- United States

- /

- IT

- /

- NYSE:DOCN

DigitalOcean (DOCN): Exploring Valuation as Market Sentiment Shifts Toward Short- and Mid-Term Strategies

Reviewed by Kshitija Bhandaru

Recent analysis points to a shift in market sentiment for DigitalOcean Holdings (DOCN), as institutional models now prefer short and mid-term trading strategies. This evolving outlook is attracting attention among both retail and professional investors.

See our latest analysis for DigitalOcean Holdings.

Fuelled by a shift in trading sentiment, DigitalOcean’s share price has rallied with a 14.2% return over the past month and a substantial 40.3% gain in the last 90 days. However, the total shareholder return over the past year is -4.4%. This shows that while recent momentum is building, long-term investors have yet to see sustained rewards.

If you’re keen to see which other tech stocks are making waves right now, it’s worth checking out See the full list for free..

With strong short and mid-term momentum, but a muted longer-term outlook, is DigitalOcean Holdings an undervalued opportunity for investors, or is the recent growth already reflected in its current share price?

Most Popular Narrative: 0.5% Undervalued

With the fair value placed almost exactly at the last close price, the narrative indicates DigitalOcean is fairly priced by current analyst logic, even as new product rollouts drive optimism.

Accelerating adoption among digital native enterprises and AI-native customers, coupled with robust product innovation (over 60 new products/features released in the quarter and strong uptake of recent releases by top customers), is expanding DigitalOcean's addressable market and driving higher incremental annual recurring revenue. This impacts future top-line revenue and customer retention.

Can you unravel the numbers powering this razor-thin valuation gap? The narrative rests on a set of bold growth assumptions for future sales and margins that point to a compelling story just beneath the surface. Find out what specific forecasts are making analysts so confident, even as there are some signals of slowing momentum.

Result: Fair Value of $41.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition from hyperscale providers and the risk of slower AI adoption could quickly erode DigitalOcean's growth momentum.

Find out about the key risks to this DigitalOcean Holdings narrative.

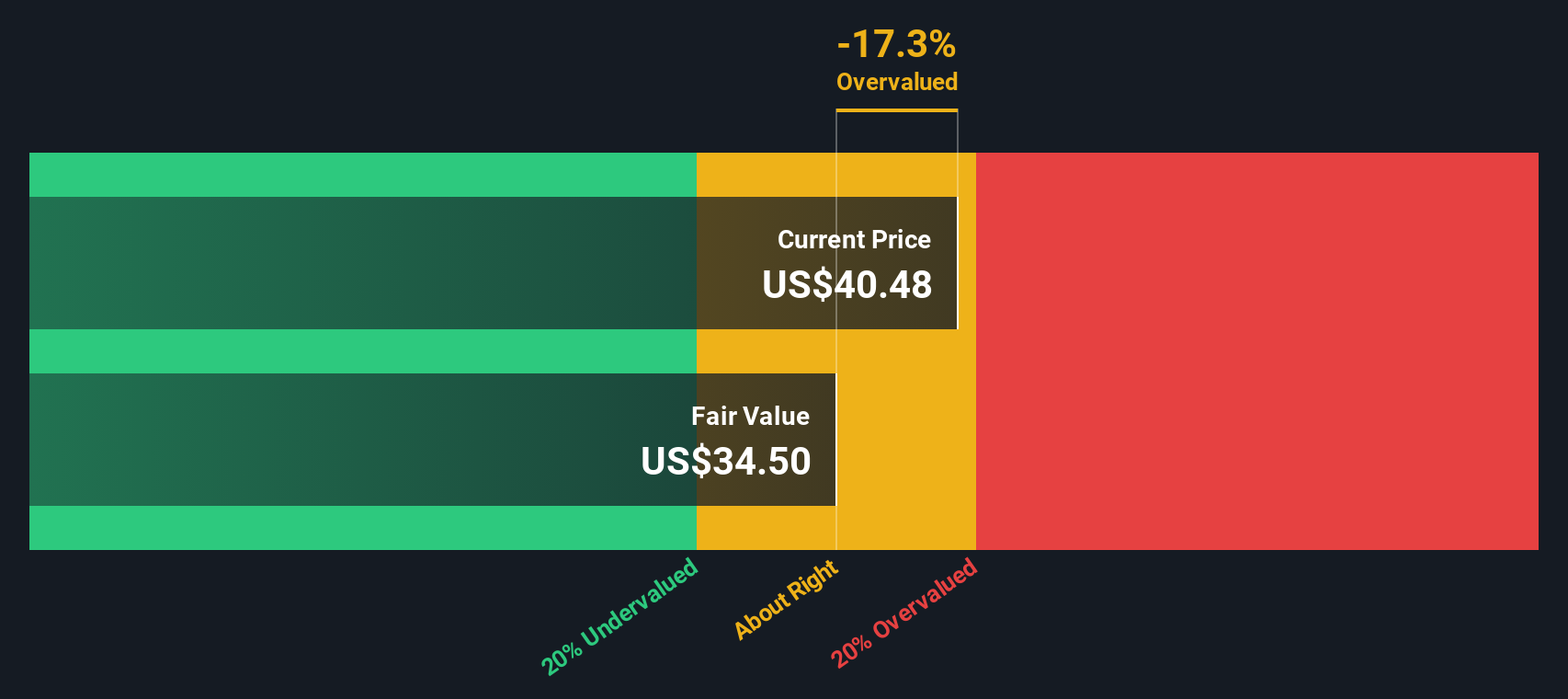

Another View: DCF Points to Caution

While current analyst narratives see DigitalOcean as fairly priced based on growth and peer multiples, our DCF model signals a different story. It places fair value lower than the present share price. This result suggests that optimism about future earnings might already be priced in. Are recent gains stretching the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DigitalOcean Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DigitalOcean Holdings Narrative

If you want to challenge these perspectives or prefer to dive into the data firsthand, you have the option to build your own narrative in just a few clicks. Do it your way.

A great starting point for your DigitalOcean Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want an edge in your next trade, don't miss top stocks and themes moving fast. These smartly screened picks can help you spot real opportunities now.

- Target higher yields and steady returns by tapping into these 18 dividend stocks with yields > 3% built for investors wanting solid dividend income with robust fundamentals.

- Stay ahead of the tech curve as you gain access to these 24 AI penny stocks showcasing companies pushing the boundaries in artificial intelligence innovation and growth.

- Capitalize on innovation in finance when you zero in on these 79 cryptocurrency and blockchain stocks. See which stocks are transforming the digital asset landscape right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives