- United States

- /

- IT

- /

- NYSE:DAVA

High Growth Tech Stocks to Watch in September 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, though it has risen 20% in the past 12 months with earnings expected to grow by 15% per annum. In this environment, identifying high growth tech stocks that can capitalize on these favorable conditions is crucial for investors looking to maximize their returns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Super Micro Computer | 20.49% | 27.13% | ★★★★★★ |

| Ardelyx | 27.44% | 65.92% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ascendis Pharma | 39.71% | 68.43% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.81% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 248 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Endava (NYSE:DAVA)

Simply Wall St Growth Rating: ★★★★☆☆

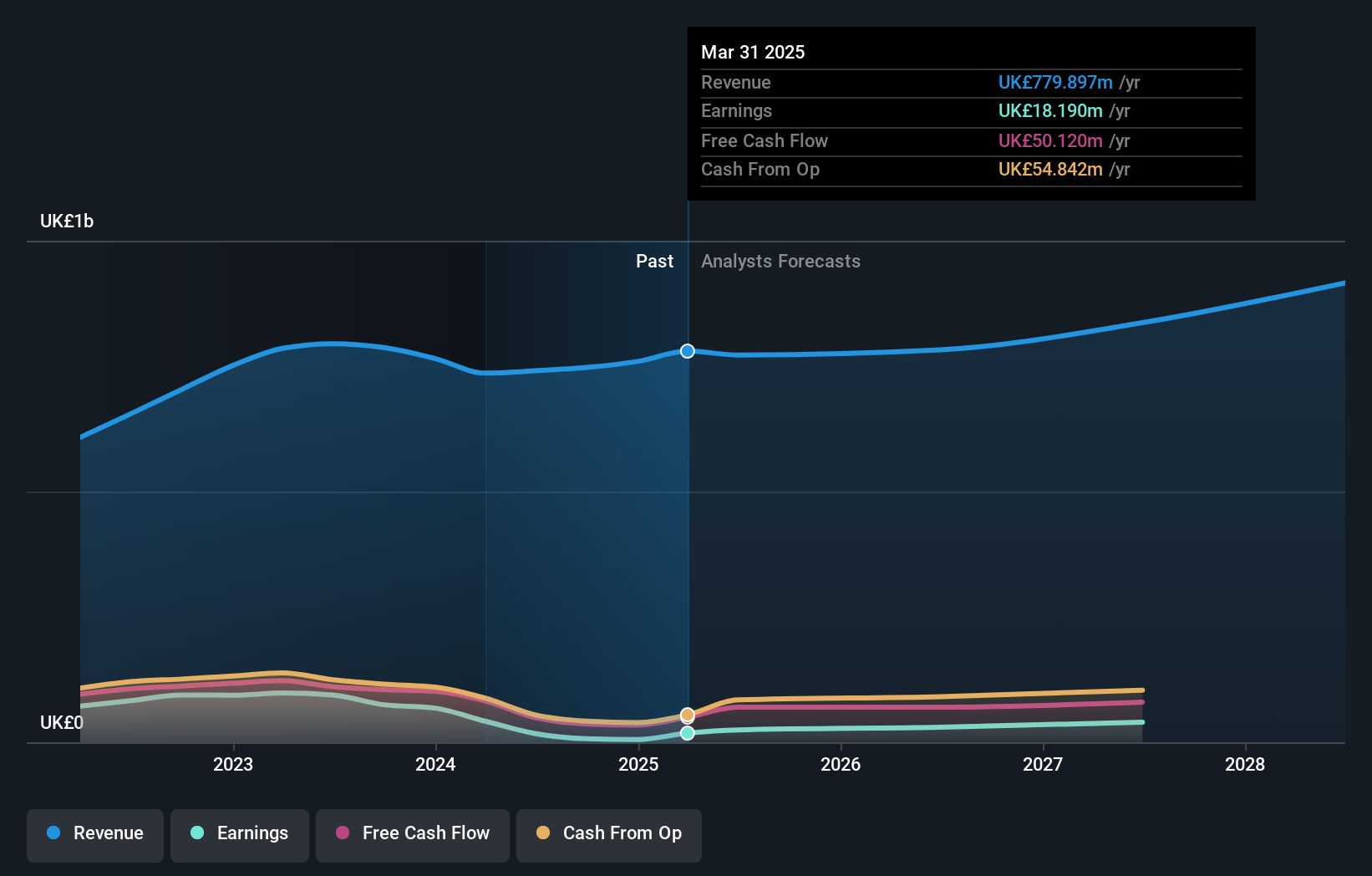

Overview: Endava plc offers technology services across various sectors including consumer products, healthcare, mobility, and retail in North America, Europe, the United Kingdom, and internationally with a market cap of approximately $1.77 billion.

Operations: Endava plc generates revenue primarily from computer services, amounting to £736.13 million. The company's market cap is approximately $1.77 billion.

Endava, a tech firm with notable growth prospects, is forecasted to see earnings rise by 35.8% annually over the next three years. Despite a recent 57.2% dip in earnings, its revenue is expected to grow at 11.9% per year, outpacing the US market's average of 8.6%. The company's R&D expenses underscore its commitment to innovation; last year's investment was significant compared to peers in the industry. However, ongoing legal issues may pose risks moving forward.

- Dive into the specifics of Endava here with our thorough health report.

Assess Endava's past performance with our detailed historical performance reports.

Semrush Holdings (NYSE:SEMR)

Simply Wall St Growth Rating: ★★★★☆☆

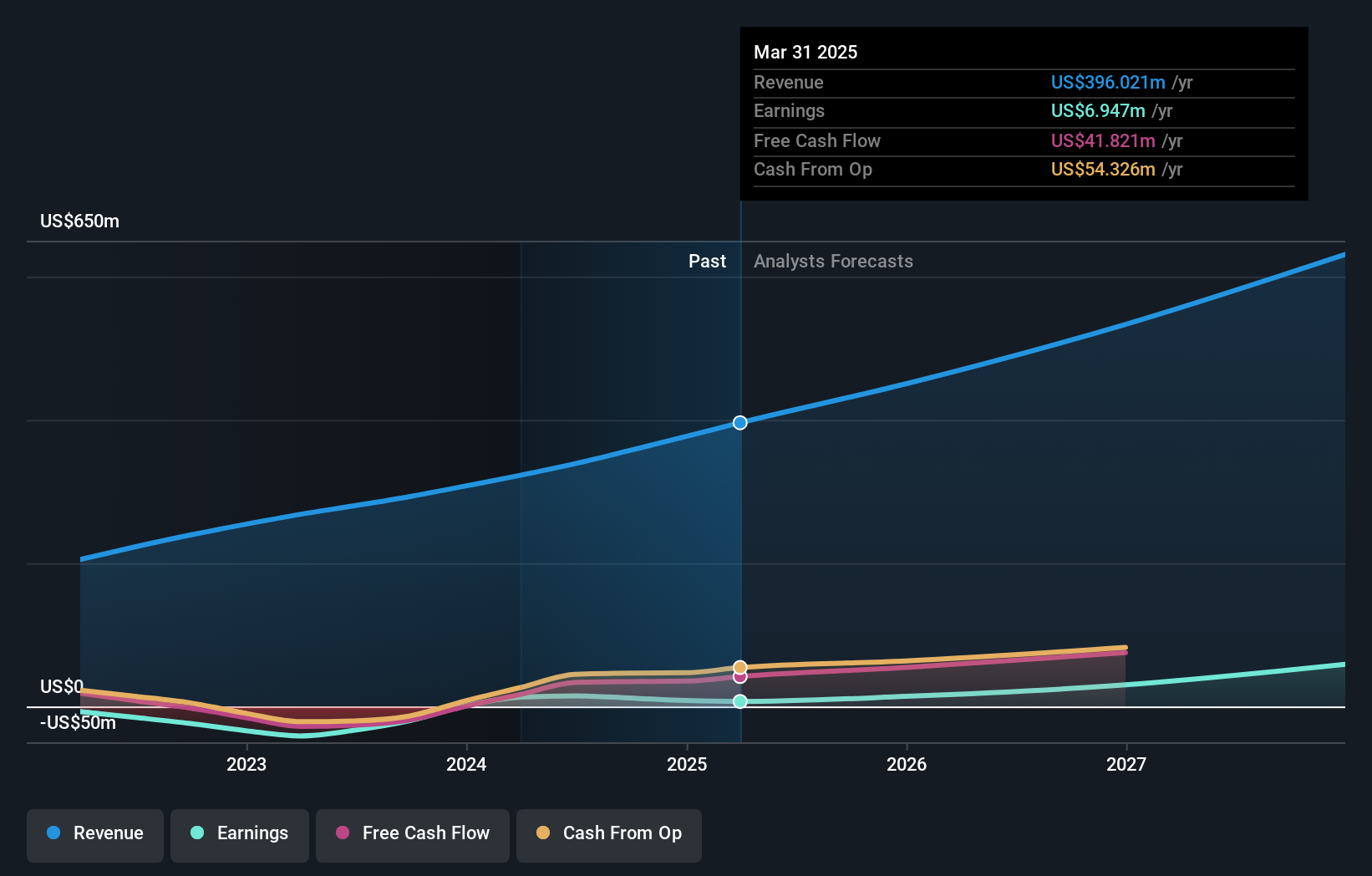

Overview: Semrush Holdings, Inc. develops an online visibility management software-as-a-service platform in the United States, the United Kingdom, and internationally with a market cap of $1.95 billion.

Operations: Semrush generates revenue primarily from its software and programming segment, which reported $338.88 million. The company focuses on providing a SaaS platform for online visibility management across various international markets.

Semrush Holdings, a digital marketing software firm, has shown robust growth with revenue increasing to $90.95 million in Q2 2024 from $74.69 million the previous year. The company's earnings are projected to grow significantly at 53.7% annually over the next three years, outpacing the US market's average of 15%. Notably, Semrush invests heavily in innovation with R&D expenses accounting for a substantial portion of its budget; last year's R&D expenditure was pivotal in driving product enhancements and customer satisfaction improvements led by their new chief customer and data officer.

- Click to explore a detailed breakdown of our findings in Semrush Holdings' health report.

Gain insights into Semrush Holdings' past trends and performance with our Past report.

Similarweb (NYSE:SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers cloud-based digital intelligence solutions across various regions including the United States, Europe, the Asia Pacific, the United Kingdom, and Israel, with a market cap of $727.52 million.

Operations: The company generates revenue primarily from providing online financial information, amounting to $231.21 million. The business focuses on offering digital intelligence solutions through a cloud-based platform across multiple regions globally.

Similarweb's revenue is forecasted to grow at 14.6% annually, outpacing the US market's average of 8.6%, with earnings expected to surge by 114.02% per year over the next three years. The company has significantly reduced its net loss from $9.29 million in Q2 2023 to $0.738 million in Q2 2024, demonstrating improved financial health and operational efficiency. Moreover, Similarweb's strategic collaboration with You.com aims to enhance productivity and market analysis capabilities, potentially driving further growth and innovation in their SaaS offerings.

- Take a closer look at Similarweb's potential here in our health report.

Gain insights into Similarweb's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 248 companies within our US High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endava might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAVA

Endava

Provides technology services for clients in the consumer products, healthcare, mobility, and retail verticals in North America, Europe, the United Kingdom, and internationally.

Flawless balance sheet and good value.