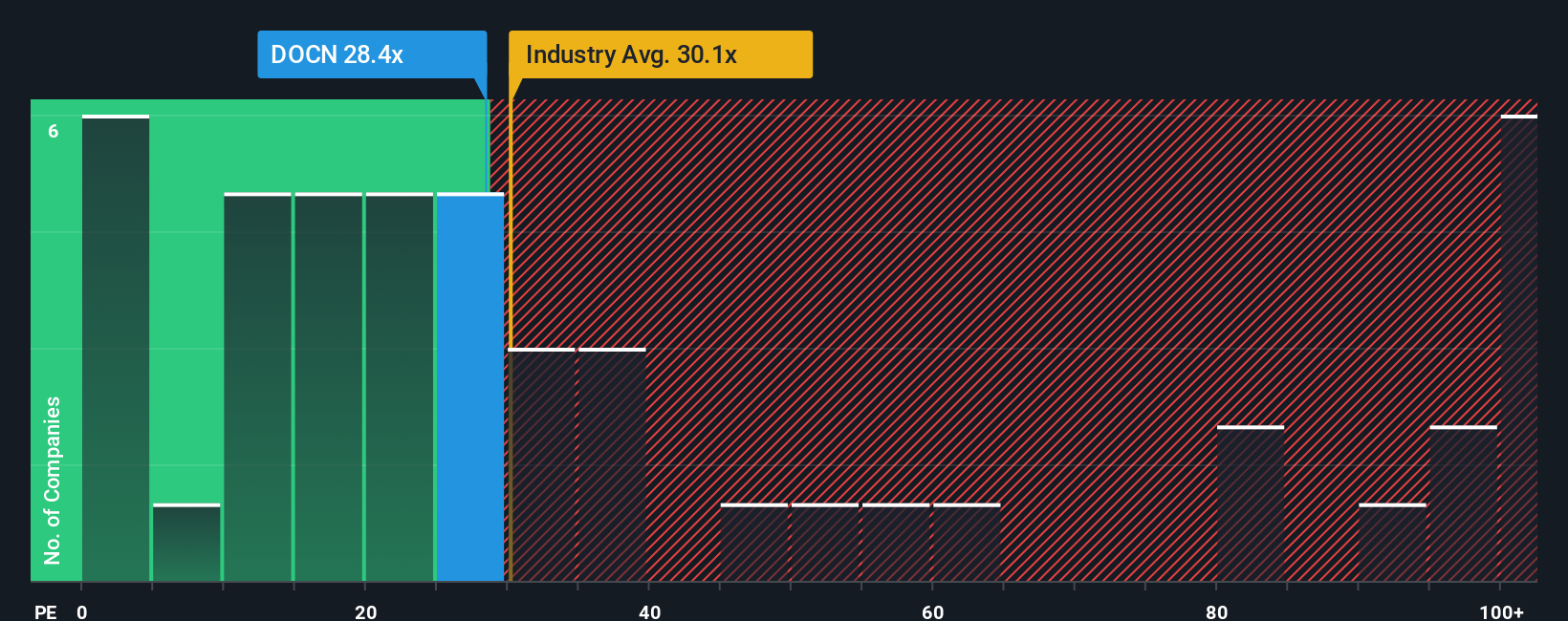

Looking through the lens of the company's price-to-earnings ratio, DigitalOcean stands at 16.3x, which is notably cheaper than both the US IT industry at 27.9x and its peer average of 47.4x. This gap suggests the stock could present a value opportunity if market sentiment shifts toward industry norms, but it also raises the question of why investors are discounting its earnings today. Will the market bridge the divide, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DigitalOcean Holdings Narrative

If you want a different perspective or enjoy diving into your own analysis, you can craft your own narrative with just a few clicks. Do it your way.

A great starting point for your DigitalOcean Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors don’t wait on the sidelines. Step up your game and tap into fresh, actionable stock ideas before everyone else does.

- Capture hidden value by targeting leading companies flagged as discounted through these 933 undervalued stocks based on cash flows, and seize opportunities others may overlook.

- Ride the wave of health technology advancements and supercharge your portfolio with trailblazers excelling in medical AI. Get started easily using these 30 healthcare AI stocks.

- Maximize income potential by screening for stocks delivering yields above 3 percent with these 14 dividend stocks with yields > 3%, and put your capital to work efficiently.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success