- United States

- /

- IT

- /

- NYSE:DOCN

DigitalOcean (DOCN): Exploring Valuation After New AI Partnership With fal Expands Gradient Platform Capabilities

Reviewed by Simply Wall St

DigitalOcean Holdings (DOCN) has taken a step forward in the AI space by announcing an expanded partnership with fal to make advanced image and voice generation models available through its Gradient AI Platform. This move opens new possibilities for startups and enterprises using DigitalOcean’s cloud services.

See our latest analysis for DigitalOcean Holdings.

DigitalOcean’s deepening focus on AI has dovetailed with notable momentum in its share price. After surging over 50% in the last quarter, the 1-year total shareholder return is now nearly flat at -0.4%. While the long-term picture remains positive with a three-year total return of 33.2%, recent gains suggest renewed optimism around the company’s growth trajectory and expanding ecosystem.

If the latest AI partnership has you curious about what else is gaining steam, now’s a perfect moment to broaden your perspective and discover See the full list for free.

But with shares rebounding in recent months, investors may wonder if DigitalOcean’s next chapter of AI innovation is still undervalued or if the market is already pricing in much of its future potential growth.

Most Popular Narrative: 2% Undervalued

The narrative’s fair value of $41.60 sits just above DigitalOcean’s last close at $40.66, setting up a close debate on pricing and future prospects. A catalyst for optimism emerges from how the company is broadening its reach and strengthening its financials.

Material progress using direct sales, enhanced product-led growth motions, and strategic partnerships to both win multiyear, committed contracts and facilitate workload migrations from competitors provides higher visibility into future cash flows. This supports stronger future earnings predictability and improved free cash flow margins.

Want to know what’s fueling this valuation? The most popular narrative hinges on bold growth assumptions. Analysts bet on a leap in revenues, shrinking margins, and an earnings surge by 2028. Ready to unpack what’s driving this price target and what it means for DigitalOcean’s next chapter?

Result: Fair Value of $41.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growing competition from hyperscaler clouds and unpredictable shifts in AI demand could challenge DigitalOcean's ability to maintain its current growth momentum.

Find out about the key risks to this DigitalOcean Holdings narrative.

Another View: What About Our DCF Model?

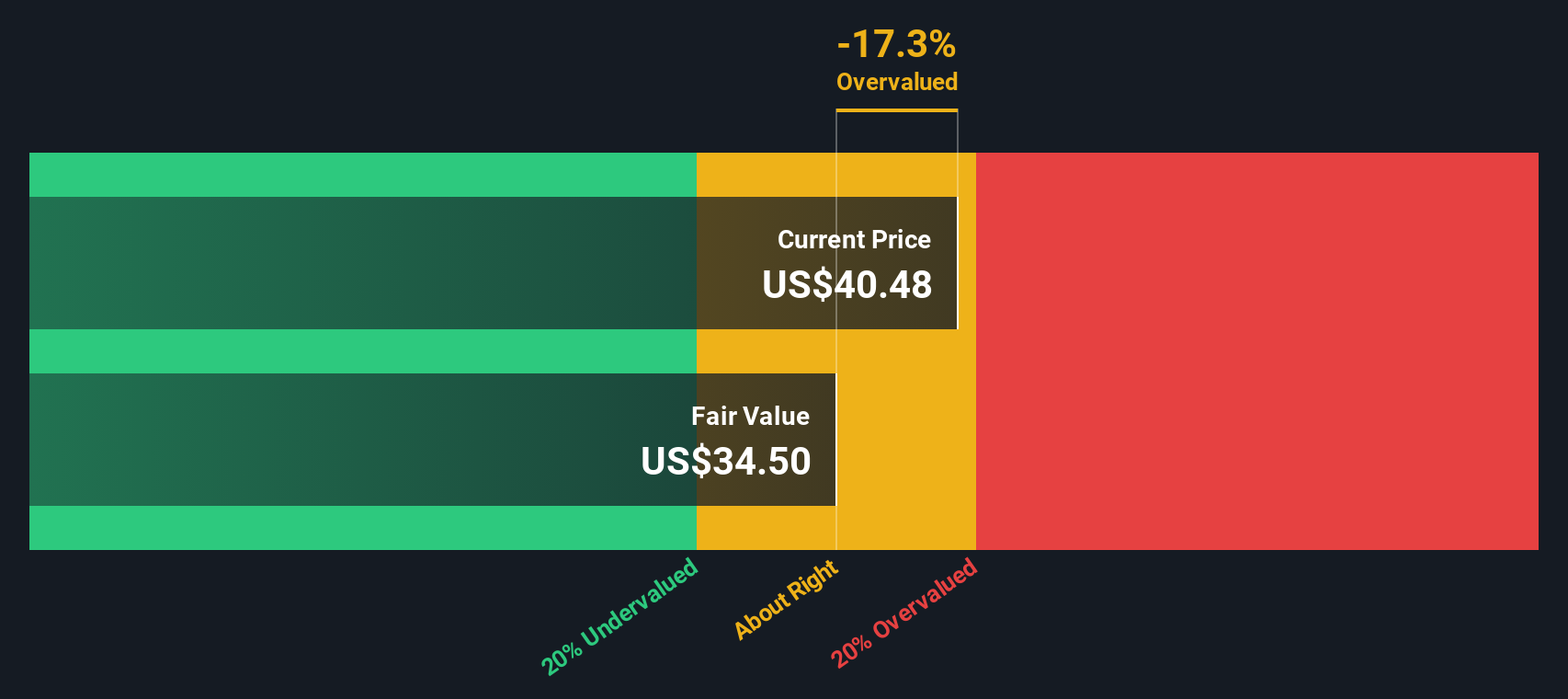

While the popular analyst narrative sees DigitalOcean as undervalued, our SWS DCF model provides a different angle. Based on projected future cash flows, it suggests shares might be trading above the estimate of fair value right now. Could this mean the optimism is a step ahead of fundamentals, or is the market just pricing in future potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DigitalOcean Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DigitalOcean Holdings Narrative

If this view isn’t quite your own or you’d rather dive into the data firsthand, you can put together your own take on DigitalOcean’s story in just a few minutes, and Do it your way.

A great starting point for your DigitalOcean Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors constantly scan for tomorrow’s winners. Don’t miss your chance to spot powerful trends early. There are remarkable opportunities that few are paying attention to right now.

- Uncover income potential as you tap into these 22 dividend stocks with yields > 3% offering strong yields and steady cash flows for stable growth in any market.

- Leap ahead of the curve by following these 27 AI penny stocks, shaping the future with advancements in intelligent automation and tech-powered disruption.

- Catch the next wave of technological change by exploring these 28 quantum computing stocks, at the forefront of quantum computing breakthroughs and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives